Private sector employment growth decelerates sharply in May: ADP/Moody's

Job growth in the private sector slowed dramatically in May, adding to concerns of a deceleration in U.S. economic expansion.

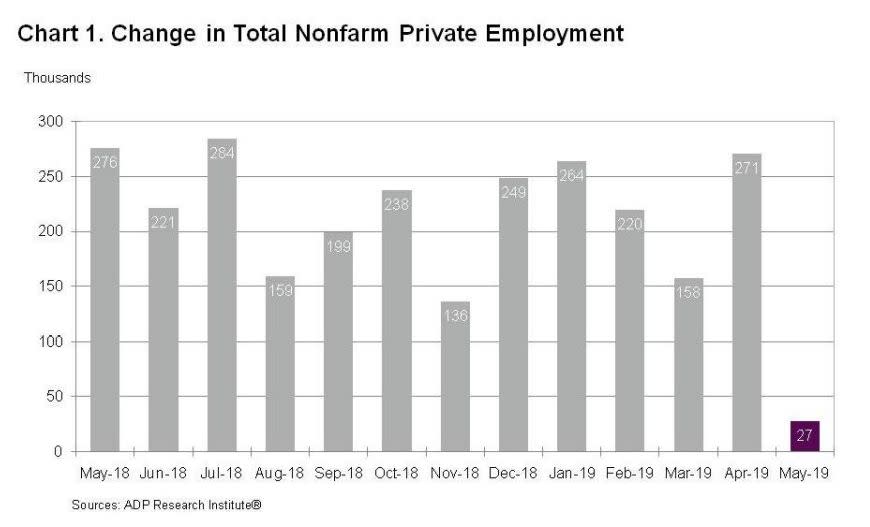

New private sector payrolls rose by just 27,000 in May, ADP Research Institute and Moody’s reported Wednesday, versus 185,000 new private payrolls expected by consensus economists polled by Bloomberg. The disappointing reading represented the smallest gain in private positions since the start of the current U.S. economic expansion.

May’s reading also marks a sharp reduction from April’s slightly downwardly revised reading of 271,000 new private sector positions, from 275,000 seen previously.

“Job growth is moderating. Labor shortages are impeding job growth, particularly at small companies, and layoffs at brick-and-mortar retailers are hurting,” Mark Zandi, chief economist at Moody’s Analytics, said in a statement.

Small businesses bore the brunt of May’s deceleration, with companies employing fewer than 50 workers seeing a loss of 52,000 payrolls between April and May.

By sector, goods-producing companies lost 43,000 private positions in May, with construction firms leading declines. The service sector added a total of 71,000 jobs, the slowest pace of gains since September 2017.

Wednesday’s report from ADP/Moody’s adds to a roster of softening data on the U.S. economy. IHS Markit’s survey of U.S. manufacturers fell to a near decade low in April. Its survey of activity in the services sector – typically the more robust portion of the U.S. economy – fell to a more than three-year low.

“Bottom line, the slowdown seen in many non labor economic statistics finally showed up in a slower rate of hiring,” Peter Boockvar, chief investment officer for Bleakley Advisory Group, wrote in an email.

Stock futures pared gains Wednesday morning following the report, with contracts on the Dow retreating from advances of more than 150 points earlier in the session. In bond markets, the 2-year U.S. Treasury yield fell 9 basis points to below 1.80%, marking the lowest level since December 2017, and the 10-year yield broke below 2.10%.

The Bureau of Labor Statistics releases its monthly report on nonfarm payrolls and the state of the U.S. job market on Friday. Consensus economists are expecting that 180,000 new non-farm payrolls and 175,000 private payrolls were added in May.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Tech companies like Lyft want your money – not ‘your opinion’

Levi Strauss shares jump more than 30% above IPO price at open

Facebook sued by Trump administration for alleged ‘discriminatory’ ad practices

Boeing 737 Max groundings ‘pressure’ U.S. economic data: Wells Fargo

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.