Agricultural Bank of China and 2 Other SEHK Dividend Stocks to Consider

Amid a backdrop of fluctuating global markets, with particular emphasis on the recent downturn in Hong Kong's Hang Seng Index, investors may find refuge and potential growth in dividend-paying stocks. These stocks can offer a measure of stability and regular income, which might be particularly appealing given the current economic uncertainties highlighted by trade tensions and regional economic slowdowns.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.94% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 9.81% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.92% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 9.92% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.23% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 9.33% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.46% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.40% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 5.19% | ★★★★★☆ |

Tian An China Investments (SEHK:28) | 4.96% | ★★★★★☆ |

Click here to see the full list of 88 stocks from our Top SEHK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

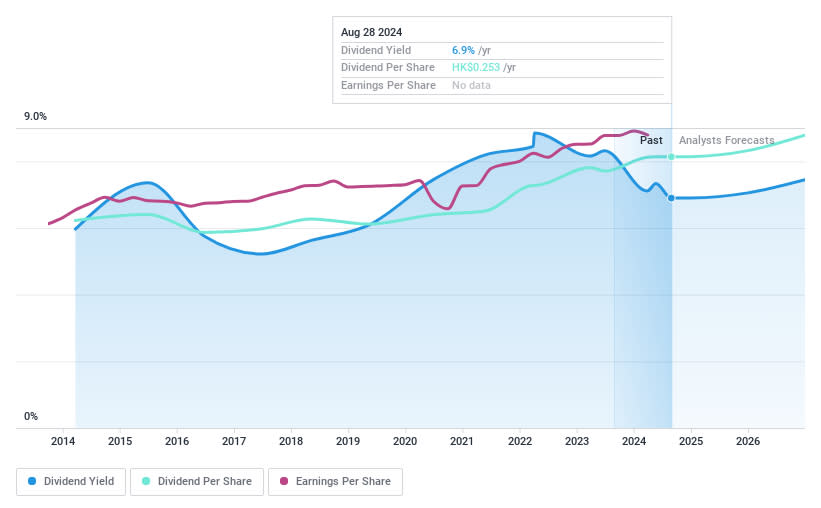

Agricultural Bank of China

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Agricultural Bank of China Limited, along with its subsidiaries, offers a range of banking products and services and has a market capitalization of approximately HK$1.75 trillion.

Operations: The Agricultural Bank of China Limited generates its revenue through various banking products and services, although specific segment details are not provided.

Dividend Yield: 7.2%

Agricultural Bank of China recently announced a dividend distribution of RMB 2.309 per 10 shares, maintaining its history of reliable payouts. Despite a slight dip in net income and earnings per share in the first quarter of 2024, dividends remain well covered by earnings with a payout ratio of 32.3%. However, its dividend yield at 7.23% is below the top quartile in Hong Kong's market. Recent executive changes and a substantial CNY 60 billion fixed-income offering suggest strategic shifts but also raise questions about stability amidst leadership transitions.

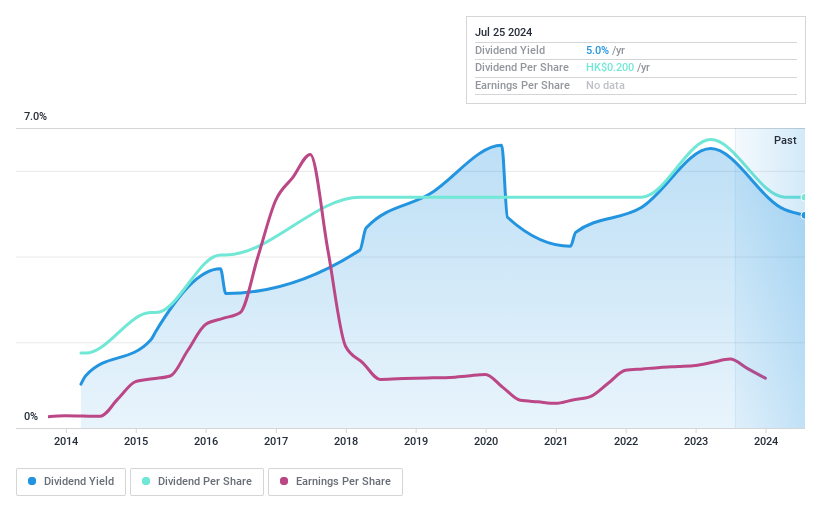

Tian An China Investments

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia, with a market capitalization of approximately HK$5.91 billion.

Operations: Tian An China Investments Company Limited generates revenue primarily from property development, which brought in HK$1.53 billion, followed by property investment at HK$591.38 million and healthcare services contributing HK$394.15 million.

Dividend Yield: 5%

Tian An China Investments offers a stable dividend yield of 4.96%, lower than the Hong Kong market's top quartile. Its dividends, growing over the past decade, are well-supported by a low payout ratio of 24.1% and an even lower cash payout ratio of 16.9%. Recent board changes following the AGM may impact governance dynamics but have not directly influenced dividend policies to date. The company's price-to-earnings ratio at 4.9x remains attractive compared to the broader market average of 9.2x.

Click to explore a detailed breakdown of our findings in Tian An China Investments' dividend report.

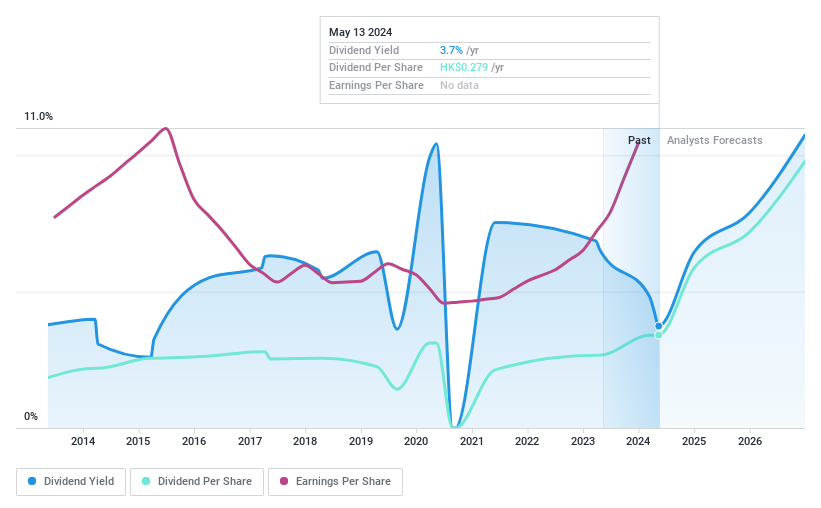

Wasion Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that specializes in the research, development, production, and sale of energy metering and energy efficiency management solutions across the People’s Republic of China, Africa, the United States, Europe, and other parts of Asia; it has a market capitalization of approximately HK$6.19 billion.

Operations: Wasion Holdings Limited generates revenue through three primary segments: Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

Dividend Yield: 4.5%

Wasion Holdings Limited's dividend profile shows mixed stability, with a history of both increases and volatility over the past decade. While its current yield of 4.54% trails behind Hong Kong's top dividend payers, the dividends are sustainably supported by earnings and cash flows, with payout ratios at 48.9% and 27.6%, respectively. Recently, on May 10, 2024, a final dividend of HK$0.28 per share was declared for the fiscal year ending December 2023, reflecting a positive adjustment despite past inconsistencies in payments.

Summing It All Up

Delve into our full catalog of 88 Top SEHK Dividend Stocks here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1288 SEHK:28 and SEHK:3393.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]