Bank of America CEO: Why it matters that 21% of our deposits are made through mobile

This past quarter, Bank of America (BAC) achieved more than 1 billion digital interactions with its customers.

And while this may not be as popular a metric as net interest income or trading revenue, the company’s second-quarter earnings beat estimates on Tuesday. That earnings beat was driven by strength in its consumer bank, which has, in turn, been fueled by innovation in digital and mobile. The business saw loan growth across credit cards, autos and residential mortgages.

The second-largest US lender by assets has said its consumer business grew $60 billion in deposits year-over-year, with around half of that growth coming from checking account balances and one half of that rate driven by innovation including digital interactions.

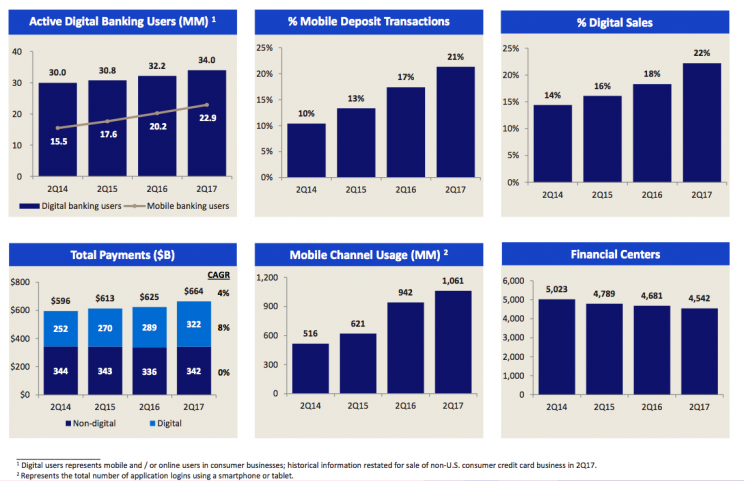

CEO Brian Moynihan said 21% of its deposits are made through mobile devices today.

“That’s the equivalent of what a thousand financial centers does,” Moynihan said on the company’s second-quarter conference call. “That’s important for client satisfaction. It is also important because those cost one-tenth of what it costs to do over-the-counter.”

Cost reduction is also a product of increased digital roll-out, because of branch closures and headcount cuts. The bank said it aims to reduce annual operating expenses to $53 billion next year.

This quarter, the company launched new capabilities for car shopping and financing those cars through mobile along with new person-to-person features through its partnership with Zelle.

“We can’t emphasize enough the positive impacts of all these investments, especially in mobile and digital,” Moynihan said on the conference call.

Mobile has contributed to payments growth at the bank. Last quarter, the 4% in payments growth was driven by 8% growth in digital while non-digital stayed relatively flat. And at the end of the quarter, mobile banking users rose to 23 million.

More room to run with mobile

Moynihan added that the bank can make even more inroads when it comes to mobile penetration.

And specifically, he said that person-to-person transactions are an important payment stream the company is driving with much upside ahead.

“Person-to-person customers sent $18 billion in payments for our platform of quarter two. This is up 20% year-over year,” Moynihan said. “It’s already sizable but it still accounts for 3% of the total payments in our consumer business this quarter…we’ve got a long way to go on penetration.”

Digital marks pivotal moment for banks

According to McKinsey, digital growth presents a key decision point for major banks.

“If the last epoch in retail banking was defined by a boom-to-bust expansion of consumer credit, the current one will be defined by digital,” according to a recent report by McKinsey.

According to their analysis, digital laggards could see up to 35% net profit erosion while winners could see up to 40% profit upside, as shown below.

It is key, according to McKinsey, to embrace digital in order to increase connectivity, refine decision-making and foster innovation.

For now, Bank of America seems to be moving in the right direction.

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

Low oil prices are hurting Pepsi’s business

The No. 1 concern for companies during this earnings season

Retail dwarfs coal, and yet Trump has said little about massive job losses

The opioid crisis is hurting prospects for the US labor market

Fed sees easing financial conditions despite tightening