Archean Chemical Industries And 2 More Value Stocks Trading At A Discount On The Indian Exchange

Over the past 7 days, the Indian market has risen 2.8%, and over the past 12 months, it is up an impressive 48%, with earnings forecast to grow by 16% annually. In this thriving market environment, identifying undervalued stocks like Archean Chemical Industries can offer significant opportunities for investors seeking value investments at a discount.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

Shyam Metalics and Energy (NSEI:SHYAMMETL) | ?739.75 | ?1349.51 | 45.2% |

HEG (NSEI:HEG) | ?2222.50 | ?3892.74 | 42.9% |

S Chand (NSEI:SCHAND) | ?229.01 | ?353.60 | 35.2% |

Titagarh Rail Systems (NSEI:TITAGARH) | ?1568.95 | ?2548.42 | 38.4% |

Updater Services (NSEI:UDS) | ?318.70 | ?626.76 | 49.2% |

Vedanta (NSEI:VEDL) | ?448.10 | ?836.89 | 46.5% |

Rajesh Exports (NSEI:RAJESHEXPO) | ?308.45 | ?591.11 | 47.8% |

Mahindra Logistics (NSEI:MAHLOG) | ?509.60 | ?990.63 | 48.6% |

Piramal Pharma (NSEI:PPLPHARMA) | ?173.25 | ?289.56 | 40.2% |

Strides Pharma Science (NSEI:STAR) | ?1089.45 | ?2032.10 | 46.4% |

Here we highlight a subset of our preferred stocks from the screener.

Archean Chemical Industries

Overview: Archean Chemical Industries Limited manufactures and sells specialty marine chemicals both in India and internationally, with a market cap of ?96.98 billion.

Operations: Archean Chemical Industries generates revenue primarily from its marine chemicals segment, amounting to ?13.30 billion.

Estimated Discount To Fair Value: 10.3%

Archean Chemical Industries appears undervalued based on cash flows, trading at ?785.95, which is 10.3% below its estimated fair value of ?876.26. Despite a recent penalty of INR 4,976,100/- for GST issues and a drop in net income to INR 3.19 billion for FY2024 from INR 3.83 billion the previous year, the company’s revenue is forecast to grow at 24.1% per year, significantly outpacing the Indian market average of 9.7%.

Our growth report here indicates Archean Chemical Industries may be poised for an improving outlook.

Take a closer look at Archean Chemical Industries' balance sheet health here in our report.

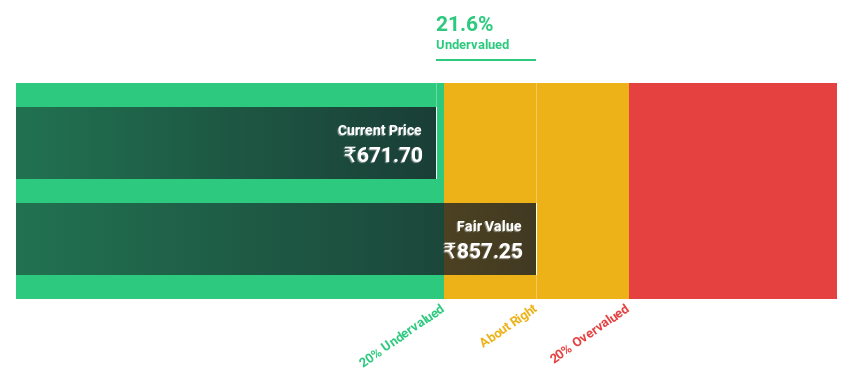

CMS Info Systems

Overview: CMS Info Systems Limited, with a market cap of ?91.81 billion, operates as a cash management company in India through its subsidiaries.

Operations: The company's revenue segments include Card Services at ?890.75 million, Managed Services at ?8.54 billion, and Cash Management Services at ?15.11 billion.

Estimated Discount To Fair Value: 11.7%

CMS Info Systems is trading at ?564.1, below its estimated fair value of ?638.71, indicating it may be undervalued based on cash flows. Earnings have grown 20.8% annually over the past five years and are forecast to grow 16.99% per year, outpacing the Indian market's 16.4%. Despite a recent dilution and an unstable dividend track record, CMS Info Systems shows strong revenue growth prospects at 14.4% per year compared to the market's 9.7%.

Shyam Metalics and Energy

Overview: Shyam Metalics and Energy Limited is an integrated metal company that manufactures and sells long steel products and ferro alloys in India and internationally, with a market cap of ?205.79 billion.

Operations: The company's revenue segments include Iron and Steel, which generated ?134.74 billion.

Estimated Discount To Fair Value: 45.2%

Shyam Metalics and Energy, trading at ?739.75, is significantly undervalued with a fair value estimate of ?1349.51. The company's earnings are expected to grow 30.7% annually over the next three years, outpacing the Indian market's 16.4%. Recent earnings for Q1 2025 showed net income rising to ?2,761.4 million from ?2,040.8 million a year ago despite shareholder dilution and an unsustainable dividend of 0.73%.

Summing It All Up

Click through to start exploring the rest of the 21 Undervalued Indian Stocks Based On Cash Flows now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:ACI NSEI:CMSINFO and NSEI:SHYAMMETL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]