America's small businesses haven't had this much trouble finding workers in 17 years

Hiring has become a major headache at America’s small businesses.

According to the latest report on small business optimism from the National Federation of Small Business published Tuesday morning, 33% of all owners reported job openings they could not fill in April. This is the highest reading since November 2000.

Ian Shepherdson, an economist at Pantheon Macro in New York, said Tuesday that this number “points to upward pressure on wage gains” as employers are forced to pay up to fill open positions.

However, the NFIB’s report indicated that reports of increased compensation were down 2% to 26% of employers, below the recovery record seen in January. This is still one of the best readings since February 2007.

Last week the U.S. economy added 211,000 jobs in April as the unemployment rate fell to 4.4%. Wage gains, a closely-watched measure by the Federal Reserve and seen as a sign of inflation popping up in the economy, hit just 2.5% over the prior year in April, a disappointment relative to expectations.

This dislocation in the numbers is likely to force economists to rethink what’s happening in the labor market.

Neil Dutta, an economist at Renaissance Macro, said the latest NFIB data indicates that the Federal Reserve will likely lower its NAIRU rate (the non-accelerating inflation rate of unemployment, or the unemployment rate at which inflation takes off) as a result of this. The Fed’s latest projections showed median expectations for NAIRU to be around 4.5%.

Dutta said the decrease in small businesses planning to increase compensation coupled with a further drop in the unemployment rate shows that “residual labor market slack may remain,” adding that he would expect compensation plans to be “much higher” at the current rate of unemployment.

Skills mismatch

Also in economic data on Tuesday, we learned that in March there were 5.74 million jobs open, according to the latest job openings and labor turnover survey from the Bureau of Labor Statistics.

This report is consistent with a trend we’ve seen in recent years in which the number of available jobs has continued to soar while hiring has been steady, but notably not keeping pace with availability.

This dynamic outlines the oft-discussed skills mismatch that exists in the economy, but also is a clear sign that we are seeing an increasing “tight” labor market.

A “tight” labor market is economist-speak for a labor market in which the pool of workers has decreased amid steady hiring. As labor markets tighten, economists expect wages to rise in order for employers to satisfy their demand for workers.

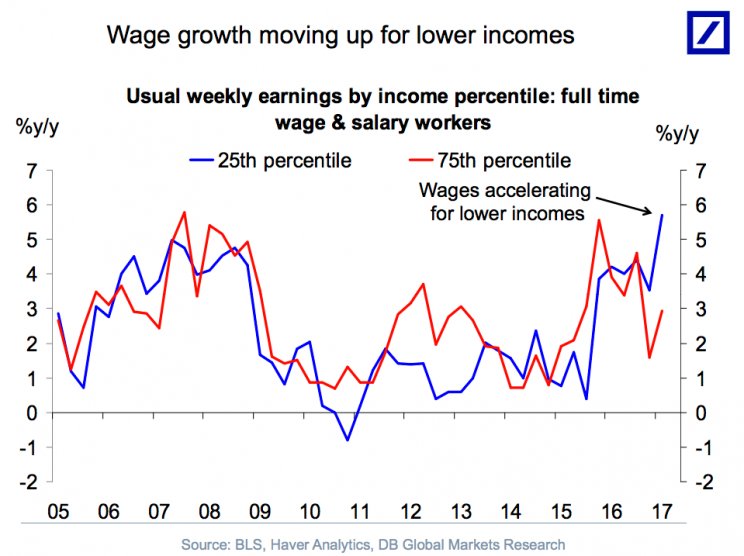

Deutsche Bank economist Torsten Sl?k noted, however, that in April we saw wages for those at the lowest-end of the income scale rise faster than overall gains. This indicates employers having trouble finding low-skill workers, something we see only when the labor market has tightened considerably.

Additionally, with the threshold for matching needs with skills being presumably lower at the low-skill, low-wage end of the labor market, in this we are seeing employers pay up for workers when they can find them.

Other measures of compensation, however, have continued to show that wages are on the rise for American workers, something economists would expect as the pool of available labor is taken up.

In the first quarter, the employment cost index — which captures both wages and benefits paid out to employees — rose at a seasonally adjusted pace of 0.8%, the most since the fourth quarter of 2007.

And so while the monthly jobs report is indicating an economy that still has plenty of available labor for hire, more and more data around the edges of this report show a labor market that is clearly tightening up.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: