Best Pacific International Holdings And Two Other High Yield Dividend Stocks In Hong Kong

Amid a backdrop of escalating geopolitical tensions and fluctuating market conditions, the Hong Kong stock market has shown resilience, reflecting the broader dynamics observed in global financial landscapes. In this context, identifying high-yield dividend stocks such as Best Pacific International Holdings becomes crucial for investors seeking stable returns in uncertain times.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 9.35% | ★★★★★★ |

China Construction Bank (SEHK:939) | 8.83% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.92% | ★★★★★★ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.04% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.90% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.48% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 9.84% | ★★★★★☆ |

Zhejiang Expressway (SEHK:576) | 6.86% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.52% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

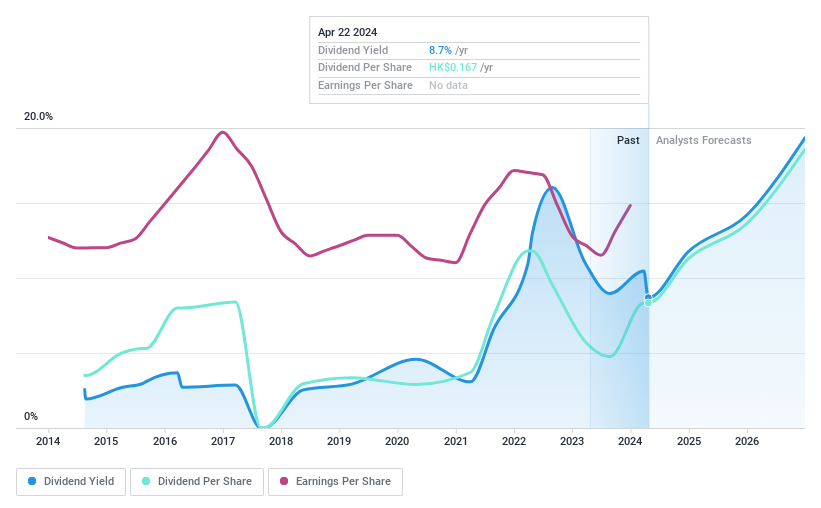

Best Pacific International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Best Pacific International Holdings Limited operates in the textile industry, focusing on the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace, with a market capitalization of approximately HK$1.00 billion.

Operations: Best Pacific International Holdings Limited generates revenue primarily through two segments: HK$834.34 million from the manufacturing and trading of elastic webbing, and HK$3.37 billion from the manufacturing and trading of elastic fabric and lace.

Dividend Yield: 8.7%

Best Pacific International Holdings recently proposed a final ordinary dividend of HK$0.1138 per share for 2023, reflecting a commitment to returning value to shareholders amid increasing earnings. The company reported a net income rise to HK$346.92 million from last year and an earnings growth of 15.9%. Despite trading 49.5% below estimated fair value and showing potential as an undervalued stock, investors should note the historical volatility in both share price and dividend payments, which could suggest caution for those seeking stable returns.

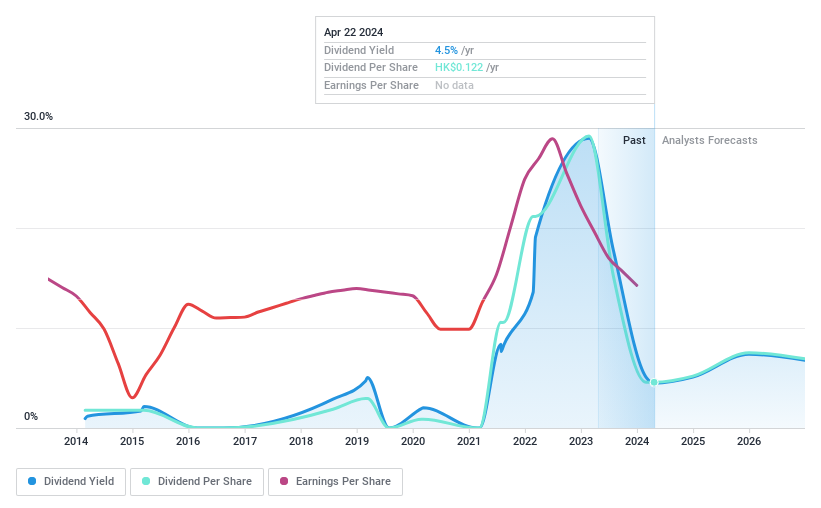

Pacific Basin Shipping

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Basin Shipping Limited operates globally, providing dry bulk shipping services with a market capitalization of approximately HK$14.32 billion.

Operations: Pacific Basin Shipping Limited generates revenue primarily through its dry bulk shipping services, totaling approximately HK$2.30 billion.

Dividend Yield: 4.5%

Pacific Basin Shipping Limited, despite a challenging year with net income dropping to US$109.38 million from US$701.86 million, continues to reward shareholders by distributing 75% of its net profit as dividends, totaling HK$12.2 cents per share for the year. The company's dividend sustainability is moderately secure with a payout ratio of 47.6% and cash payout ratio at 80.9%, though historically, the dividend track record has been unstable and volatile over the past decade. Additionally, recent corporate changes aim to enhance governance and shareholder communication through electronic means.

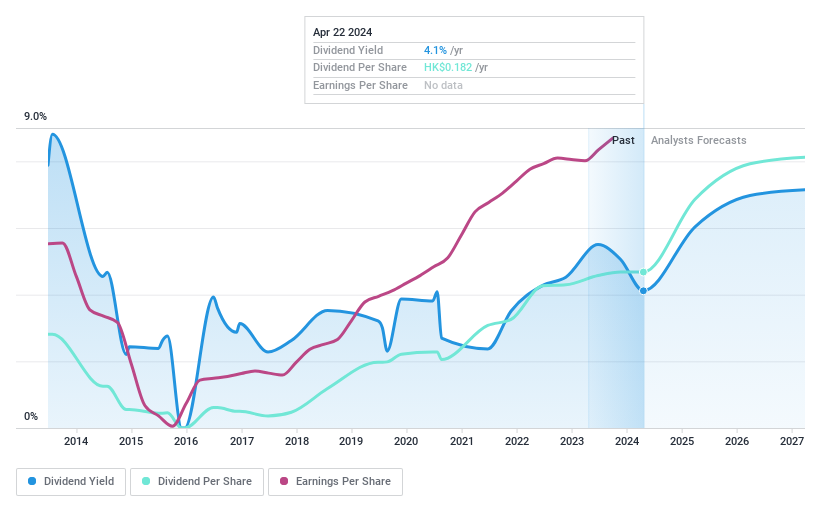

Bosideng International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited operates in the People’s Republic of China, focusing on the research, design, development, manufacturing, marketing, and distribution of branded down apparel and non-down products as well as OEM services; it has a market capitalization of approximately HK$48.02 billion.

Operations: Bosideng International Holdings Limited generates revenue primarily through three segments: down apparels (CN¥14.69 billion), original equipment manufacturing (OEM) management (CN¥2.46 billion), and ladieswear apparels (CN¥0.76 billion).

Dividend Yield: 4.1%

Bosideng International Holdings offers a modest dividend yield of 4.12%, which is below the top quartile in Hong Kong's market at 8.31%. However, the company has demonstrated consistent growth in its dividends over the past decade. Currently trading at 3.6% below its estimated fair value, Bosideng maintains a sustainable payout with earnings covering 76% and cash flows covering 50% of dividend payments. Despite this, its historical dividend reliability has been questioned due to volatility and an unstable track record over the same period.

Taking Advantage

Navigate through the entire inventory of 86 Top Dividend Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2111 SEHK:2343 and SEHK:3998.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance