The biggest misconceptions about bitcoin

The price of bitcoin rose 1,221% in 2017. Everyone was talking about the cryptocurrency in December, and will continue to talk about it into 2018, even though the frenzy and general conversation has expanded to cryptocurrencies like litecoin, ether, ripple and beyond.

But as the general public takes a much larger interest in bitcoin, a number of popular misconceptions still linger. You see people shouting these things on Twitter, or hear friends or colleagues saying them, or even sometimes read them in an incorrect news article.

Here are three of the most common misconceptions about bitcoin.

1. It’s unregulated

People say bitcoin is unregulated, usually in order to make the argument that it’s dangerous and unstable. But bitcoin is, in fact, regulated in a number of ways.

Bitcoin brokerages that are above-board are all licensed in some manner: Coinbase registered as a “money services business” with FinCEN, the Financial Crimes Enforcement Network, while Gemini registered as a “trust” with NYDFS, the New York Department of Financial Services. Both forms of license mean complying with KYC (know your customer) and AML (anti-money laundering) requirements.

In 2015, NYDFS introduced the “BitLicense,” a set of regulations governing any digital currency companies based in New York that hold customer funds. Some companies applied for the license, while others shut down their operations in New York to avoid doing so.

All the exchanges offering bitcoin futures trading have had to get approval from the CFTC, the Commodity Futures Trading Commission. CME, Cboe, and Cantor Fitzgerald all got CFTC approval in 2017 for their bitcoin futures. LedgerX, which offers bitcoin options (but not futures) also got CFTC approval.

And then there are a number of government bodies that have issued guidance, if not official rules, on bitcoin and cryptocurrency trading. In 2014, the IRS issued its first guidance on bitcoin and taxes. It decided to treat bitcoin as property, which means that income from bitcoin would be treated as capital gains, like with stocks.

More recently, SEC Chairman Jay Clayton issued a statement in December 2017 warning the public about the risk of investing in ICOs (initial coin offerings). In an ICO, Clayton said, “There is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation.” Many have taken the SEC’s warnings to be the obvious first step toward eventual stricter policy on crypto.

In other words: bitcoin trading platforms are already somewhat regulated in a number of ways, and more regulation is likely coming.

2. It’s anonymous

It’s not fully anonymous, no. When people say bitcoin is anonymous, they usually mean that they think it’s not traceable—but it is. (In fact, criminals are now moving away from using bitcoin and toward monero, which is more anonymized.)

When you buy or sell bitcoin, or send it from one place to another, your transaction goes on the public bitcoin blockchain, where anyone can see it. You are identified by your public key, a string of letters and numbers, and while that doesn’t show your name, the same key will appear for every transaction from the same bitcoin wallet address—so if someone were to identify which bitcoin wallet address is yours (either by hacking your exchange account, or obtaining your cellphone, or finding your keys if you don’t store them safely), they could easily see all the bitcoin transactions that were yours.

This makes bitcoin semi-anonymous at best, or “pseudonymous.” In addition, every block mined on the bitcoin blockchain identifies the mining pool that verified it.

As “Satoshi Nakamoto” wrote in the original bitcoin white paper in 2009, “The public can see that someone is sending an amount to someone else, but without information linking the transaction to anyone.” Nakamoto advised, “As an additional firewall, a new key pair should be used for each transaction to keep them from being linked to a common owner. Some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner. The risk is that if the owner of a key is revealed, linking could reveal other transactions that belonged to the same owner.” Even though the paper suggested using multiple keys, most bitcoin users don’t do that. Monero, on the other hand, uses different addresses for each transaction by design, which is why it’s more anonymous than bitcoin and has become a favorite for illegal activity.

That’s not to mention the fact that if you have an account with a licensed exchange or brokerage like Coinbase or Gemini, that company has your personal information (and even your bank account link) and, if pushed to by the SEC, will share that information.

3. It’s a scam!

No. You might think the current price run-up is a bubble; you might think that bitcoin will never become widely adopted as a currency; but bitcoin is legitimate technology, built on a system that has attracted major interest from big financial companies. It is not a trick or a hoax. It is something real, that exists (even if not physically tangible).

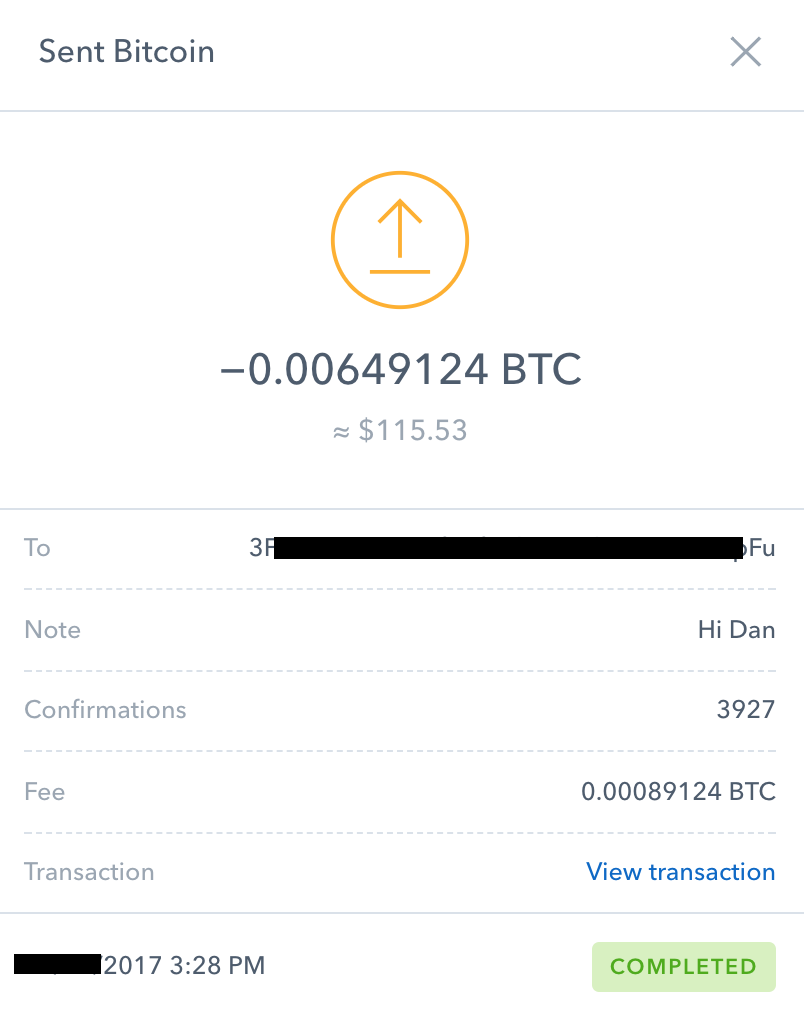

If you doubt it, try this: if you have an account at a major crypto exchange like Coinbase, send a tiny amount of bitcoin to someone else (or yourself) at a bitcoin wallet address. (Here’s how.) When you do, Coinbase logs the transaction and shows you a screen with all the pertinent info: how much you sent, from where, and to where, and how much you paid in fees to Coinbase. See the below example, from when I sent $100 worth of bitcoin from my Coinbase account to a Ledger hardware wallet (and paid a staggering $15 fee to do it):

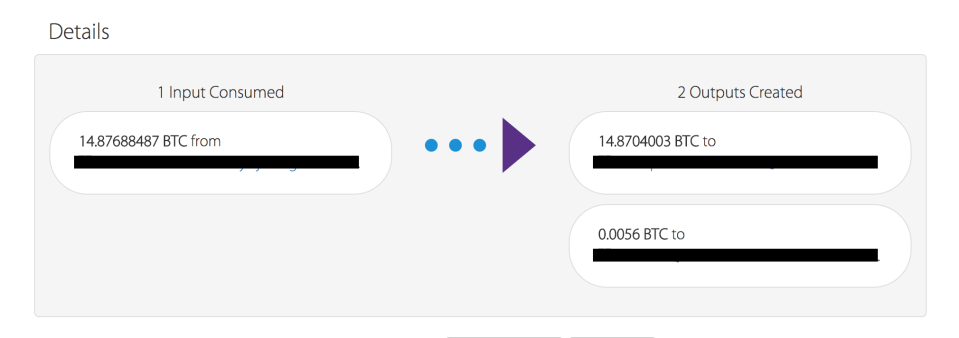

If the Coinbase screen isn’t enough, it also gives you a link (“view transaction”) to view the actual block, on the blockchain, that included your transaction. Coinbase uses BlockCypher. (Another handy blockchain explorer, where you can view the bitcoin blockchain for yourself, is blockchain.info.) Here’s what the BlockCypher screen looks like (the amount at bottom right, 0.0056 BTC, is the amount I sent to my hardware wallet):

Similar to calling bitcoin a scam, some people call bitcoin a “Ponzi scheme.” That’s not right, because a Ponzi scheme is something very specific, where the fraudster generates fake returns by giving new revenue to old clients. Saudi billionaire Prince Alwaleed called bitcoin “Enron in the making,” which was another faulty comparison. Enron was practicing fraudulent accounting, and went bankrupt. The bitcoin blockchain is a public, immutable ledger where you can view every transaction.

Another misconception under the same general tone as calling it a scam is that many people think it’s illegal. The US government has not officially recognized bitcoin as a legitimate currency the way that Japan and Australia have, but that does not mean it is expressly illegal. Bitcoin is perfectly legal in America.

When bitcoin was created in 2009, it was envisioned as a “peer-to-peer electronic cash system.” You can certainly argue that the coin and the larger ecosystem has gotten away from that early intention, or that the trading activity around bitcoin and other coins right now is full-blown mania. But it’s not a scam.

—

Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more: