Arkema And Two More High-Yield Dividend Stocks On Euronext Paris

As European markets show signs of resilience amid easing political uncertainties and a brighter outlook for monetary policies, investors are increasingly attentive to opportunities that promise stable returns. In this context, high-yield dividend stocks such as Arkema on Euronext Paris garner interest for their potential to offer both income and stability in a fluctuating economic landscape.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.47% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.27% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.74% | ★★★★★★ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.08% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.29% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.17% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.82% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 6.32% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.13% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

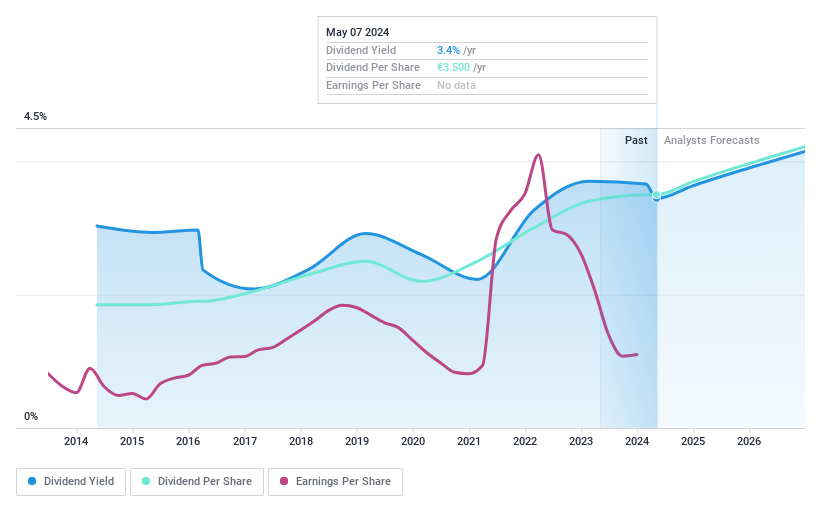

Arkema

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Arkema S.A. is a global manufacturer and seller of specialty chemicals and advanced materials, with a market capitalization of approximately €6.27 billion.

Operations: Arkema S.A.'s revenue is primarily derived from its Advanced Materials segment at €3.50 billion, followed by Adhesive Solutions at €2.70 billion, Coating Solutions contributing €2.36 billion, and Intermediates generating €0.74 billion.

Dividend Yield: 4.2%

Arkema, a significant player in the chemical industry, reported a decline in Q1 2024 earnings with sales dropping to €2.34 billion from €2.52 billion year-over-year and net income falling to €79 million from €132 million. Despite this downturn, Arkema maintains a stable dividend history over the past decade, supported by a payout ratio of 74.9% and cash payout ratio of 45.9%, indicating that dividends are well-covered by both earnings and cash flow. However, its current dividend yield of 4.17% is below the top quartile of French dividend stocks at 5.55%. Recent collaborations with ProLogium hint at strategic positioning for future growth in battery technologies.

Navigate through the intricacies of Arkema with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Arkema's share price might be too pessimistic.

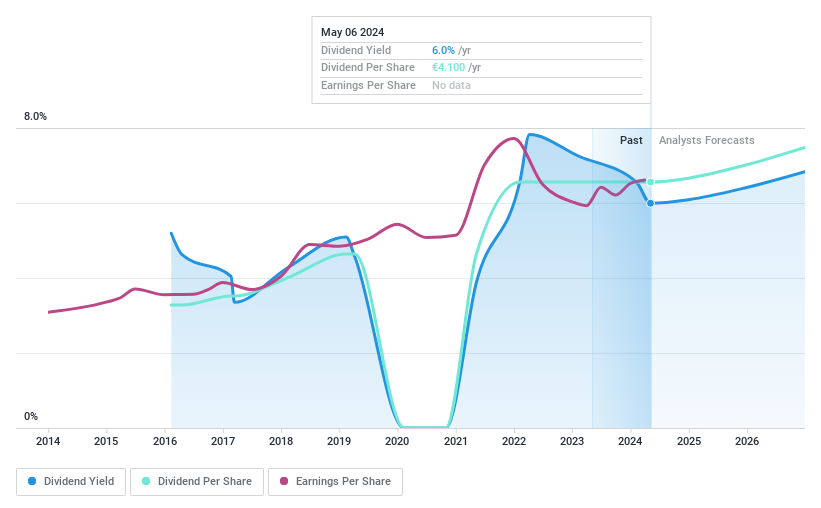

Amundi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market capitalization of approximately €12.76 billion, operating primarily in the asset management sector.

Operations: Amundi generates its revenue primarily through asset management, with earnings amounting to €6.03 billion.

Dividend Yield: 6.5%

Amundi's recent dividend affirmation of €4.10 per share reflects a solid commitment to shareholder returns, with a distribution set for early June 2024 following an earnings uptick in Q1 2024, where revenue and net income rose to €824 million and €318 million respectively. Despite this positive trajectory, Amundi's dividend history is relatively short and marked by volatility over its 8-year span. The appointment of Barry Glavin as head of equity investments could signal strategic enhancements aimed at stabilizing these payouts. Trading below estimated fair value offers potential upside amidst a backdrop of reasonable cash and earnings coverage ratios (56% and 71.9% respectively), albeit the dividend track record remains uneven with significant fluctuations in past payments.

Delve into the full analysis dividend report here for a deeper understanding of Amundi.

Our expertly prepared valuation report Amundi implies its share price may be lower than expected.

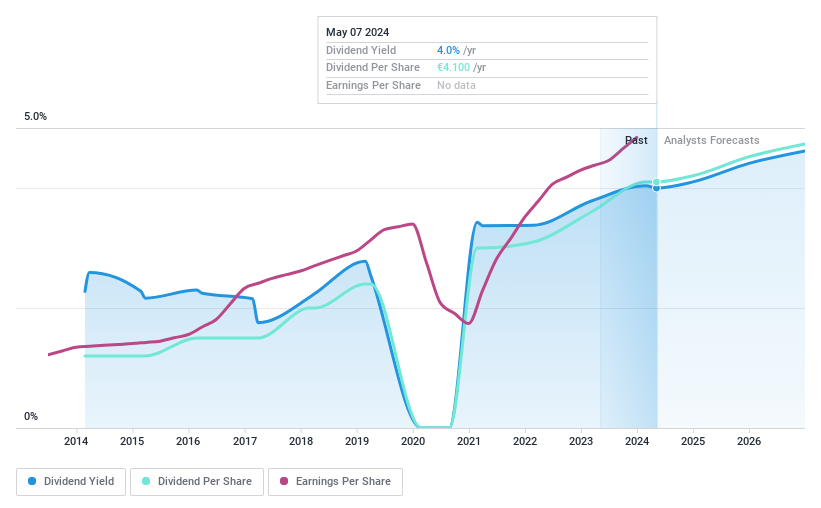

Eiffage

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in various sectors including construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions both in France and internationally, with a market capitalization of approximately €8.42 billion.

Operations: Eiffage SA's revenue is primarily generated through its infrastructures (€8.43 billion), energy systems (€5.99 billion), construction (€4.29 billion), and concessions (€3.90 billion) segments.

Dividend Yield: 4.6%

Eiffage, involved in the Valby cloudburst tunnel project valued at approximately €65.8 million, showcases a mixed dividend profile. While its dividends are covered by earnings and cash flows with payout ratios of 38.5% and 15.6% respectively, the company's dividend history has been unstable over the past decade with significant annual fluctuations exceeding 20%. Analysts predict a potential stock price increase of 43.6%, but Eiffage's dividend yield of 4.58% remains below the French market's top quartile average of 5.55%.

Click here and access our complete dividend analysis report to understand the dynamics of Eiffage.

Our valuation report unveils the possibility Eiffage's shares may be trading at a discount.

Summing It All Up

Embark on your investment journey to our 32 Top Euronext Paris Dividend Stocks selection here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AKEENXTPA:AMUN ENXTPA:FGR

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]