BB&T, SunTrust merger could spur domino effect of bank M&A

The $66 billion deal to tie up southern bank giants BB&T and SunTrust could be the first domino to fall in a wave of M&A deals, as banks of all size race to build scale in an increasingly competitive space.

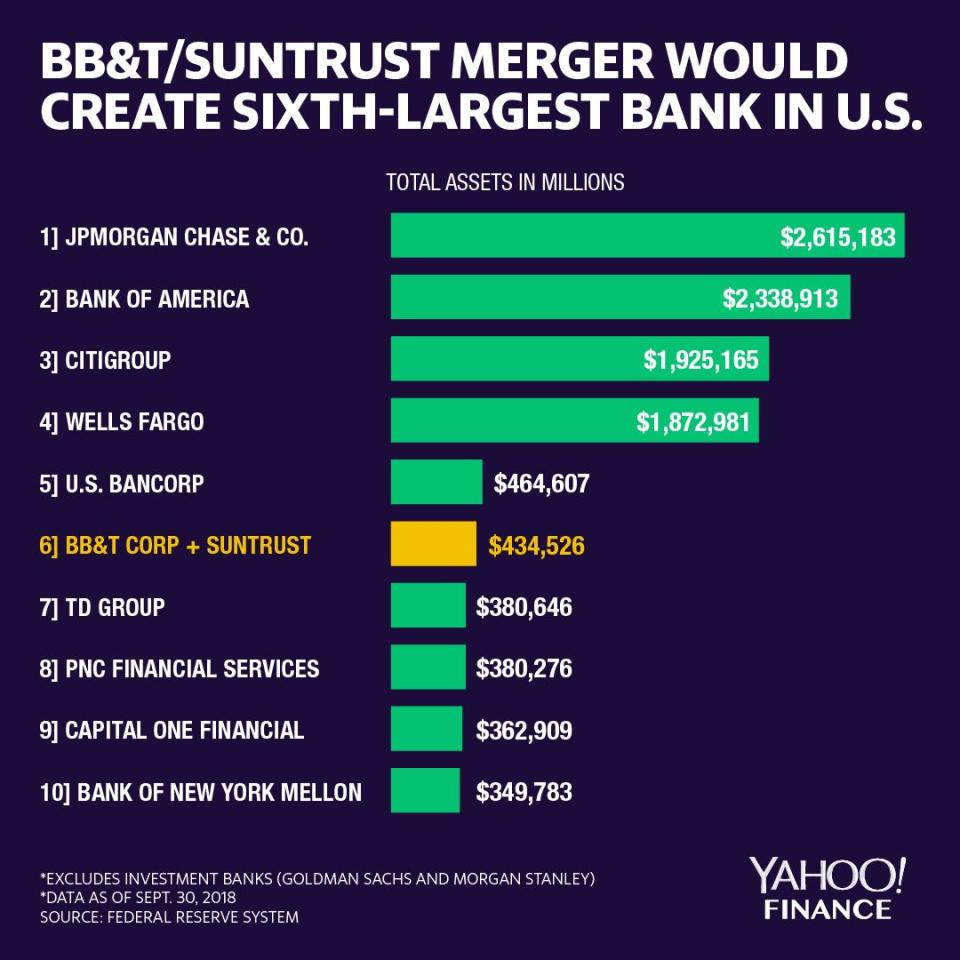

On Thursday morning, BB&T (BBT) and SunTrust (STI) announced that they would be forming the sixth-largest bank in the United States by joining in a merger of equals, with BB&T shareholders owning about 57% of the pro-forma company and SunTrust shareholders owning about 43%.

UBS analysts noted Thursday that the deal could serve as a “catalyst for consolidation” as other large regional banks feel the pressure to take on the largest players in the industry.

Shares of BB&T had risen 3.5% to $50.24 and shares of SunTrust were up 9.8% to $64.52 as of 3:13 pm E.T. on Thursday.

“We also think a positive share reaction to the transaction could help induce managements to more actively consider tying up with other depository institutions,” UBS noted.

Big getting bigger

Large banks have been eager to strike deals amid a perfect storm of favorable conditions; the Trump tax cuts gave banks plenty of cash and tweaks to the regulatory environment brought down barriers to consolidation.

Under the Federal Reserve’s previous rules, banks with above $250 billion were required to hold a minimum level of liquid assets to ensure that they would withstand financial stress, a requirement known as the “liquidity coverage ratio.” But Trump’s appointee to the Fed, Randal Quarles, expressed the view that some of these rules went too far. Quarles proposed “tailoring” the regulations on superregional banks with between $250 billion and $700 billion in total assets and reducing their liquidity requirements to between 70% to 80% of the current requirements.

“Anytime that there is a less draconian regulatory perspective, it’s good for banks and it’s good for larger banks,” Gary Tenner, a managing director covering banks for D.A. Davidson & Co., told Yahoo Finance.

The combined BB&T and SunTrust entity - yet to be named - would have $442 billion in total assets and therefore would benefit from those reduced requirements. The pro-forma company catapults the southern banks into competition with the likes of U.S. Bancorp (USB) and PNC Financial Services (PNC).

Those companies are still magnitudes smaller than the big four: JPMorgan Chase & Co, Bank of America, Citigroup, and Wells Fargo.

But BB&T and SunTrust are sticking a flag in Bank of America’s territory by announcing its new headquarters in Charlotte, North Carolina - where Bank of America is also domiciled.

To take on the giants, BB&T and SunTrust acknowledge that they need to build the infrastructure to allow consumers to access and manage their financial products online. But building a digital platform is both challenging and expensive, a problem that BB&T hopes to address through its acquisition of SunTrust and its fairly built-up digital lending technology.

“This combination allows us to invest substantially in technology which will enhance our already outstanding levels of trust and confidence and that will result in a lasting, trusting relationship with our client which was our winning proposition,” BB&T Chairman and CEO Kelly King said on the announcement call Thursday. King will serve as the combined company’s CEO through September 2021, after which point SunTrust Chairman and CEO William Rogers Jr. will take over as CEO.

Pressure on smaller banks

UBS writes that the need for investment in technology - presumably to take on the giants that have large war chests to build their own systems - will push banks to the dealmaking table. Smaller banks could feel the pressure as well.

Tenner says banks around the $30 billion mark have sidelined themselves amid market volatility that hurt bank stocks at the end of 2018, since wild price moves make it difficult to price deals paid for in stock. But those smaller banks have also benefited from regulatory changes - particularly around the $50 billion threshold where companies used to face extra regulations like stress testing. The Trump administration, in conjunction with some moderate Democrats, raised that threshold to $250 billion last year.

“A big part of the conversation was what was the next catalyst for the group,” Tenner said.

BB&T and SunTrust’s monster deal - comparable to other eye-popping M&A deals like CVS Health’s $70 billion acquisition of Aetna in 2017 - could be that catalyst in an industry where smaller banks are competing against giants that are getting more giant.

In the south, the battle is already heating up; Alabama-based Regions Financial (RF) recently had its application approved to beef up its presence in three states where SunTrust and BB&T currently operate: Georgia, Tennessee, and Texas.

The BB&T/SunTrust deal is still subject to regulatory approval but executives said on a conference call that they expect the deal to close in the fourth quarter of 2019. King said BB&T still faces a consent order with the Federal Reserve regarding its compliance with the Bank Secrecy Act, but King said the company is in the “final stages” of fixing the issue.

“We do not expect it to stand in the way of this combination being approved,” King said on the call.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Consumer watchdog loosens Obama-era guardrails on payday lending

Dallas Fed President wants 'no further action' on rates

Trump meets Powell to talk about economy on eve of State of the Union

E-commerce is insulated from deteriorating consumer confidence

Congress may have accidentally freed nearly all banks from the Volcker Rule