AutoNation (AN) Q3 Earnings Trail Estimates, Sales Up Y/Y

AutoNation Inc. AN reported third-quarter 2022 adjusted earnings of $6 per share, which jumped 17% year over year but missed the Zacks Consensus Estimate of $6.32. This underperformance can be primarily attributed to the lower-than-expected sales and profit from new-vehicle and used-vehicle units.

In the reported quarter, revenues amounted to $6,666 million, growing 4% year over year and topping the Zacks Consensus Estimate of $6,645 million.

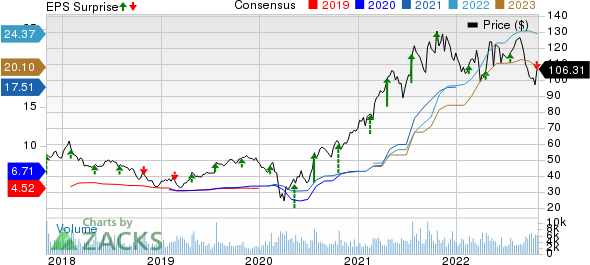

AutoNation, Inc. Price, Consensus and EPS Surprise

AutoNation, Inc. price-consensus-eps-surprise-chart | AutoNation, Inc. Quote

Key Takeaways

In the reported quarter, new-vehicle revenues grew 4% year over year to $2,863.9 million. It, however, missed the Zacks Consensus Estimate of $2,951 million. Gross profit from the segment came in at $329.7 million, rising 3.2% from $319.6 million but falling short of the consensus mark of $344 million.

Used-vehicle revenues rose 3.4% from the year-ago figure to $2,401.7 million, but lagged the consensus mark of $2,429 million. Gross profit from the segment came in at $142 million, down 19.8% and missing the consensus mark of $153 million. Net revenues in the finance and insurance business amounted to $360.7 million, up 3.4% from the year-ago quarter but missing the consensus mark of $375 million. Gross profit was $360.7 million.

Revenues from the parts and service business rose 9.4% to $1,032.1 million, topping the consensus metric of $1,016 million. Gross profit from this segment came in at $478.6 million, rising 12.7% year over year and beating the consensus mark of $463 million.

During the quarter, AutoNation opened its 12th AutoNation USA store in Kennesaw, GA. It maintains its target to have more than 130 AutoNation USA stores in operation, from coast to coast, by the end of 2026.

Segmental Details

Revenues from the Domestic segment were up 4% year over year to $2,032.8 million. The segment’s income fell 4.3% to $142.7 million in the reported quarter.

Revenues from the Import segment shrunk 5.5% from the prior-year quarter to $1,875.2 million. The segment’s income also contracted 10.2% to $180.3 million.

Premium Luxury segment sales rose 13% to $2,506.4 million. The segmental income soared 14.1% year over year to $235.2 million in the reported quarter.

Financial Tidbits

The adjusted SG&A expenses, as a percentage of gross profit, were 58.1%, an improvement from 56.9% in the year-ago period. Expenses rose to $763.2 million from $723.7 million.

AutoNation’s cash and cash equivalents were $442.9 million as of Sep 30, 2022, a whopping rise from $72 million in the year-ago period. The company’s liquidity was $2.2 billion, including $443 million in cash and nearly $1.8 billion available under its revolving credit facility.

The firm’s inventory was valued at $ 1,851.3 million. At the end of the third quarter, non-vehicle debt was $3,544.6 million, increasing from $2,680.3 million in the year-ago quarter. Capital expenditure in the quarter amounted to $83.1 million, rising from $47.5 million.

During the third quarter of 2022, AutoNation repurchased 3.8 million shares of common stock for an aggregate purchase price of $428 million. As of Oct 25, 2022, it had approximately 50 million shares outstanding. The company has also authorized the repurchase of up to an additional $1 billion of its common stock.

Zacks Rank & Key Picks

AN currently has a Zacks Rank #4 (Sell).

Some better-ranked players in the auto space are Cummins Inc. CMI, CarParts.com PRTS and Genuine Parts Company GPC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Cummins has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for CMI’s current-year earnings has been revised 1% upward in the past 30 days.

CarParts has an expected earnings growth rate of 45% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant over the past 30 days.

Genuine Parts has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 1.6% upward over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

CarParts.com, Inc. (PRTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance