Berkshire Hathaway Earnings: Coronavirus affected business, investments got slammed, cash balance ballooned

Berkshire Hathaway (BRK-A, BRK-B), the conglomerate run by billionaire Warren Buffett, reported first-quarter financial results, and it was a mixed picture. On one hand, operating earnings actually climbed during the period. But Berkshire’s massive investment portfolio took a massive unrealized loss. The keyword is “unrealized,” and we’ll get to that in just a minute.

The big story here is the impact of the coronavirus pandemic. In fact, Berkshire’s 10-Q filing makes reference to “COVID-19” 31 times.

First, some highlights:

Q1 operating earnings: $5.871 billion, up from $5.555 billion last year ($5.56 billion expected by analysts

Q1 investment gains: -$54.517 billion, down from $15.498 billion last year

Q1 net earnings per A share: -$30,652, down from $13,209 last year

Q1 net earnings per B share: -$20.44, down from $8.81 last year

Q1 cash and equivalents: $137.263 billion, up from $127.997

Click here for live updates from Berkshire Hathaway’s annual shareholders meeting

About COVID-19

“Prior to the middle of March, many of our operating businesses were experiencing comparative revenue and earnings increases over 2019,” management said in the regulatory filing. “As efforts to contain the spread of the COVID-19 pandemic accelerated in the second half of March and continued through April, most of our businesses were negatively affected, with the effects to date ranging from relatively minor to severe.”

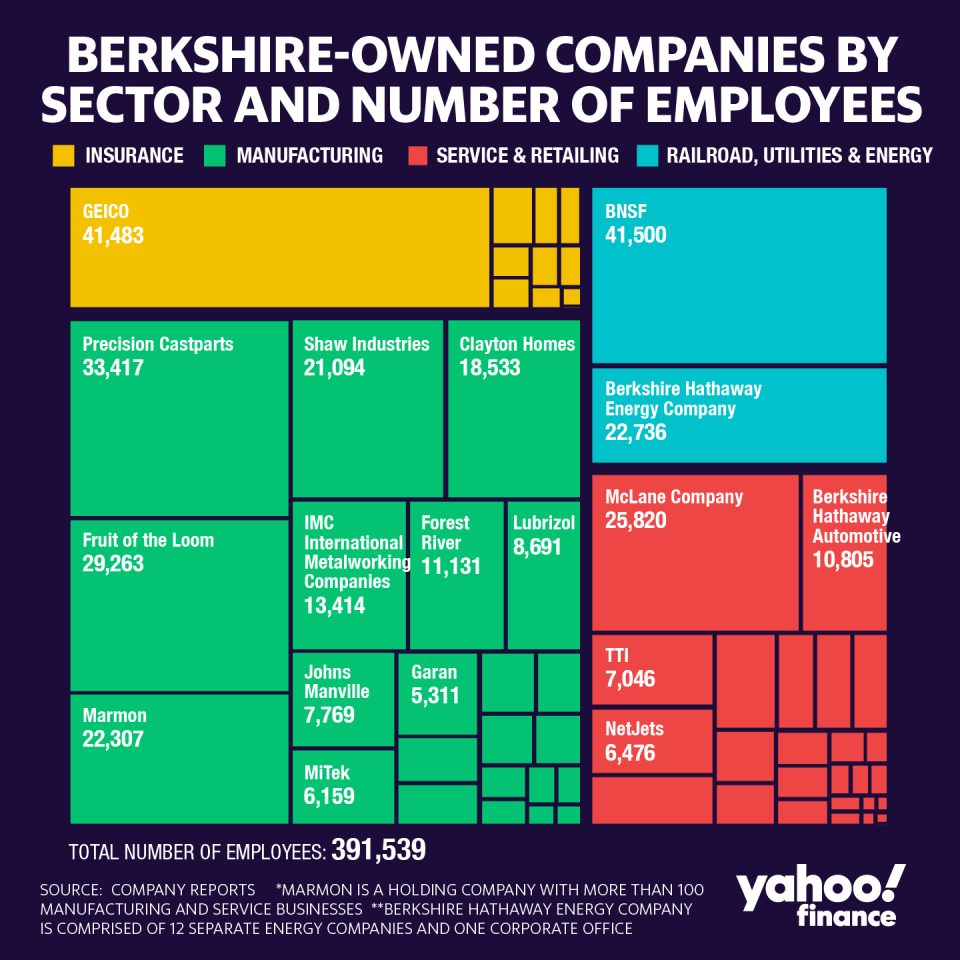

Berkshire is a conglomerate consisting of companies that touch a broad array of industries, and so it’s arguably a reflection of the U.S. economy. And like the economy, it is getting disrupted by the coronavirus pandemic. In February, Buffett warned that “a very significant percentage of our businesses“ was being affected.

“Several of our businesses deemed essential have continued to operate, including our railroad, utilities and energy, insurance and certain of our manufacturing, distribution and service businesses,” management continued. “However, revenues of these businesses have slowed considerably in April. Other businesses, including several of our retailing businesses and certain manufacturing and service businesses are being severely impacted due to closures of facilities where crowds can gather, such as retail stores, restaurants, and entertainment venues.”

Additionally, like many other companies across the country and world, Berkshire’s portfolio companies have also made painful cuts.

“These actions have included employee furloughs, wage and salary reductions, capital spending reductions and other actions intended to help mitigate the economic losses and preserve capital and liquidity,” management said. “While we believe that these necessary actions are temporary, we cannot reliably predict when business activities at our numerous and diverse operations will normalize. We also cannot predict how these events will alter the future consumption patterns of consumers and businesses we serve.

Ignore the investment losses

Regarding that massive loss in investments, Berkshire’s managers explain it this way: “The amount of investment gains/losses in any given quarter is usually meaningless and delivers figures for net earnings per share that can be extremely misleading to investors who have little or no knowledge of accounting rules.“

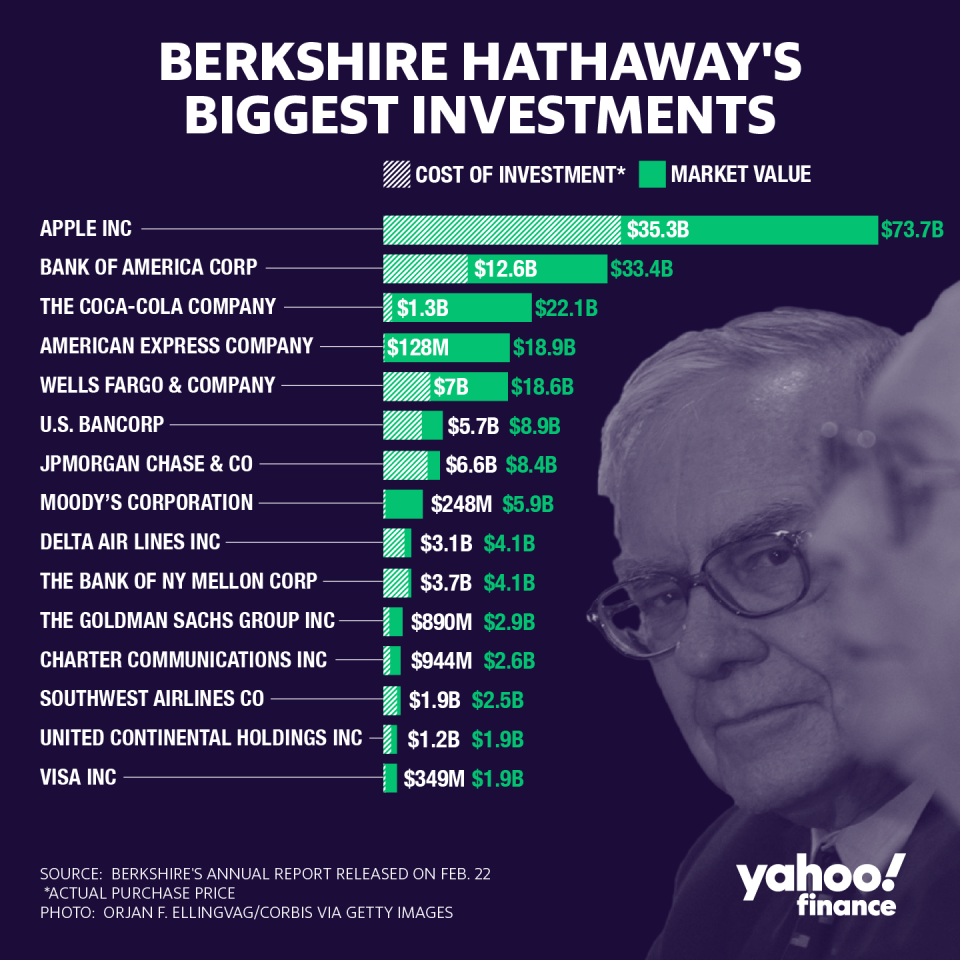

The reported number includes an unrealized loss of $55.5 billion in Berkshire’s stock portfolio. This is the result of the COVID-19 crisis triggering the fastest bear market in history, which continued to crash before bottoming in late March.

A recent change to generally accepted accounting principles (GAAP) by the Financial Accounting Standards Board requires companies to account for short-term swings of their equity investments in their quarterly and annual earnings. These are known as unrealized gains and losses — unrealized because these are paper losses, not actual losses (or realized gains and losses) that come from the sales of these securities.

Berkshire chairman and CEO Warren Buffett and vice chair Charlie Munger voice their disdain for the rule with every earnings announcement.

Q1’s unrealized loss offsets the $53.7 billion unrealized gain in the previous quarter.

“Over time, Charlie and I expect our equity holdings — as a group — to deliver major gains, albeit in an unpredictable and highly irregular manner,” Buffett said in February.

Meanwhile, Berkshire’s cash (and equivalents) balance climbed to $137.263 billion as of the end of Q1, up from $127.997 three months ago.

Investors and spectators continue to monitor how Buffett and his team may deploy some of that cash. Perhaps they buyback more shares of Berkshire. Perhaps they increase the positions in the investment portfolio. Perhaps the acquire another massive business.

Berkshire’s businesses take a hit amid COVID-19

Insurance underwriting earnings, which includes the GEICO auto insurance business, fell to $363 million in Q1, down from $389 million a year ago.

During an interview on March 10, Buffett told Yahoo Finance's editor-in-chief Andy Serwer that the COVID-19 outbreak had caused GEICO to see fewer accidents, which is favorable for the business’s profit margins.

"People just haven't been driving as much,” Buffett said. “People have changed their behavior."

It’s worth noting that GEICO has been offering insurance credit to current and prospective policyholders.

Berkshire’s railroad earnings declined to $1.190 billion from $1.253 billion a year ago. Railroad operator Burlington Northern saw business drop off during the end of the quarter. According to the Association of American Railroads, March carloads were down 6% year-over-year.

“The decrease is principally a result of the negative impact on volumes of the COVID-19 pandemic,“ the company said in its 10-Q filing.

Berkshire’s utilities and energy earnings fell to $561 million from $605 million. PacifiCorp and MidAmerican Energy both reported lower profit margins.

Manufacturing, service and retailing earnings declined to $2.038 billion from $2.200 billion. Aerospace supplier Precision Castparts was hit by “Boeing’s decision to temporarily suspend production of the 737 MAX aircraft.”

Elsewhere, chemicals supplier Lubrizol saw revenue decline 4.3% year-over-year, at least partially due to capacity disruptions stemming from a fire at one of the unit’s French facilities.

Why were operating earnings up? Dividends and less exposure to fraud

While most of the Berkshire operations suffered, two items that go into operating earnings were up year-over-year.

Insurance investment income climbed to $1.386 billion from $1.237 billion a year ago thanks to dividend income jumping to $1.243 billion from $972 million.

Also, Q1 2020 benefited from easier year-over-year comparisons, unfortunately, because Berkshire Hathaway was the victim of fraud. Long story short, this saga ended with Berkshire booking a $377 million charge in Q1 2019 as the company “concluded it was more likely than not that the income tax benefits that we recognized prior to 2019 were not valid.”

Buffett and Greg Abel, vice-chairman of the non-insurance operations of Berkshire Hathaway, is likely to address some of the many matters during the company’s annual shareholder meeting on later today.

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

Why Warren Buffett’s 2008 message to American investors was timed perfectly

Warren Buffett warns coronavirus will affect business, but he 'certainly won’t be selling' stocks

Warren Buffett explains why CEOs prefer ‘cocker spaniels’ over ‘pit bulls’

Berkshire Hathaway was responsible for 1.5% of the taxes paid by corporate America in 2019

An unfortunate story that reflects Berkshire Hathaway's incredible scope

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.