Believe Leads These 3 High Growth Tech Stocks In France

As the pan-European STOXX Europe 600 Index shows signs of optimism with a modest rise amid hopes for quicker interest rate cuts by the European Central Bank, France's CAC 40 Index has also experienced a slight increase, reflecting a cautiously positive sentiment in the region. In this environment, identifying high-growth tech stocks requires attention to companies that demonstrate resilience and adaptability to evolving economic conditions and regulatory landscapes.

Top 10 High Growth Tech Companies In France

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

Archos | 25.98% | 77.41% | ★★★★★☆ |

Valneva | 22.83% | 17.91% | ★★★★★☆ |

Munic | 42.94% | 174.09% | ★★★★★☆ |

Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

Adocia | 70.20% | 63.97% | ★★★★★☆ |

Valbiotis | 33.52% | 39.79% | ★★★★★☆ |

VusionGroup | 28.35% | 81.72% | ★★★★★★ |

beaconsmind | 26.32% | 74.88% | ★★★★★★ |

Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Believe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Believe S.A. is a company that offers digital music services to independent labels and local artists across various regions including France, Germany, the rest of Europe, the Americas, Asia, Oceania, and the Pacific with a market cap of approximately €1.51 billion.

Operations: With a market cap of approximately €1.51 billion, Believe S.A. generates revenue primarily through its Premium Solutions segment (€877.53 million) and Automated Solutions segment (€61.50 million), focusing on digital music services for independent labels and local artists across multiple regions.

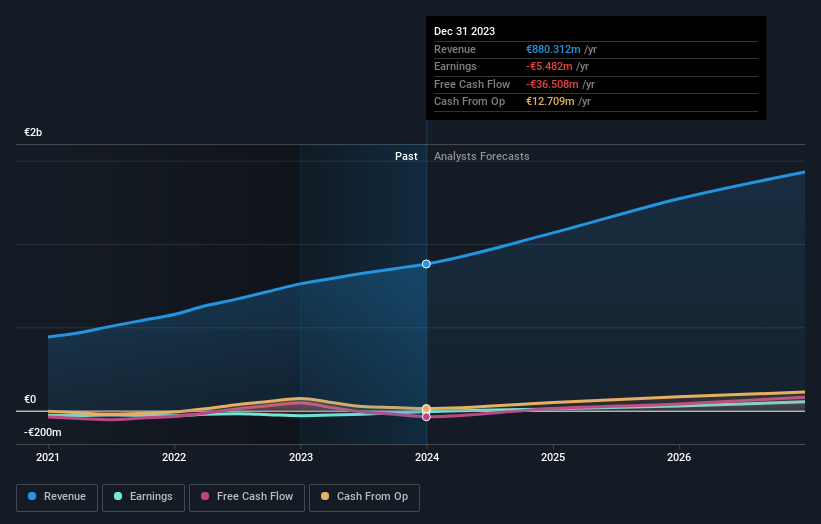

Believe S.A., navigating through a transformative phase, reported a significant sales increase to €474.13 million, up from €415.42 million last year, although it shifted from a slight net income of €0.334 million to a net loss of €7.57 million in the first half of 2024. This backdrop frames its R&D intensity, crucial for fostering innovation in the competitive tech landscape; however, specific R&D spending figures are essential for evaluating its strategic focus further. With revenue growth outpacing the French market average at 13.1% annually and projected earnings growth surging by 56.79% per year, Believe is poised for recovery and profitability within three years despite current unprofitability challenges—underscoring its potential resilience and adaptability in high-growth tech sectors.

Navigate through the intricacies of Believe with our comprehensive health report here.

Evaluate Believe's historical performance by accessing our past performance report.

Bolloré

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across multiple continents including Europe, the Americas, Asia, Oceania, and Africa with a market cap of €16.82 billion.

Operations: The company generates revenue primarily from its communications segment, contributing €14.86 billion, followed by Bollore Energy at €2.75 billion and the industry sector at €353 million. The communications segment is the largest revenue driver among its diversified operations across various continents.

Bolloré SE, with its substantial revenue leap to €10.59 billion from €6.23 billion in the first half of 2024, underscores a robust financial trajectory, complemented by a net income surge to €3.76 billion from just €114 million year-over-year. This financial uplift is mirrored in its R&D commitment, crucial for sustaining innovation and staying competitive within the tech sector; however, detailed figures on R&D spending would provide deeper insights into its strategic allocations. The company's projected earnings growth of 32.75% annually outstrips the French market's average, positioning it well for future advancements despite a slower revenue growth forecast of 8.3% per year compared to the broader market expectation of 20%.

Take a closer look at Bolloré's potential here in our health report.

Explore historical data to track Bolloré's performance over time in our Past section.

Genfit

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genfit S.A. is a late-stage biopharmaceutical company focused on discovering and developing drug candidates and diagnostic solutions for metabolic and liver-related diseases, with a market cap of €268.96 million.

Operations: The primary revenue stream for Genfit S.A. is the research and development of innovative medicines and diagnostic solutions, generating €80.47 million. The company's focus lies in addressing metabolic and liver-related diseases through its biopharmaceutical advancements.

Genfit S.A. has demonstrated a remarkable financial turnaround, with first-half 2024 revenues soaring to €61.2 million from €15.37 million in the previous year, reflecting a robust growth trajectory in the biotech sector. This surge is underpinned by a significant shift to profitability, reporting net income of €30.31 million compared to a loss of €20.85 million year-over-year, illustrating effective operational and strategic management. The company's commitment to innovation is evident from its R&D investments which are crucial for maintaining competitive edge and driving future growth; however, specific R&D expenditure figures would enhance understanding of its strategic focus areas. Despite the impressive revenue and profit growth, Genfit's annual revenue growth projection of 17.8% trails the broader French market expectation of 20%. Nevertheless, earnings are anticipated to outpace this with an estimated increase of 33.8% per annum over the next three years, significantly above the market average of 12.1%, indicating potential for sustained upward financial trends despite current market challenges.

Unlock comprehensive insights into our analysis of Genfit stock in this health report.

Review our historical performance report to gain insights into Genfit's's past performance.

Next Steps

Click this link to deep-dive into the 40 companies within our Euronext Paris High Growth Tech and AI Stocks screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:BLV ENXTPA:BOL and ENXTPA:GNFT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]