‘Astonishing’: Dumbfounded economists struggle to describe today’s jobs report surprise

May’s jobs numbers released by the Bureau of Labor Statistics Friday shocked economists and other labor market observers, who expected something starkly different from the 2.5 million payrolls added and lower 13.3% unemployment rate.

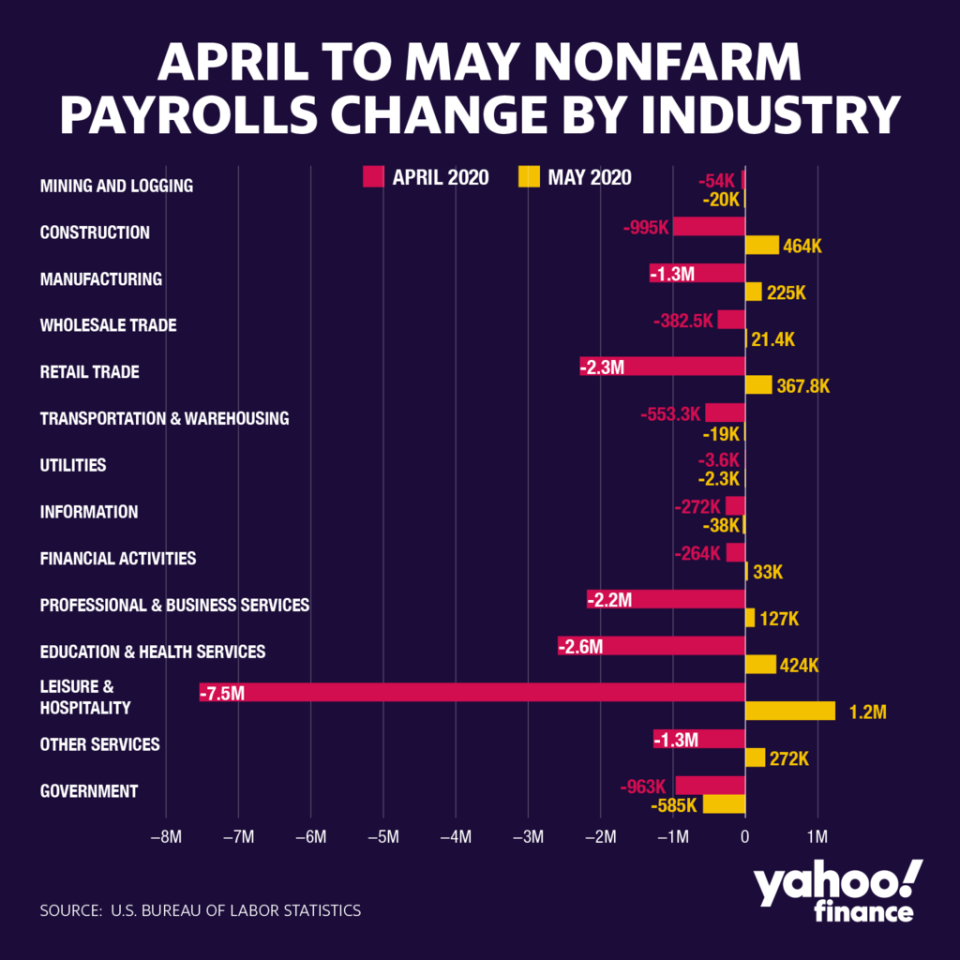

Economists estimated that the country would lose 7.5 million jobs. The unemployment rate was expected to hit 19%. A boost in leisure and hospitality drove the job gains.

In notes circulating following the release, dumbfounded economists struggled to get their jaws off the ground. This surprise, many wrote, was historic.

“In one line: Rather startling,” wrote Pantheon’s Ian Shepherdson. “The biggest payroll surprise in history, by a gigantic margin.”

ING’s chief international economist James Knightley called the report "simply astonishing."

“Somehow the US jobs market has come back from the brink with employment surging 2.509 million despite none of the labour demand surveys suggesting this was remotely possible,” Knightley wrote. “The biggest data surprise in history?”

The language in Knightley’s dispatch to clients was a departure from the normally measured reactions — indicating just how wild this was.

“Apologies — this has taken a little longer to write having just fallen off my chair and broken it,” Knightley wrote. “This was so far away from what anyone was expecting. It is simply astonishing given the slow pace of reopening and the fact that more than 12 million people filed a new unemployment claim during the survey period.”

“This is one of the biggest economic data shocks in history, if not the biggest,” he wrote.

The unemployment rate is likely a few percentage points higher than reported, due to survey issues that also plagued March and April, BLS added in the release. With this in mind, however, the economists were still shocked.

allow me to explain today's jobs report, you see- pic.twitter.com/QnxDO6pWBk

— Dave Itzkoff (@ditzkoff) June 5, 2020

JPMorgan joked about the economists’ massive miss with a reference to Charlie Sheen’s pitcher character in the 1989 film “Major League,” who would hit the back stop. “Juuust a bit outside,” the bank wrote, echoing the sportscaster Bob Uecker’s understatement. The bank called the jobs numbers "shocking" and said both the unemployment rate and payrolls are "huge surprises."

MUFG's Chris Rupkey and LPL’s senior market strategist Ryan Detrick joined in with JPMorgan calling it “shocking.”

Allianz’s senior investment strategist for investor management Charlie Ripley said the numbers have made investors do a “double take.”

Other reactions were milder, with Goldman Sachs and others measuredly calling it “unexpected” and Bank of America calling it a “major positive surprise.”

Shepherdson attributed the difference between estimates and BLS data to the fact that employers likely did much of the rehiring out of the limelight — a simple text or email to temporarily laid-off employees. This wouldn’t have shown up on formal data points that affect estimates, like ADP’s numbers that economists use.

Some, like Indeed.com's Nick Bunker, warned people not to get "too excited about this one month of data.” Like Bunker, almost all analysts issued reminders that the numbers were strong but the labor market was still in bad shape.

--

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

2021 health insurance rates are coming out despite 'unprecedented uncertainty'

Insurance premiums expected to rise 4% to 6%, before factoring in COVID

High-yield savings banks finally hit by the Fed's coronavirus rate cut

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Yahoo Finance

Yahoo Finance