Bull and bear markets: What to know - Yahoo U

For more business and finance explainers, check out our Yahoo U page.

Nearly everyone knows that “bear” denotes a market on the way down and “bull” denotes a market on the way up. But calling a bear and bull market is an inexact science, and definitions can vary slightly depending on who you’re asking.

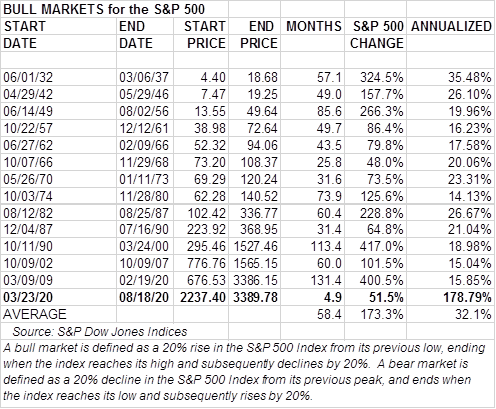

Despite concerns over the course of the coronavirus in the United States, the U.S. stock market has been on a tear since last March. And on August 18, the S&P 500 (^IXIC) hit a new record high.

The new high marked a fresh bull market for the index and officially ended the market’s deep but brief bear market. The 2020 bear market is officially the shortest on record.

With the market swing from bull to bear to bull again over just the last eight months, a reference on what constitutes a bear and a bull market is critical to knowing the type of market environment you may be investing in.

What defines a bear market?

A bear market traces an index’s decline from market peak to market bottom.

But market bottoms can be difficult to call in real time (for example, even when markets rebounded after March 23, it was unclear if the gains could reverse and retest a new low).

Although there are different methods for declaring bear and bull markets, the broadly accepted threshold is 20%. When a market has fallen more than 20% from its previous peak, a bear market is generally understood to have begun.

The bear market also therefore ends when the market touches a low and then, after the fact, rises at least by 20%.

What defines a bull market?

A bull market traces an index’s rise from market bottom to market peak.

The same 20% threshold generally applies to calling a bull market as well. A market would have to bounce back by at least 20% from the bear market low in order to declare a bull market. A good number of investors also have another requirement: that the market touch a new record high.

If the market touches a new high and then falls 20%, then the bull market is broadly understood to have ended.

An alternative measure of a bull market tacks on a requirement that the 20% rally be sustained over at least six months.

How long do bear markets generally last?

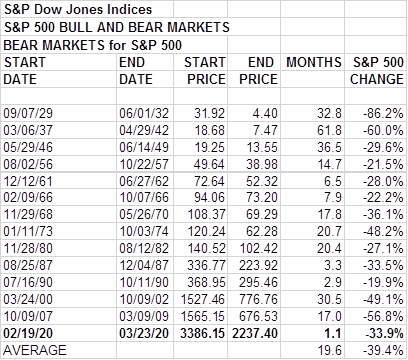

Based on data from Howard Silverblatt at S&P Dow Jones Indices, the S&P index has experienced 14 bear markets in its history. On average, a bear market lasts 19.6 months and shaves an average of 39.4% from the index.

The longest-lasting bear market began during the 1937 recession, which lasted over five years. The bear market that preceded it - the Great Depression from 1929 through 1932 - was the worst ever by percentage lost on the S&P index: -86.2%.

The 2020 bear market is officially the shortest on record, having begun at the S&P 500’s then-record high of 3386.15 on February 19 and falling 33.9% to a low of 2237.40 on March 23 - only a little over a month later.

UBS Global Wealth Management strategist Justin Waring writes that the 2020 bear market is unprecedented, noting that future bear markets will likely look more like previous post-war examples.

“We expect many of this bear market's speed records to remain uncontested for decades, if not permanently,” Waring said in a note August 18.

Prior to 2020, the shortest bear market on record was in 1990, which lasted almost three months.

How long do bull markets generally last?

The S&P 500 is now in its 14th bull market, already rising over 50% from the March 23 low.

According to Silverblatt, the average bull market lasts 54.4 months and realizes an average 173.3% gain in the S&P 500 (or an annualized 32.1%).

The longest-lasting bull market in history was the post-crisis rally that began on March 9, 2009 and lasted until the coronavirus-related concerns hit in February 2020.

Is a bear market the same as a recession?

No. The stock market is tied to the U.S. economy, but does not reflect the condition of the U.S. economy in its entirety. The National Bureau of Economic Research is the authority on declaring a recession, and looks at several economic measures (including, but not limited to the often-referenced two-quarters-of-GDP-decline).

In many cases, the same macroeconomic shock that throws an economy into recession is the same shock that sends the stock market into a bear market - such as the coronavirus in 2020.

But NBER-defined recessions don’t always line up with bear markets. For example, Paul Volcker’s efforts to quell inflation through the monetary shock of higher interest rates sent the U.S. economy into a recession from January 1980 until July of that same year. A bear market in the S&P 500 did not emerge until months later, in November 1980.

That bear market continued to slug along for a year, despite the economy having technically emerged from the recession. But in July 1981, a new recession had begun, extending through November of 1982.

The bear market ended slightly before that, on August 12, 1982.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance