Bitcoin's Pullback: 4 Questions to ask Yourself

Bitcoin: Know What You Own

On Wall Street, it is imperative that investors understand the “character” of their stock or asset. After a more than 150% gain this year, Bitcoin bulls took some chips off the table over the weekend. The world’s largest cryptocurrency sliced lower by 7.5% within minutes over the weekend before paring some of its losses. For those who track Bitcoin, the violent price action is nothing new. Assets like Bitcoin tend to have a “bucking bronco” nature, with wild swings in both directions. With volatility comes opportunity. How can we, as investors, ride these trends?

· Is my position size too large? Amateur investors tend to position size far too large.If you are too affected by price swings, try to decrease your position size. Position size allows you to hold through normal fluctuations and helps to calm emotions.

· What is my average cost on the position? How much room you give an asset on pullbacks should be directly correlated to position size. For example, we have a double-digit gain on our ProShares Bitcoin Strategy ETF (BITO) position in the Technology Innovators Portfolio. If you are playing with “the house’s money” as we are, you can afford to sit through more violent swings. Conversely, if you are underwater in a position, you must allow less slack to the downside.

· What is my “portfolio heat?” Are you having a profitable year? If you are having a profitable year in your overall portfolio, you can take on more risk. Risk mitigation should take center stage if you are struggling and are down on the year.

· Is the chart pattern intact? When push comes to shove, most investors try to latch onto a trend and ride it higher. Investors can leverage moving averages to determine whether a trend is intact or broken unbiasedly. Understand that the moving average period will vary depending on one’s timeframe. For example, swing traders like myself tend to utilize the intermediate-term 50-day moving average as a point of reference.

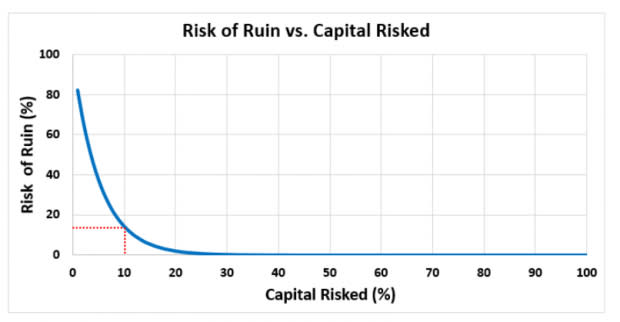

Position Size: Smaller Size Decreases Your Risk of Ruin

Investors should have a fixed amount of capital they are willing to risk on a given trade. For example, I never risk more than 1% of my aum (assets under management) on a given trade. In other words, if the account I manage is $100,000, the most I will lose on one trade is $1,000. By keeping my risk small, I do not have to be overly concerned with the risk of any individual trade and can suffer a string of losses and still live to trade another day.

Image Source: TradingTact.com

Average Cost: Earn the Right to Sit Through Pullbacks

Let’s say investor A bought XYZ stock (trading at $125) at $120, and Investor B bought the same stock at $100. Because investor B enjoys a much larger cushion in XYZ, he can be much more patient with pullbacks. Be patient with winners while ruthlessly cutting losers.

Portfolio Heat: Understand the Big Picture

Because most stocks are correlated in some fashion, you must understand your overall portfolio’s risk. When a portfolio has few winners, a pullback in the market will increase what I call “portfolio heat.” If you have closed several winners and are having a strong year in the market, you can afford to sit through some portfolio heat. On the other hand, if you are breakeven or worse year-to-date, protecting profits is job #1. Remember, if you protect your downside risk, the upside will eventually take care of itself. Never put yourself in a position where you can blow up your account.

Charts: Trend Filters Keep You on the Right Side

A simple 200-day moving average filter overlayed on the Nasdaq 100 ETF (QQQ) has kept investors on the right side of the market over the past five years. Above the 200-day moving average, investors should be net long stocks. Conversely, below the 200-day moving average, investors should decrease market exposure and actively manage downside risk.

Image Source: TradingView

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Invesco QQQ (QQQ): ETF Research Reports

ProShares Bitcoin Strategy ETF (BITO): ETF Research Reports