There is no consensus anymore: Morning Brief

Tuesday, April 7, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Analyst estimates are as wide as ever ahead of earnings season

We’re just about a week away from the unofficial start of earnings season for U.S. corporates.

And the range of forecasts is as wide as it’s been since the crisis and about as all over the place as we’ve seen in the modern market.

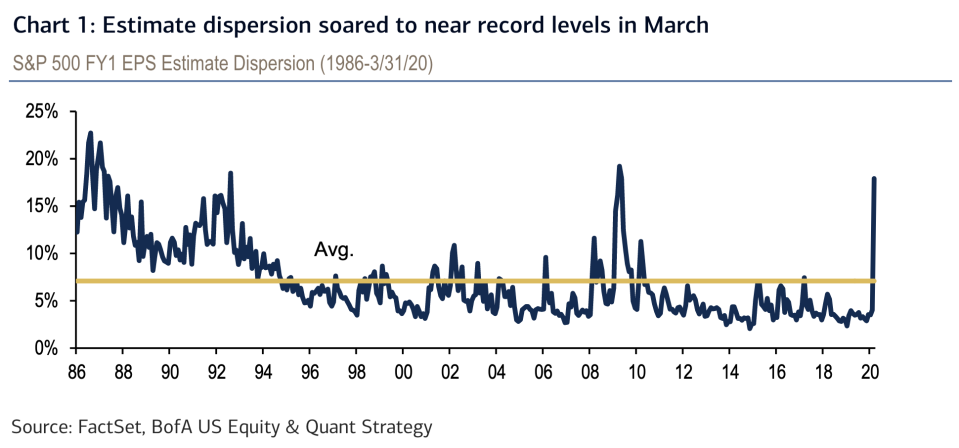

In a note to clients published late last week, Savita Subramanian and the equity strategy team at Bank of America Global Research highlighted the recent spike in dispersion among earnings estimates as a sign of how broad the expected range of outcomes has become.

And it serves as another illustration of how the current environment has become one in which businesses are flying blind and analysts are admitting they can only make guesstimates.

This surge in dispersion — or the range of anticipated outcomes from analysts — is notable as it follows a period that saw the range of outcomes narrow to its tightest on record.

In mid-January, we highlighted the decline in dispersion as presenting a challenge for stock-pickers even amid the busiest periods for corporate earnings.

The environment that prevailed in the fourth quarter of 2019 was one in which analyst forecasts were clustered together and few held a view that diverged from consensus. The macro environment was stable, earnings growth was seen as predictable, and the conversation had shifted from when the expansion would end to how much longer it would last. Now, there is no consensus, no optimism, and little basis for holding any view at all.

“In March, both the one-month S&P 500 earnings and sales estimate revision ratios plummeted to either record or near record lows last seen during the financial crisis,” BofA wrote in its note.

“Only 52 companies saw increases to consensus earnings estimates, the lowest since January 2009, while 441 companies saw their earnings estimates decline (a record high since 1986)... On a less volatile [3-month] basis, all sizes are now seeing over 2x as many cuts as raises to earnings estimates.”

A growing trend in this market has been companies withdrawing their guidance, but Wall Street analysts are still trying to offer some semblance of expectations for companies in their coverage area. And while these revisions have mostly been negative, BofA still doesn’t think the downside to corporate results is being captured.

“Despite the record pace of estimate cuts, bottom-up consensus numbers have yet to reflect the severity of this downturn (-2% vs. our -29% YoY),” BofA adds.

And amid an environment in which economists expect GDP declines to be the worst on record, it is unlikely at best that earnings will drop 2%.

The widening of anticipated earnings outcomes also challenges investors as it goes against a secular market trend that has seen forecasts grow more uniform over the last few decades. In a world of increasing passive exposure to the stock market analysts are less incentivized to cut against the grain in crafting a forecast for any company or industry.

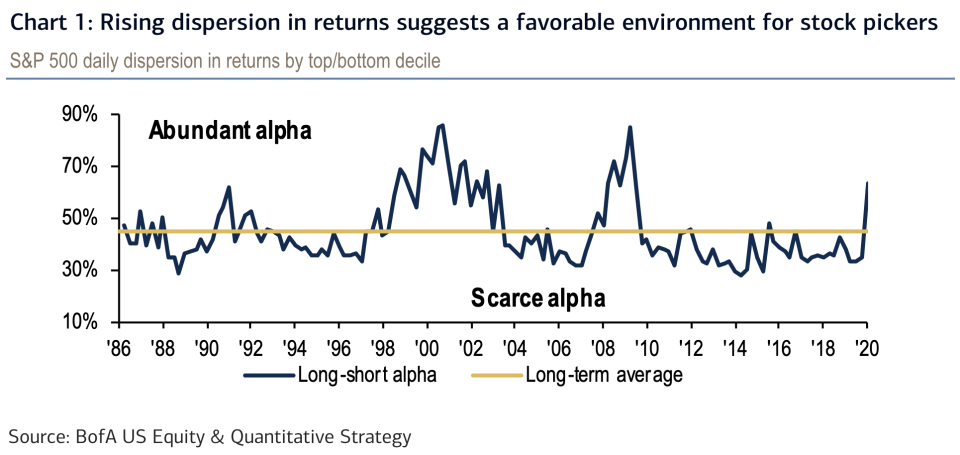

For active investors, however, there might be a silver lining in all this: a wider range of earnings estimates means better opportunities to pick stocks and potentially generate excess returns.

Or as BofA illustrates in an alternative version of its dispersion chart: more dispersion = more (potential) alpha.

Finally, an opportunity for active managers.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

10 a.m. ET: JOLTS Job Openings, February (6500 expected, 6963 in January)

Earnings

Post-market

4:15 p.m. ET: Levi’s (LEVI) is expected to report adjusted earnings of 35 cents per share on $1.46 billion in revenue

Take our survey

How's the coronavirus recession affecting you? And what questions can we answer?

Top News

Pound rises with UK prime minister 'not on ventilator' [Yahoo Finance UK]

Stocks climb amid further signs of coronavirus plateau in Europe [Yahoo Finance iUK]

Global oil powers stumble their way toward historic deal [Bloomberg]

NYSE in talks with SEC to ease listing rules during coronavirus volatility [Reuters]

YAHOO FINANCE HIGHLIGHTS

Bill Gates is spending billions to ‘save months’ on a coronavirus vaccine

Hackers are posting verified Zoom accounts on the dark web

The coronavirus scenario that has Dr. Zeke Emanuel 'really worried'

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay