Survey: 25% of Americans expect to die in debt

As Sen. Bernie Sanders (I-VT) and Rep. Alexandria Ocasio-Cortez (D-NY) push for lower credit card interest rates, it’s useful to recall that about 25% of Americans surveyed in December expect to die in debt.

The online survey of 1,000 adults CreditCards.com also found that 41% of people don’t know when they’ll pay off what they owe, and 65% of adults with debt don’t know when or if they’ll get out of it.

In a recent interview with Yahoo Finance, CreditCards.com Analyst Ted Rossman described it as “a depressing stat and one that we can hopefully avoid.”

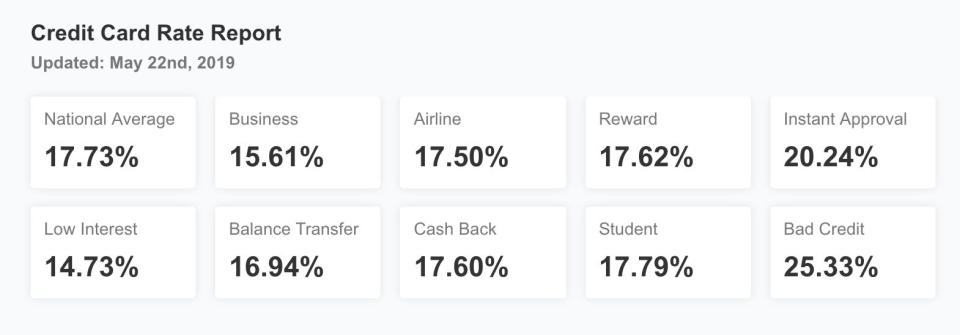

“You’ve got to do whatever you can — whether it’s a balance transfer, taking on a second job, cutting expenses, or whatever you have to do,” he added. “Credit card debt has a much greater impact on your finances than something like a mortgage, an auto loan, or a student loan, because those products are all in the 4, 5, 6% range. Credit card rates are so much higher.”

‘It’s an important discussion to have’

Credit card interest rates recently came under the spotlight as of late after Sanders and Ocasio-Cortez introduced legislation to cap credit card interest rates at 15%.

“There is no reason a person should pay more than 15% interest in the United States,” the freshman representative wrote on Twitter. “It’s a debt trap for working people + it has to end.”

Rossman didn’t see much hope for the bill.

“Practically speaking, I don’t think that’ll become law any time soon,” Rossman said of the proposal, “but I still think it’s an important discussion to have because credit card rates are really high.”

He recommended a way for people to avoid this situation is to aim to pay off their credit cards in full, if possible.

“We know … that about 40% of cardholders are already paying their bills in full each and every month, so that’s great,” Rossman said. “Those are the kinds of people that are great candidates for rewards. But, the 60% who are carrying debt really need to prioritize their interest rate over all else. Unfortunately, a lot of people aren’t doing that.”

The CreditCards.com survey also found that the most common debt held by consumers were mortgage (54%), credit cards (53%), auto loans (47%), student loans (21%), medical debt (13%), and personal loans (11%).

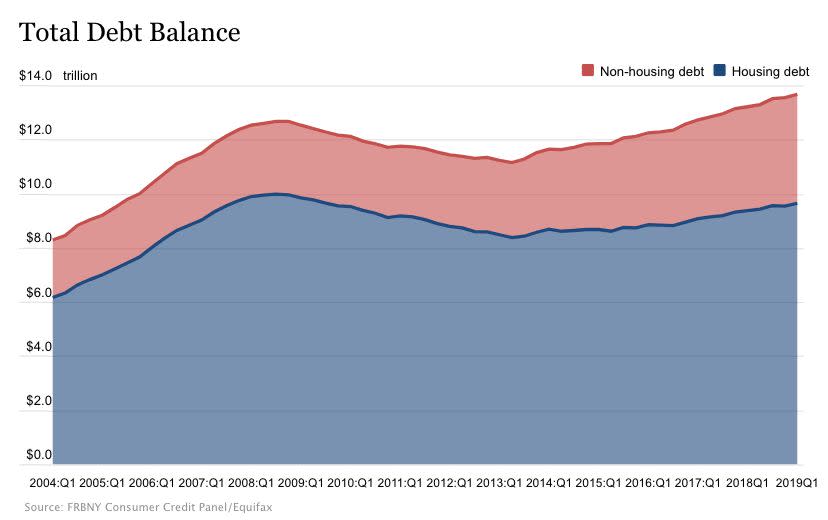

Overall debt held by households — which includes all of the types above — has been climbing steadily, hitting $13.67 trillion in the first quarter this year according to the New York Fed. That’s higher than the third quarter of 2008 right before the Great Recession.

At the same time, serious delinquencies — which are payments late by 90 dates or more — are also on the rise, driven by credit cards and student loans.

“We feel like most people are being responsible,” Rossman said. “Most people who have credit card debt didn’t get there because of a vacation. They didn’t get there because of a shopping spree. They got there because something happened with their health, their car, their home, or they’re just having trouble making ends meet.”

“That’s a tough situation to be in,” Rossman added. “I think it brings up some of the fundamentals of personal finance about doing whatever you can to budget, live within your means.”

Aarthi Swaminathan contributed to this post.

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

As Trump waits on Obamacare, Americans list health care as top worry

America's 'inefficient' health care system is driving our fiscal instability: Powell

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.