ASX Dividend Stocks CTI Logistics And 2 Other Top Picks

Over the last 7 days, the Australian market has risen 1.7%, contributing to a 17% increase over the past year, with earnings forecasted to grow by 12% annually. In this favorable environment, identifying strong dividend stocks like CTI Logistics and two other top picks can provide investors with reliable income and potential growth opportunities.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Perenti (ASX:PRN) | 7.55% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.52% | ★★★★★☆ |

Super Retail Group (ASX:SUL) | 6.54% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.21% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.66% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 3.95% | ★★★★★☆ |

MFF Capital Investments (ASX:MFF) | 3.65% | ★★★★★☆ |

CTI Logistics (ASX:CLX) | 5.98% | ★★★★★☆ |

National Storage REIT (ASX:NSR) | 4.33% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.57% | ★★★★★☆ |

Click here to see the full list of 40 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

CTI Logistics

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CTI Logistics Limited (ASX:CLX) provides transport and logistics services in Australia with a market cap of A$147.19 million.

Operations: CTI Logistics Limited generates revenue through its logistics segment (A$118.28 million) and transport segment (A$225.42 million), along with property-related income (A$6.37 million).

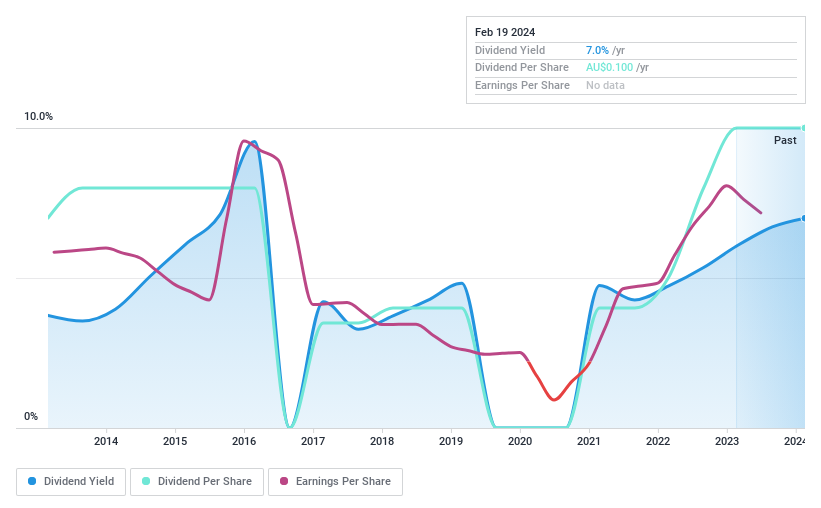

Dividend Yield: 6%

CTI Logistics reported A$321.16 million in sales for the year ending June 30, 2024, with a net income of A$15.83 million. Despite a slight decline in earnings per share from A$0.2227 to A$0.2049, the company announced a dividend of A$0.055 per share for the six months ending June 30, 2024. The payout ratio stands at 51.2%, indicating dividends are covered by earnings and cash flows (57%). However, its dividend history has been volatile and unreliable over the past decade despite recent growth.

IGO

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company focused on discovering, developing, and operating assets for clean energy metals with a market cap of A$4.35 billion.

Operations: IGO Limited's revenue segments include A$48.80 million from the Cosmos Project, A$539.10 million from the Nova Operation, and A$234.80 million from the Forrestania Operation, with an additional A$18.10 million in interest revenue.

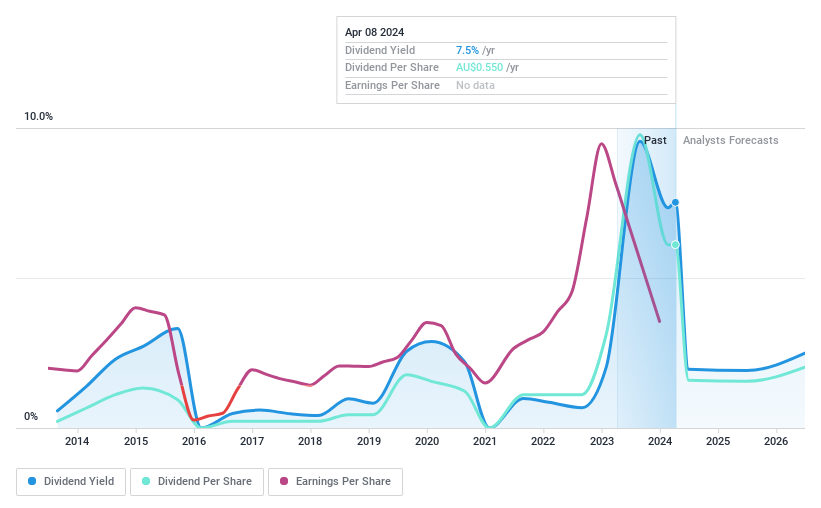

Dividend Yield: 6.4%

IGO's recent dividend of A$0.26 per share, announced for the six months ending June 30, 2024, highlights both opportunities and concerns for dividend investors. While its dividend yield is in the top 25% of Australian payers at 6.43%, earnings have significantly dropped to A$2.8 million from A$549.1 million a year ago, leading to an unsustainable payout ratio and unreliable dividends over the past decade. Recent M&A rumors suggest potential strategic shifts that might impact future dividends.

Southern Cross Electrical Engineering

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$481.81 million.

Operations: Southern Cross Electrical Engineering Limited generates A$551.87 million in revenue from its provision of electrical services.

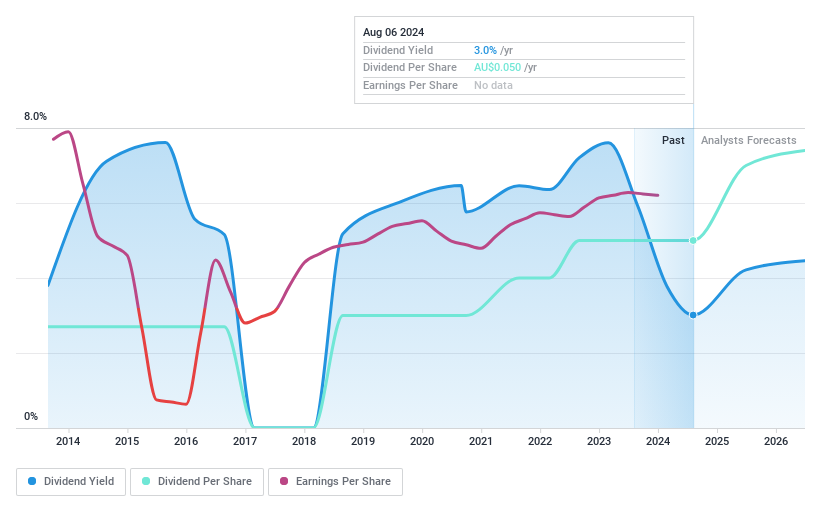

Dividend Yield: 3.3%

Southern Cross Electrical Engineering's recent inclusion in the S&P Global BMI Index and a dividend increase to A$0.05 per share underscore its commitment to returning value to shareholders. The company's dividends are well-covered by earnings (72% payout ratio) and cash flows (46.7% cash payout ratio), though its dividend history has been volatile over the past decade. Despite a modest dividend yield of 3.29%, SXE's consistent earnings growth supports future payouts, albeit with some reliability concerns.

Summing It All Up

Unlock more gems! Our Top ASX Dividend Stocks screener has unearthed 37 more companies for you to explore.Click here to unveil our expertly curated list of 40 Top ASX Dividend Stocks.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CLX ASX:IGO and ASX:SXE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]