Amazon is still king of the online grocery wars, survey finds

The online grocery wars are hot, and Amazon (AMZN) is still on fire, according to a survey by RBC Capital Markets.

“Overall this [survey] data largely helps confirm the Amazon company thesis; growing adoption of online channels for what is arguably the single largest consumer spend category, and Amazon holds a demonstrably leading position amongst online grocery channels,” RBC said.

RBC’s fourth annual grocery e-commerce survey collected responses from 1,304 people aged 18 and over, whom identified themselves as the primary decision maker for groceries in their respective households.

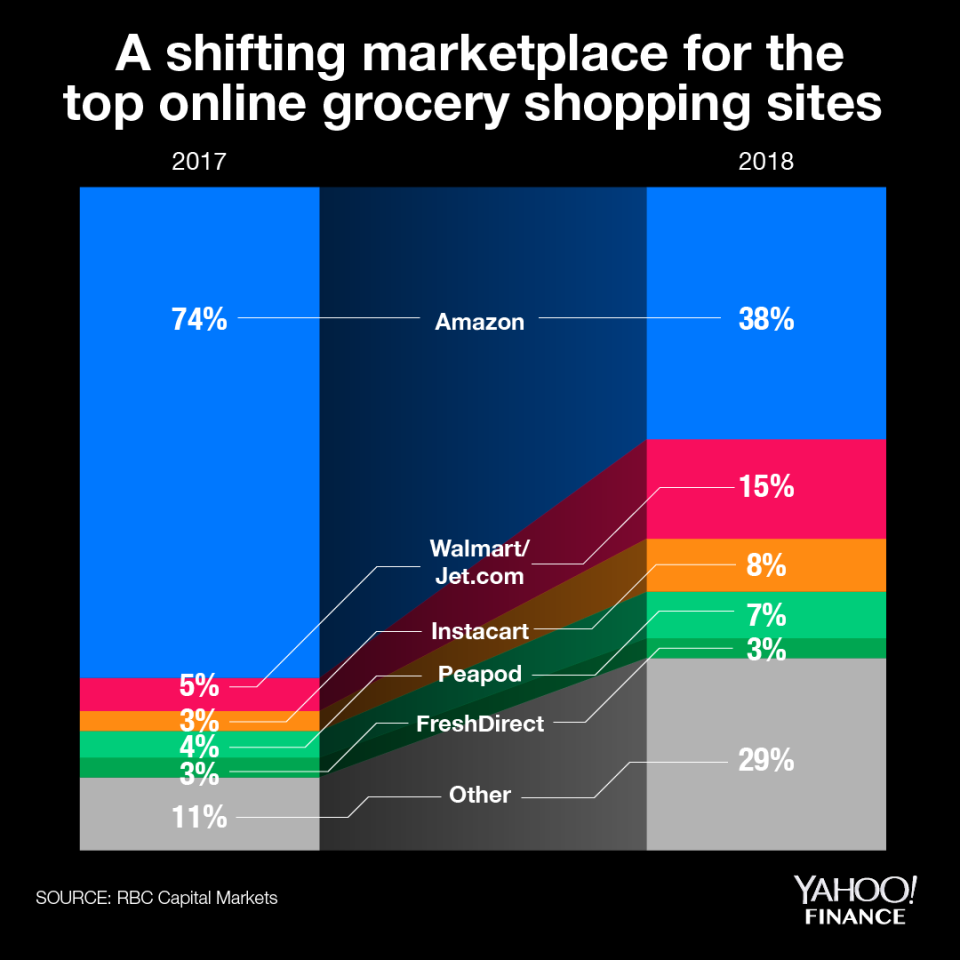

E-commerce behemoth Amazon took the top spot as the most frequently used site for online grocery shopping; however, the survey found that other platforms have started to steal market share in the space. Walmart-owned Jet.com, Click & Collect and Instacart are now solid competitors in the online grocery wars.

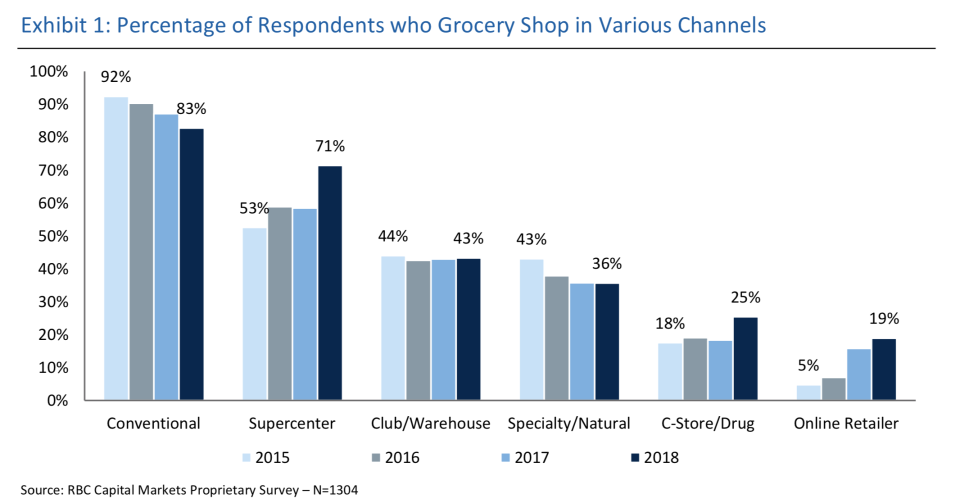

According to the survey, while online grocery shopping has gained significant momentum, conventional grocery shopping still remains the most frequent grocery channel. Walmart (WMT) Supercenters came in second, and clubs/warehouses such as Costco (COST) and Sam’s Club took the third spot.

When survey respondents were asked what the primary driver was for grocery shopping in general, price came in at the top with 39% saying that it was the leading decision driver. While location was the second most important driver, the number decreased from 31% in 2017 to 26% in 2018. RBC attributed the decline in the importance of location to the growing online options being offered.

Thirty-six percent of respondents said they purchased groceries online in 2018, and 28% said that they purchased groceries online through Amazon. Last year 74% of online grocery shoppers turned to Amazon, but that number took a plunge in 2018 to only 38% as Jet.com and Instacart stole some of the market share.

Satisfaction was an important indicator that the online grocery space has more room to grow. The survey concluded that 79% of respondents that purchased groceries online planned on continuing to do so.

RBC concluded that if Amazon wants to hold onto the top spot, getting customers to keep coming back to its online grocery shopping platform remains critical. “The goal, particularly for Amazon, is to create habitual shoppers in their ecosystem.”

“2018 saw an acceleration in online grocery shopping adoption. Online grocery pulled off a rare retail feat: increasing shopper frequency and basket size. At the same time, perceived quality is increasing and repeat and expected trial scores improved. A large contributor to this has been availability of Click & Collect and Instacart. Amazon is still growing as the share leader, but it appears others have gained share,” RBC said.

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Heidi:

The U.S. has a secret weapon in the trade war: Nomura says

The 10 U.S. cities with the highest economic confidence

Trump slams Fed Chair Powell, says he’s ‘not even a little bit happy’ with him

Trade uncertainty is ‘squelching business investments,’ JPMorgan strategist says