Almost half of Amazon Prime members surveyed plan to spend over $100 on Prime Day

If you’re an Amazon Prime member, you may already know how much you plan on spending this coming Monday — when Amazon Prime Day begins at 3 p.m. ET and goes on for 36 hours.

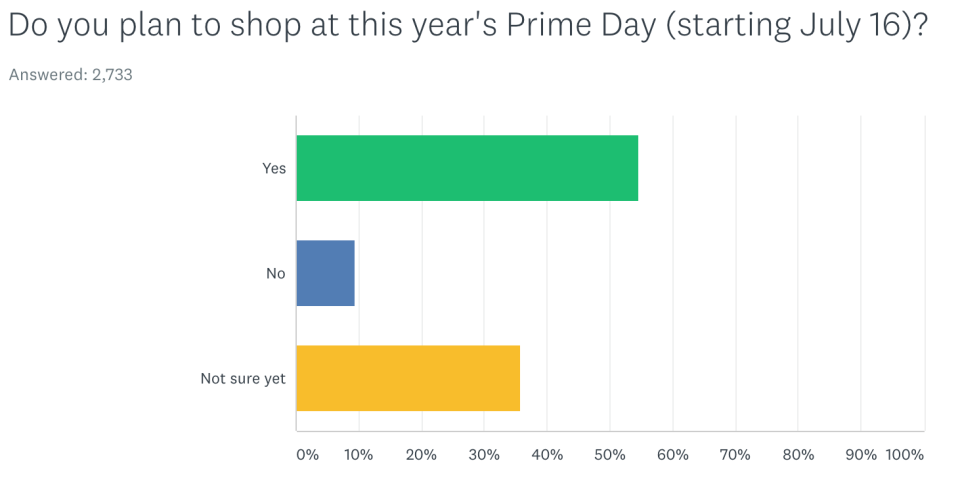

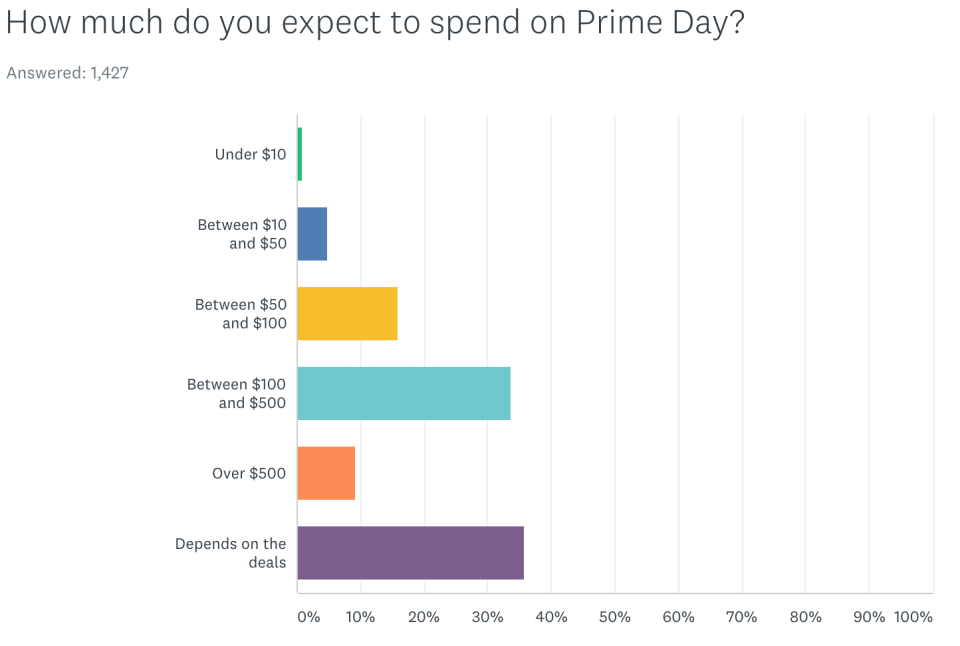

Yahoo Finance surveyed more than 4,000 readers about their plans on Prime Day. Among 3,001 Amazon Prime members, more than half said they’ll shop on Prime Day without even knowing the deals. About 43% of them plan to spend more than $100 on the shopping holiday.

Amazon (AMZN) Prime members are satisfied enough with the concept of great deals on Prime Day that they are willing to spend, said Barbara Kahn, professor of marketing at Wharton Business School.

“If you don’t know what’s going to be on sale, but you already say you’re gonna do it, you’re not buying for the acquisition utility, which is the utility associated with acquiring the product,” said Kahn. “It’s more the utility associated with the purchasing process. That’s just exciting and fun.”

Prime growth may slow, but people are spending big

Research from RetailMeNot, the digital coupon site, also shows shoppers plan to spend an average of $167 this year on Prime Day, with $70 going specifically toward back-to-school items.

Prime Day deals usually feature electronics goods, especially Amazon devices like smart speaker Echo and Fire tablets. “The transactional utility here is, ‘I’m saving money’. You can’t save a bunch of money if you don’t spend any,” said Kahn. Morgan Stanley estimates that Prime subscribers spend up to 4.6 times more than non-Prime customers annually.

But for those who are not one of the 1 million Prime members, unknown deals are hardly incentives to get them to sign up for a Prime membership. Most choose to wait and see. Less than 7% among 1,084 non-Prime members surveyed said they will become Prime members before July 16, and the majority only will sign up for a free trial. They don’t want to commit to paying the annual $119 fee.

One of the main reasons Amazon created Prime Day is to lure people into becoming members. Consumer Intelligence Research Partners (CIRP) estimates Amazon Prime had 95 million members in the U.S. by the second quarter of 2018. But the year-over-year growth fell to 12% from 35% during the same period a year ago. From 2014 to 2016, new membership jumped at an a staggering annual pace of 50%. It remains to be seen if this year’s Prime Day will fuel subscriber growth.

Whole Foods’ deal is not available to everyone

This year marks the first Prime Day since the e-commerce giant bought Whole Foods Market, the acquisition took place last August. Customers who spend at least $10 at the natural-foods chain between July 11 and 17, will get a $10 credit to use on Amazon on Prime Day.

This deal, while seen as “free money” by many, has only won a quarter of Prime members surveyed by Yahoo Finance, who said they will shop at a Whole Foods store to get the credit. Many of the survey respondents who showed little interest said they simply couldn’t shop at a Whole Foods because there weren’t any stores where they live.

Whole Foods now operates 457 stores in the U.S., still small compared to Walmart, which operates more than 5,000 in the U.S. Whole Foods, known for its natural and organic selections, thrive in some of the most affluent ZIP codes in the U.S.

The “fairly generous” deal is aimed at existing Whole Foods shoppers, said Neil Sanders, managing director at GlobalData Retail. “The deal is also a smart way to get Whole Foods ‘involved’ in Prime Day without having to offer too many price cuts and promotions on food products — which are often low margin,” Sanders told Yahoo Finance. “Amazon wants to get more of these shoppers to join Prime. It also wants them to shop and buy more on Amazon.”

Krystal Hu covers technology and economy for Yahoo Finance. What do you want to read about Amazon? Tell her via [email protected] or follow her on Twitter.

Read more about Prime Day: