Beyond Meat sales beat expectations, boosts full-year outlook

Beyond Meat (BYND) posted better-than-expected sales in the second quarter and boosted its full-year outlook.

Here are the numbers for Beyond Meat’s second quarter, compared to Wall Street estimates compiled by Bloomberg:

Revenue: $67.3 million vs. $52.71 million expected

Adj. loss per share: 24 cents vs. 8 cents expected

Beyond now expects revenue for the full year above $240 million, up from the previously expected $210 million. The company also expects this year’s adjusted EBITDA to be positive.

“We are very pleased with our second quarter results which reflect continued strength across our business as evidenced by new foodservice partnerships, expanded distribution in domestic retail channels, and accelerating expansion in our international markets. We believe our positive momentum continues to demonstrate mainstream consumers’ growing desire for plant-based meat products both domestically and abroad,” CEO Ethan Brown said in a statement. “Looking ahead, we will continue to prioritize efforts to increase our brand awareness, expand our distribution channels, launch new innovative products, and invest in our infrastructure and internal capabilities in order to deliver against the robust demand we are seeing across our business.”

Shortly after announcing second-quarter results, Beyond announced a secondary stock offering, which sent the stock tumbling after hours.

Shares of Beyond have been on fire since its public debut on May 2. After pricing at $25, the stock has skyrocketed 789%, as of Monday’s close. Beyond’s market cap currently sits around $13 billion. Investors have been piling into the alternative-meat space as it completely takes the food industry by storm.

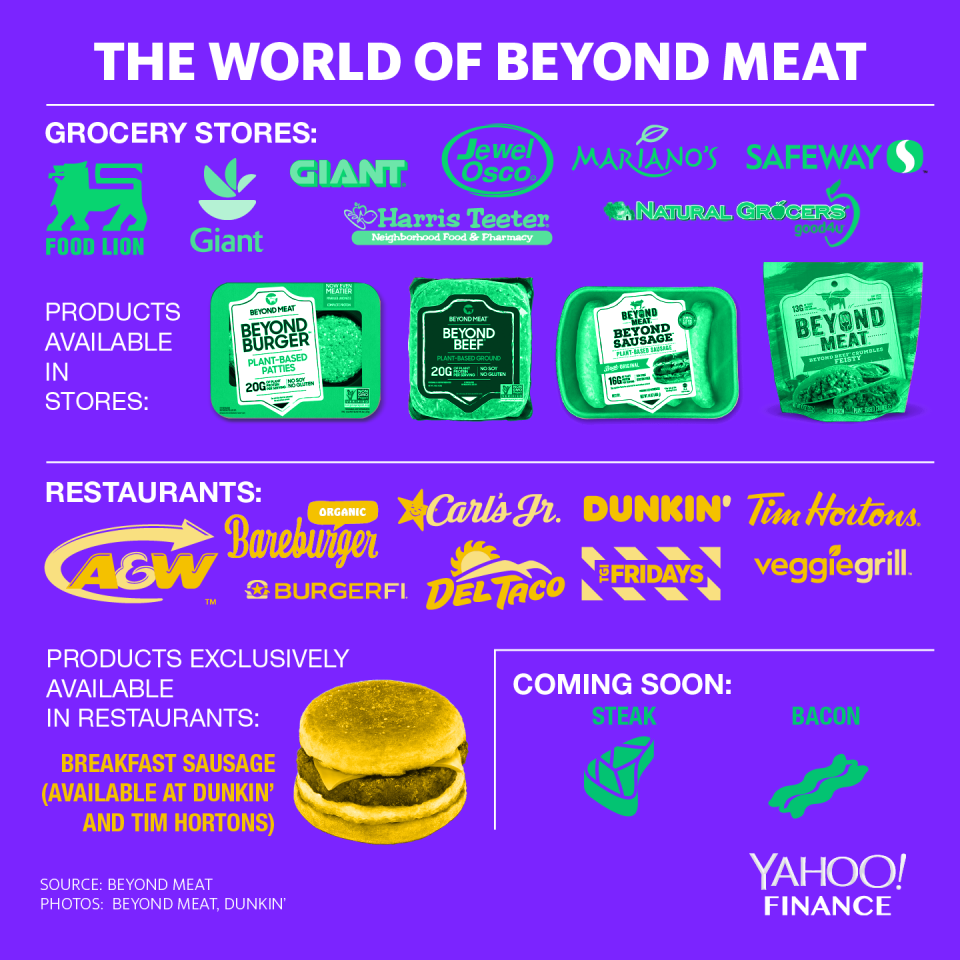

Beyond recently inked deals with Tim Horton’s (QSR) and Dunkin’ (DNKN) to sell items across thousands of stores. However, the recent frenzy has analysts ringing the alarm on Beyond’s ballooning valuation.

Nevertheless, the significant growth potential in the alternative-meat space coupled with Beyond’s aggressive and swift partnerships with restaurant and food services companies has most analysts bulled up on the stock.

“Despite the valuation considerations, we continue to expect significant growth potential in the plant-based meat category and believe that Beyond Meat is well positioned as one of the front-runners leading the new wave of plant-based meat products,” Bernstein analyst Alexia Howard wrote in a note June 12. “In addition, we believe that Beyond Meat has been thoughtful about gradually growing its partnerships with QSR customers in relation to its ability to scale its supply chain.”

The stock currently has zero Buy ratings, eight Hold ratings and one Sell rating, according to data compiled by Bloomberg.

Beyond’s earnings conference call with management kicks off at 4:30 p.m. ET.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.