Amazon Web Services CEO: We're going to see an 'explosion' of voice apps

For Amazon (AMZN), 2017 was another blockbuster stretch — and not just because it was Yahoo Finance’s Company of the Year. The Seattle tech giant saw its stock soar nearly 58%, driven by strong revenues, the $13.7 billion acquisition of Whole Foods Market and the popularity of voice assistant Alexa.

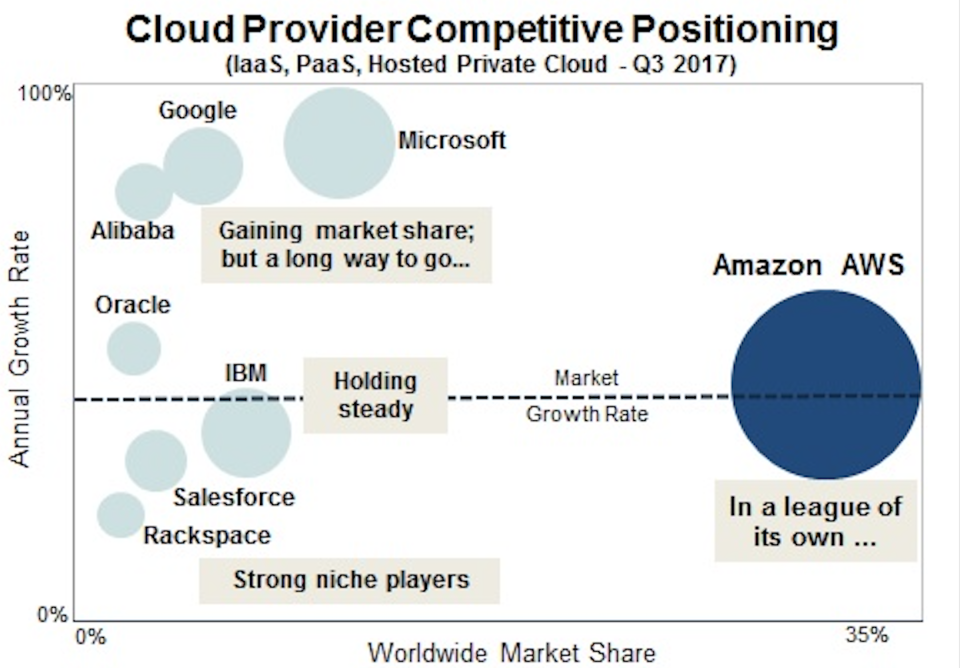

Far less buzzed about was Amazon Web Services’ ongoing hot streak. In the first three quarters of 2017, AWS generated $12.3 billion in revenues — up from nearly $8.7 billion in revenues during the same period in 2016 — and continued to have cloud computing cornered with a 35% market share. And during its sixth-annual re: Invent conference in Las Vegas this November, AWS released over 60 new features and product updates, including Alexa for Business.

“AWS is focused on giving companies the opportunity to iterate and innovate faster and more easily than anywhere else,” Andy Jassy, CEO of AWS, told Yahoo Finance. “Our significantly broader functionality and ecosystem, as well as performance maturity, are why so many more companies continue to choose AWS as their long-term, strategic technology partner.”

Jassy contends there’s much more untapped potential in the cloud computing space as more companies traverse the big shift from managing their own data servers to storing and crunching their data remotely in the cloud.

One piece of cloud-based technology Jassy remains particularly bullish about is voice-activated applications including Alexa, which runs off AWS. On its own, Alexa is the undisputed market leader, with hundreds of third-party Alexa-enabled devices on the market now, alongside competitors such as Google Home, Microsoft’s Cortana and Apple’s Siri. But the AWS chief executive foresees a future where voice becomes even more intertwined in people’s everyday lives as voice technology becomes more sophisticated and one day able to perform more tasks, like say, booking an entire trip from beginning to end.

“When we first started being able to use applications on the phone, tapping a few times felt pretty handy,” Jassy adds. “Then you used an application on something like Alexa, a voice-driven application, and it actually seems awfully inconvenient to have to tap three or four times. So we’re going to see an explosion of voice applications over time, as well.”

Moving at a breakneck pace

AWS wasn’t always a surefire moneymaker or the go-to cloud computing provider for millions of businesses.

When it launched in 2006, pundits at the time wondered why CEO Jeff Bezos strayed so far from the company’s retail roots and building data centers that stored and processed information for other businesses. In the BusinessWeek cover story “Jeff Bezos’ Risky Bet” from October 2006, one analyst griped that then-new investments like AWS were “more of a distraction than anything else.”

Fast-forward to the present, and AWS is obviously more than a mere “distraction.” Although AWS isn’t as flashy as Amazon’s booming retail business, it nonetheless accounted for 10% of Amazon’s overall revenues during the first three quarters of 2017.

Rolling out myriad new features and updates at a breakneck pace is a large part of the reason AWS stays on top.

According to Jassy, the cloud computing business follows a 90-10 rule when it comes to development: 90% of what AWS builds is in direct response to what clients ask for, while the remaining 10% is what he calls a “strategic interpretation” of customer needs.

One example of a feature AWS launched as a direct result of many AWS customers asking for it is Amazon Redshift, a service rolled out in February 2013 that basically serves up a fully automated virtual warehouse that processes and spits out data at brisk speeds. According to Jassy, Redshift became one of the fastest-growing services in the history of AWS, although he did not specify exactly what Redshift growth looks like.

“We weren’t really thinking about a data warehouse, but customers were unhappy with the options that were available at the time,” Jassy recalled. “They were too hard to use and too costly. So they said us, ‘Why don’t you guys do this?’

Likewise, an example of something AWS launched that customers were not asking for is AWS Lambda, which lets customers upload some code that is automatically run once certain parameters are met. AWS Lambda is growing 300% year over year, according to Jassy.

Untapped market potential

The way AWS’ chief executive sees it, the cloud computing market is still in the early innings. In 10 to 15 years, Jassy sees far fewer businesses managing their own data centers and relying more and more on services crunched remotely in the cloud, like machine learning and artificial intelligence, connected devices and the so-called Internet of Things. That’s a view largely in line with third-parties like Gartner, which estimates worldwide revenues for overall public cloud services — which AWS is a part of — will grow 58% to $411 billion between now and 2020.

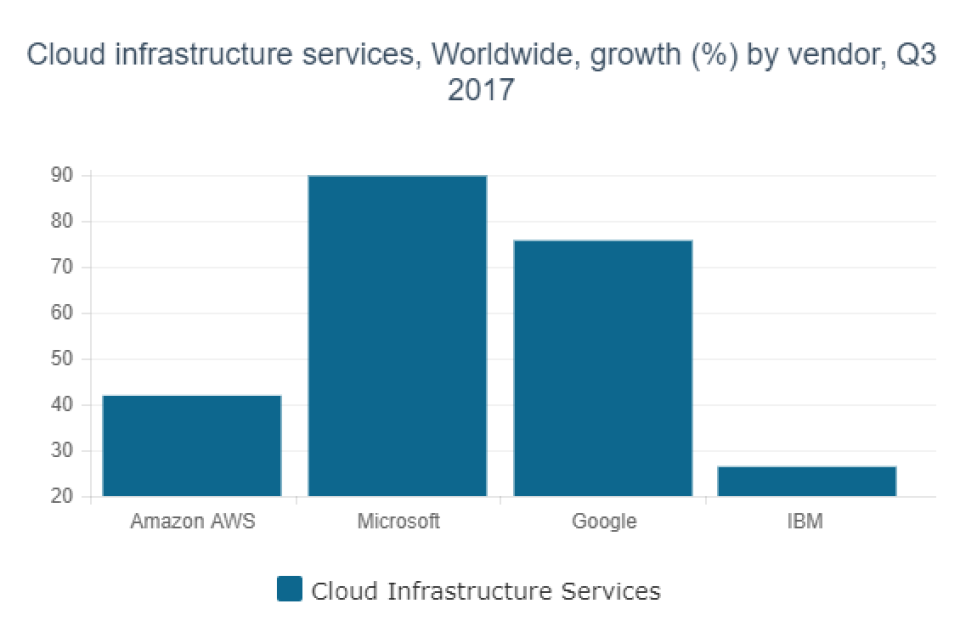

The challenge for AWS, in particular, remains increasing competition from Azure and Google Cloud. The two may still be trailing AWS by a wide margin, but conversely, both Azure and Google Cloud’s businesses are seeing faster growth. AWS must continue to remain competitive by aggressively rolling out new updates and features, keeping pricing competitive and investing heavily in data centers around the world.

In typical Amazon fashion, however, Jassy downplays concerns for the competition and maintains the same the “customer-obsessed” attitudes shared by other Amazon executives.

“The key is to be focused on customers, not competitors, because that’s what matters to the people making purchasing decisions,” Jassy contends. “AWS is focused on giving companies the opportunity to iterate and innovate faster and more easily than anywhere else, and our significantly broader functionality and ecosystem, as well as performance maturity are why so many more companies continue to choose AWS as their long-term, strategic technology partner.”

If in the process, AWS keeps its lead over the competition, Jassy likely wouldn’t mind that, either.

Click here to read more about why Yahoo Finance chose Amazon as its company of the year and here to learn more about Amazon’s plans for Alexa. And here, you can see our timeline for Amazon’s path to domination in 2017.

—

JP Mangalindan is the Chief Tech Correspondent for Yahoo Finance covering the intersection of tech and business. Email story tips and musings to [email protected]. Follow him on Twitter or Facebook.

More from JP:

Facebook targets 6- to 12-year-old demographic with Messenger Kids

Intuit CEO: Old-school accountants will be ‘struggling in 5 years’ because of A.I.

How Amazon quickly trains 120,000 employees for the holidays

Why the Russia ad scandal could actually be a win for Facebook

RBC analyst: Only 2 scenarios would spur investors to flee Facebook

LEAKED AUDIO: New Uber CEO Dara Khosrowshahi reveals 3 things employees should know about him

Yahoo Finance

Yahoo Finance