Axfood And Two Other Top Dividend Stocks In Sweden

Amidst a backdrop of fluctuating European markets and political uncertainties, Sweden's economic resilience continues to capture investor interest. This makes exploring dividend stocks in the region particularly relevant, as they can offer potential stability and consistent returns in an otherwise volatile environment.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.23% | ★★★★★★ |

Betsson (OM:BETS B) | 6.11% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.40% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.36% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.06% | ★★★★★☆ |

Duni (OM:DUNI) | 4.81% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.60% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.30% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.05% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.71% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Axfood

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axfood AB operates primarily in Sweden, focusing on food retail and wholesale, with a market capitalization of approximately SEK 59.99 billion.

Operations: Axfood AB's revenue is generated through several segments, with Willys contributing SEK 44.54 billion, Dagab at SEK 74.94 billion, Home Purchase at SEK 7.57 billion, and Snabbgross bringing in SEK 5.35 billion.

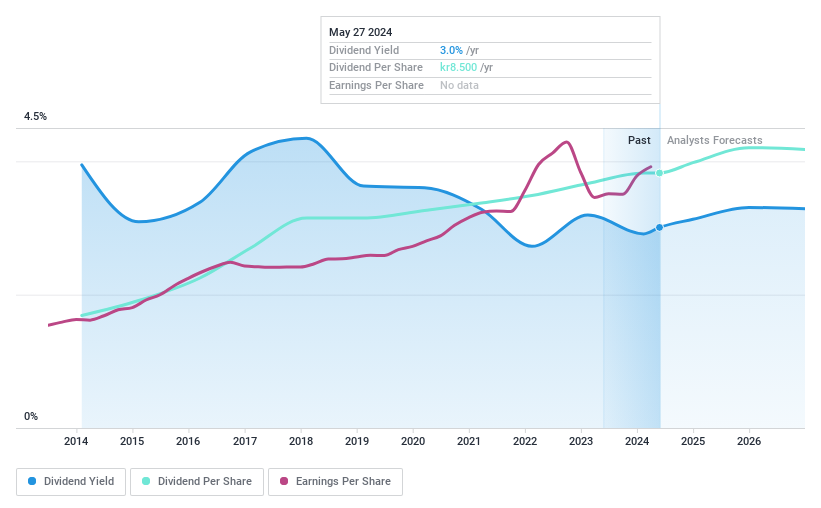

Dividend Yield: 3.1%

Axfood, a notable player in the Swedish food retail sector, reported a solid increase in sales and net income for Q1 2024, with figures rising from SEK 19.25 billion to SEK 20.25 billion and SEK 475 million to SEK 561 million respectively. The firm also declared a dividend of SEK 8.50 per share, split into two payments. Leadership transitions include Simone Margulies becoming CEO in August, promising continuity in strategy as she has extensive experience within the group. Additionally, Axfood is set to acquire City Gross Sverige AB, potentially expanding its market footprint further.

Dive into the specifics of Axfood here with our thorough dividend report.

Our valuation report here indicates Axfood may be overvalued.

Duni

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Duni AB (publ) is a Swedish company that specializes in developing, manufacturing, and selling concepts and products for serving, take-away, and meal packaging both domestically and internationally, with a market capitalization of approximately SEK 4.89 billion.

Operations: Duni AB generates revenue primarily through two segments: Dining solutions at SEK 4.60 billion and Food packaging solutions at SEK 3.03 billion.

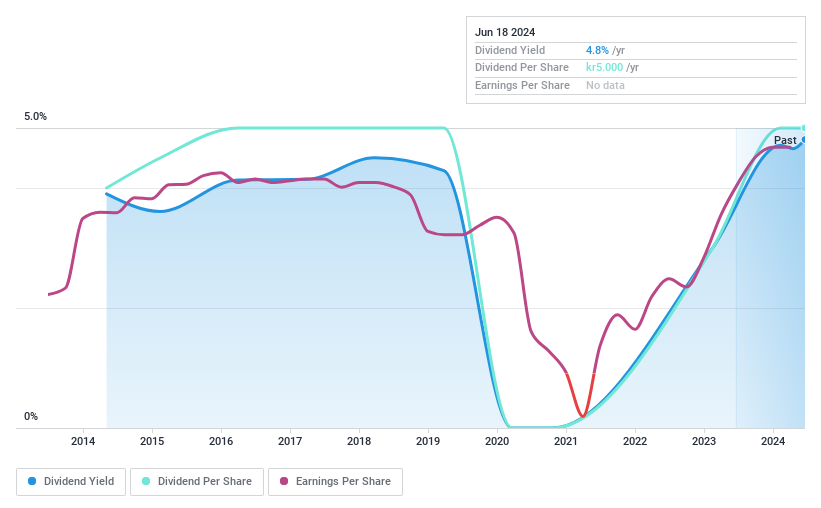

Dividend Yield: 4.8%

Duni AB, a Swedish company, approved a dividend of SEK 5.00 per share at its recent AGM, with payments split across two dates. Despite this positive step, the firm's dividend history over the past decade shows volatility and an unstable track record. However, dividends are well-supported by earnings and cash flows with payout ratios of 60.3% and 28.2% respectively. Q1 2024 sales decreased to SEK 1.736 billion from SEK 1.877 billion year-over-year, while net income remained steady at SEK 78 million.

Click here and access our complete dividend analysis report to understand the dynamics of Duni.

The valuation report we've compiled suggests that Duni's current price could be inflated.

Softronic

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) specializes in providing IT and management services mainly in Sweden, with a market capitalization of approximately SEK 1.14 billion.

Operations: Softronic AB generates its revenue primarily through its Computer Services segment, which accounted for SEK 834.42 million.

Dividend Yield: 6.2%

Softronic's recent financials show a slight decline, with Q1 2024 sales at SEK 230.1 million and net income at SEK 18 million, both lower than the previous year. The basic and diluted earnings per share also decreased to SEK 0.34 from SEK 0.38. Despite offering a dividend yield of 6.18%, its sustainability is questionable as it is not adequately supported by cash flows, indicating potential risks for dividend-focused investors in maintaining consistent payouts.

Turning Ideas Into Actions

Unlock our comprehensive list of 22 Top Dividend Stocks by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AXFO OM:DUNI and OM:SOF B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]