Ashtead Technology Holdings Leads Three Value Stocks On UK Exchange With Estimated Discount Opportunities

Amidst a backdrop of fluctuating global markets and political uncertainties, the United Kingdom's financial landscape remains a focal point for investors seeking value. Recent shifts in economic forecasts and legislative changes under the new government could influence market conditions, highlighting the importance of identifying stocks with potential undervalued opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Begbies Traynor Group (AIM:BEG) | £1.015 | £1.98 | 48.8% |

WPP (LSE:WPP) | £7.344 | £14.09 | 47.9% |

LSL Property Services (LSE:LSL) | £3.35 | £6.43 | 47.9% |

Velocity Composites (AIM:VEL) | £0.415 | £0.81 | 48.5% |

Elementis (LSE:ELM) | £1.514 | £3.02 | 49.9% |

Loungers (AIM:LGRS) | £2.84 | £5.53 | 48.7% |

Accsys Technologies (AIM:AXS) | £0.549 | £1.05 | 47.9% |

Hostelworld Group (LSE:HSW) | £1.50 | £2.96 | 49.4% |

Nexxen International (AIM:NEXN) | £2.40 | £4.71 | 49% |

M&C Saatchi (AIM:SAA) | £2.05 | £3.99 | 48.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Ashtead Technology Holdings

Overview: Ashtead Technology Holdings Plc specializes in renting subsea equipment to the offshore energy sector across Europe, the Americas, Asia-Pacific, and the Middle East, with a market capitalization of approximately £674.26 million.

Operations: The company generates its revenue primarily from the rental of oil well equipment and services, amounting to £110.47 million.

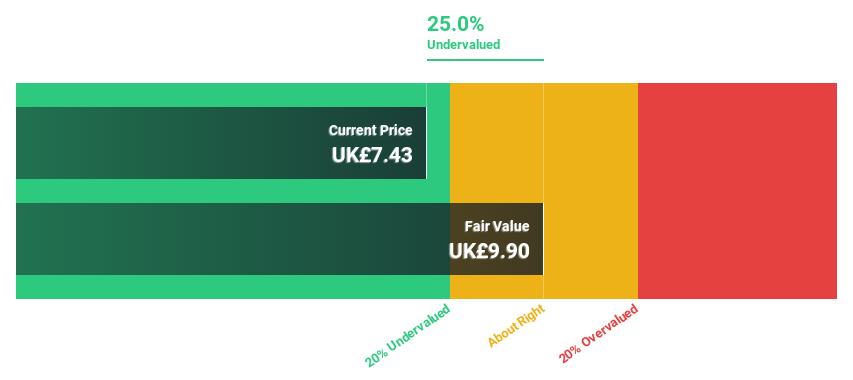

Estimated Discount To Fair Value: 20.6%

Ashtead Technology Holdings, with a current trading price of £8.41, is positioned below the estimated fair value of £10.6, suggesting undervaluation based on discounted cash flows. The company has demonstrated robust financial performance with earnings growth of 74.4% in the past year and forecasts indicating continued revenue and earnings expansion above market averages at 15.4% per year. However, it carries a high level of debt and has seen significant insider selling recently, which could be areas of concern for potential investors.

Gamma Communications

Overview: Gamma Communications plc operates in Western Europe, providing technology-based communications and software services to businesses of all sizes, with a market capitalization of approximately £1.39 billion.

Operations: Gamma Communications' revenue is derived from three primary segments: European operations generating £79.50 million, Gamma Business contributing £353.90 million, and Gamma Enterprise adding £110.60 million.

Estimated Discount To Fair Value: 17.3%

Gamma Communications, trading at £14.44, is valued below the estimated fair value of £17.46, reflecting a potential undervaluation based on discounted cash flows. The company's revenue and earnings growth forecasts outpace the UK market averages at 6.7% and 12.76% per year respectively. Recent leadership changes with John Murphy's appointment as Managing Director could influence future performance positively, alongside a dividend increase to 11.4 pence per share announced during their last AGM.

Auction Technology Group

Overview: Auction Technology Group plc operates online auction marketplaces primarily in the United Kingdom, North America, and Germany, with a market capitalization of approximately £0.60 billion.

Operations: The company generates revenue through three main segments: Auction Services at $9.77 million, Arts and Antiques at $91.90 million, and Industrial and Commercial at $73.86 million.

Estimated Discount To Fair Value: 46.4%

Auction Technology Group, priced at £4.90, trades significantly below its estimated fair value of £9.13, indicating a potential undervaluation based on cash flows. Despite a forecasted modest return on equity of 8.5% in three years, earnings are expected to rise by 34.26% annually, outpacing the UK market's 12.6%. However, recent significant insider selling and highly volatile share prices may raise concerns for potential investors. Recent corporate actions include maintaining fiscal 2024 revenue guidance amidst strategic growth initiatives.

Taking Advantage

Discover the full array of 64 Undervalued UK Stocks Based On Cash Flows right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:AT. AIM:GAMA and LSE:ATG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com