BOVE: Here's why bank stocks have been getting 'ahead of themselves'

The bank stocks have been on a tear since Donald J. Trump won the presidential election and the Republicans swept the House and the Senate.

Since election day, the KBW Nasdaq Bank Index (^BKX) shows that bank stocks have soared 23%. This week, investors will get a glimpse into just how real the impact has been on Friday when JPMorgan Chase (JPM) kicks off earnings season for big financials.

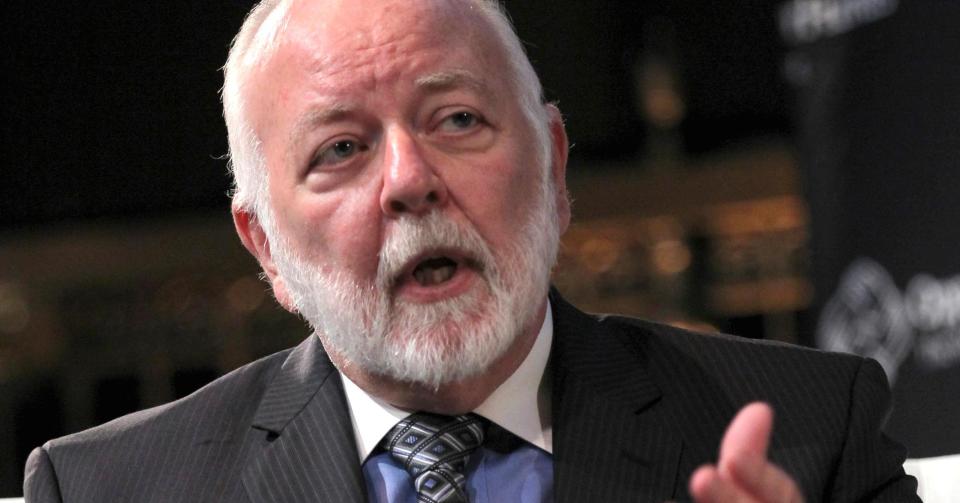

According to banking analyst Dick Bove of Rafferty Capital Markets, the bank stocks have moved higher because of three key factors: interest rates, regulation, and a stronger economy.

“Only the third is likely to have a meaningful impact on bank stocks in 2017,” Bove wrote, warning, “The risk here is that investors are buying these stocks for the wrong reasons making them vulnerable to changes in psychology.”

Bove told Yahoo Finance in a phone call on Friday that he thinks bank stocks are getting “ahead of themselves.”

Bove noted that the market is focusing too much on interest rates and regulation.

With interest rates, investors are focused on the fact that if rates increase the prices banks charge for their products also goes up. This, of course, means greater profits. The problem with interest rates, though, is the banks’ book value of the products held on its balance sheet should decrease each time there is a rate increase.

“What you hope for is the increase in earnings will be much greater than the decrease in the value of the assets. The net effect, what they are arguing this time, there’s such a surge in earnings for banking companies that you don’t have to worry about fact book value going down because earnings are growing faster, replacing the loss in book value,” Bove said.

He put out a separate note on Friday afternoon pointing to the 1970s where there was an increase in interest rates and bank earnings exploded on the upside. Eventually, though, the banks’ PE multiples declined because asset values were being destroyed by the increase in interest rates and this decline wasn’t being replenished by earnings growth.

“Near term, you emphasize the fact that earnings will be stronger. By 2018 you emphasize the fact that asset values are falling,” Bove said in the phone interview, noting interest rates is “not a reason” to buy bank stocks.

Another point of focus has been on the expectation that regulation will be eased by the Trump administration. Bove noted that repealing Dodd-Frank is “highly unlikely, if not impossible.” He also pointed out that it’s not entirely clear that the Republicans have a unified position on what should be done.

“This hope that the Trump wave of deregulations will impact banks in favorable fashion may be true if you’re a smaller bank. I doubt there will be any meaningful legislation coming out of congress on banking, at least in 2017,” Bove told Yahoo Finance, adding, “I think the degree to which you do get changes in regulation, it’s going to be for mid to small-size banks.”

The reason to buy bank stocks right now is the economy.

“My belief that bank stocks are cheap, although ahead of themselves at the moment, is a conviction that the economy will in fact change in 2017,” Bove wrote, adding, “I think that there has been a clear shift in sentiment in Washington toward the view that growing the economy and creating jobs is the primary goal. This is the basis for arguing for more jobs; more income; and a stronger economy. It is the reason to buy bank stocks. Changes in interest rates and regulation are not the reasons to own these stocks.”

Bove told Yahoo Finance that he expects 2017 to be an all-time record year in banking.

As for fourth quarter earnings, on a year-over-year basis, the results will look “quite strong” compared to the period the year prior. That said, on a quarter-over-quarter basis Bove expects that most banks will look weak.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Read more: