Amazon's in-house brands are quietly taking over the site

This month, Amazon informed some of its customers of a new in-house brand, Solimo, which is selling an array of everyday items like sunscreen, razors, soap, coffee pods, and more.

The new brand had scarcely been around for a few days before netting over 90 reviews on some of its products and the coveted “Amazon’s Choice” badge for at least one product search, “coffee pods.”

Amazon brands’ surprisingly strong performances in professional product review testing and the instant success of Solimo illustrates Amazon’s careful foray into generic, in-house brands.

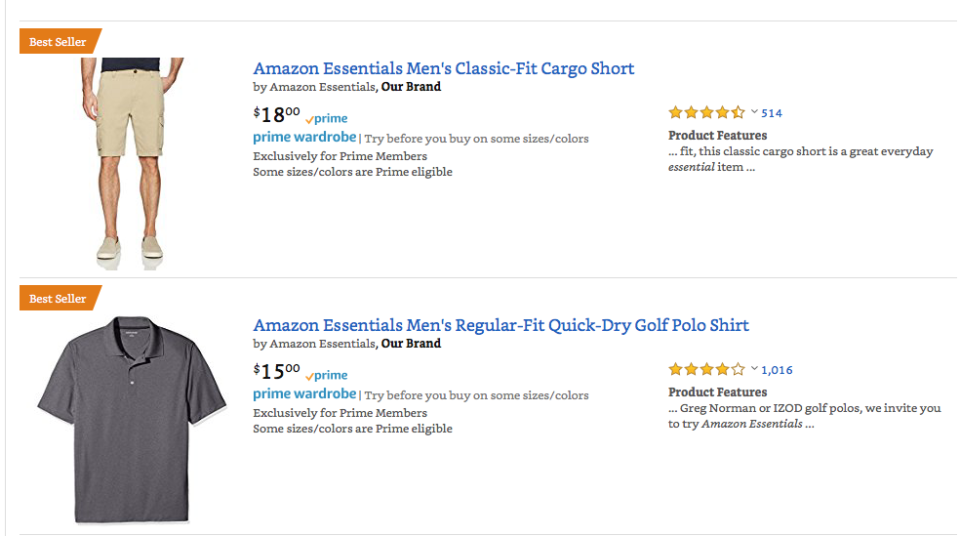

Amazon now boasts “dozens” of private brands — names that both trumpet its connection to the company (AmazonBasics, Amazon Essentials) and downplay it (Rivet, a furniture and furnishings brand; Lark & Ro, women’s apparel; Mama Bear, organic baby food). For nearly every product category, Amazon is offering curated options that are priced very competitively and consistently please the masses.

The list of categories — which began in 2015 with AmazonBasics and “Pinzon” (another home essentials brand) — was already growing quickly when it gained another boost by Amazon’s acquisition of Whole Foods and its popular 365 brand. Whole Foods itself illustrated a distinct take on generics, as its upscale reputation gave its generic brand 365 prestige.

This strategy, according to SunTrust analysis, could carry the business to sales of $25 billion a year by 2025, far above 2018’s current projection of $7.5 billion.

Amazon has found the missing piece for generics with its tech

In many ways, Amazon’s approach to generic products isn’t that different from classic in-store generics. Generics sit next to their name-brand counterparts at the pharmacy or grocery store, like Costco’s Kirkland brand, CVS’s CVS brand, or Whole Foods 365. Their location, subtle design hints like packaging shape and color, active ingredients, and the occasional “compare to Listerine” would serve to inform consumers of the lower-cost alternative.

The Amazon model is largely the same thing, but in search results — instead of on the shelf. You search for sunscreen on Amazon and you see Amazon’s “compare to Coppertone” next to the Coppertone. But there are a few secret weapons inherent to Amazon’s platform that make its current forays into generics a force that could reshape retail.

One trick up its sleeve: reviews. If a shopper were ever on the fence deciding between a generic and a name-brand product, a chorus of 5,000 Amazon reviews with a 4.8-star average is often enough to make someone trust the in-house generic. No one wants to pay more than they have to, and if you don’t care about buying a brand-name suitcase or electric kettle, the cheaper generic has a very good shot.

But Amazon itself has also become a name brand of sorts, as its brand connection may be seen as a pro, not a con for some items.

Since the Amazon marketplace is filled with countless inexpensive, largely anonymous brands — like Yungsong and Qianxiang for iPhone cables — Amazon’s often similarly priced offerings stand out. Unlike the unknown brands, Amazon’s products are backed by a large, established company with a track record of customer satisfaction and a “customer-obsessed” CEO who has a stake in the reputation of products carrying the brand.

“A big advantage of AmazonBasics is being able to deal directly with Amazon for warranty replacement,” wrote one commenter on the Wirecutter, a popular online review site owned by The New York Times. “For me, that often helps tip the scales.”

Even if an Amazon-branded product appears to be identical to a competitor’s, its branding carries an implicit promise of quality control, customer service, and a generous return policy that makes it risk-free to try. Like Whole Foods elevating generics with its 365 brand, the Amazon mark may be a value-add.

Amazon said it adds products too quickly to have metrics to share about the average reviews or return rates of its in-house branded products, but a Yahoo Finance analysis across multiple product categories found very strong showings that regularly match or exceed their counterparts.

Amazon is a search engine, and its products are doing well on it

Amazon’s most overlooked quality may be the fact that its marketplace is a search engine, and one that research has shown has supplanted Google as the first place an online shopper goes to buy something.

Amazon search results have long been a battleground for retailers looking for prominent placement because customers seldom look beyond the first page. The retailer has, unsurprisingly, become savvy at playing the placement game with its own private-label products.

Search for anything on the site and you’ll see an Amazon brand in the first few results, as well as “sponsored” products at the top. (The company sponsors Amazon-brand items on its own site.) Yahoo Finance searched dozens of product categories with a cleared browser and Amazon’s house brands were staples among the first three results.

The Amazon algorithm, sellers have told Yahoo Finance, is based on a handful of factors, including positive reviews, number of reviews, sales, SEO-quality copy, and price, a characteristic that enables the company to be especially competitive, given its tolerance for microscopic margins.

“These marketplaces always have new requirements, things they’re testing,” said Neha Gajwani, CEO of SmackTom, which sells electronics accessories and more on Amazon and other platforms, earlier this year. “All of that goes into where they put you in search.”

Amazon refines its search algorithm continuously, and like a grocery store it has no obligation to treat its own products and competitors equally. Neutral or not, Amazon says that it is focused on providing a broad selection, including both in-house and independent brands.

Data, quality and recognition

Amazon’s review system and generous return policy have allowed it to expand generics into hundreds of categories throughout its site. Armed with a precise understanding of the products people search for, Amazon can tailor its offerings.

If, for example, 40-watt light bulbs or bocce ball sets become popular items — and they have good reviews and a low price — Amazon may give the product its coveted “Amazon’s Choice” badge in a search result. (There are also “Best Seller” badges.) The idea behind “Amazon’s Choice” is similar to the reviewing model used by the Wirecutter. In short, the model is: “This product works well for most people.”

But it has long been considered an open secret that besides using this data to give popular products a badge, Amazon uses the data on what people are searching for, buying, and reviewing positively to jump in to provide its alternative, especially if it’s an everyday product that’s easy to get for a private label.

“Got a Hot Seller on Amazon?” asked one Bloomberg headline from 2016, “Prepare for E-Tailer to Make One Too.”

The open secret holds that if Amazon house-brand products don’t already dominate these badges, they’re probably strong possibilities for what’s coming next. (Amazon launched its own pet food brand, Wag, in May.)

Amazon didn’t directly confirm this open secret, but told Yahoo Finance that the idea for in-house products began by listening to and learning from customers to bring them products they’ll like.

Amazon declined to elaborate on its data use and about how many data scientists work on these projects, but from CEO Jeff Bezos’s comments in the past, and Amazon’s behavior in product rollouts, data likely plays a major role.

“There is a right answer or a wrong answer, a better answer or a worse answer, and math tells us which is which. These are our favorite kinds of decisions,” he wrote in a 2005 letter to shareholders. “Quantitative analysis improves the customer’s experience and our cost structure.”

Practically all manufacturers and retailers use data, but Amazon’s data-driven approach may be the key to its success.

On the Wirecutter, Amazon brands have performed well, earning prominent spots over the years in cables, umbrellas, paper shredders, and spots on its travel guide. As Courtney Schley wrote for the site in 2016: “We…test AmazonBasics offerings whenever they’re relevant and even recommend its stuff as a top pick or alternate in our guides to paper shredders, HDMI cables, school backpacks, and 12 other reviews (as of this writing).”

Schley advised consumers to read the customer reviews, noting the quality for some was really good but poor for others. Amazon’s lightning pace of adding products every month means a near-impossible task for professional reviewers for sites like Wirecutter and the Strategist.

Already, consumers are able to wake up with their phone plugged into an Amazon cable in an Amazon charger in an Amazon power strip, sitting next to their Rivet (Amazon) bedside table with an Amazon basics light with Pinzon (Amazon) sheets, shave, brush, and shower with Solimo shampoo, put on Amazon clothing, and so on — we haven’t even gotten 10 minutes into the day yet. If growth continues as SunTrust’s analyst thinks it will, the question may become what doesn’t Amazon competitively sell as its own?

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: emann[at]oath.com.

Read more:

Amazon announces a better way to receive packages