Business tax payments plunge, while workers pay more

Workers are shouldering a rising share of federal revenue, while tax payments by businesses are plunging toward record lows.

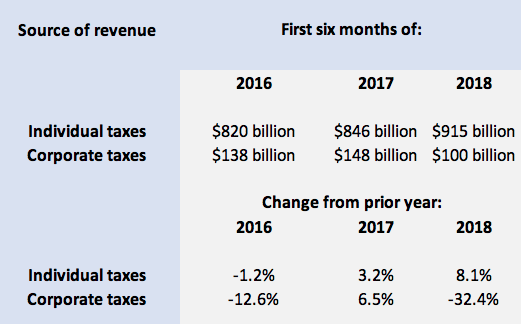

Treasury Department data for the first half of 2018 show individual income tax receipts rose 8.1%, to $915 billion. Corporate income tax receipts fell 32.4%, to $100 billion. The sharp decline in corporate tax revenue is largely a result of the tax cuts President Trump signed into law at the end of 2017, which cut the top corporate rate from 35% to 21%. Here are the numbers:

The drop in corporate tax payments isn’t surprising, since that’s exactly what the Trump tax cuts were designed to do: leave more after-tax income in corporate coffers to spur more investment. Workers got tax cuts too, but they were relatively modest. About two thirds of households got a tax cut averaging about $2,200, according to the Tax Policy Center. Taxes will rise for 6% of households, by an average of $2,800. The rest should see no change.

Demonstrators against the Republican tax reform bill hold a “Peoples Filibuster to Stop Tax Cuts for Billionaires,” protest rally outside the US Capitol on Capitol Hill in Washington, Nov. 30, 2017. (Photo: Saul Loeb/AFP/Getty Images)

Corporate tax receipts have steadily declined as a portion of all federal revenue, from 17% in 1970 to 9% last year. So far in 2018, corporate tax receipts represent just 5.6% of federal revenue, which is the smallest portion ever on an annualized basis. (Statistical note: The government’s fiscal year starts in October, so FY 2018 tax revenue will include three months without the Trump tax cuts and nine months with them. The 5.6% figure above is just for the first six months of calendar year 2018, when the Trump tax cuts were fully in effect.)

Here’s how the makeup of federal tax revenue has changed over time. Not shown are social-welfare taxes, excise taxes and other sources of revenue:

It’s not surprising that tax payments from individual workers would rise this year, even with a tax cut in effect. Inflation, wage growth and other factors normally push tax payments from workers higher when the economy is growing.

Last summer, the Congressional Budget Office (CBO) forecast that, without any tax cuts, individual tax receipts would rise 9.5% in 2018. The smaller rise of 8.1% could reflect the impact of the Trump tax cuts. And most workers didn’t see lower tax withholdings in their paychecks until March, at the earliest, which means the full effect of the tax cuts aren’t showing up yet in government revenue numbers.

The CBO expected corporate tax revenue to rise 4.5% this year, without any tax cuts. The huge drop in corporate tax revenue, following the tax cuts, highlights why the tax law has become a political problem for Trump and his fellow Republicans. The tax law is unpopular, with 43% of Americans disapproving and just 36% approving, in the Real Clear Politics average of polls. Americans in general feel the tax cuts too heavily favor businesses and the wealthy — and the federal revenue numbers bear that out. The unpopularity of the tax cuts could lead voters away from Republicans in the upcoming midterm elections, and perhaps tip one or both houses of Congress to Democrats.

The Trump tax cuts are also ballooning Washington’s annual deficits, along with the national debt. The CBO expects the gap between revenue and spending to soar by 21% this year, to $804 billion. The deficit will exceed $1 trillion by 2020 and grow for the foreseeable future.

Trump and a few sympathetic economists say the tax cuts will stimulate so much growth that federal tax revenue will eventually be higher than it would be without any tax cuts. Most budget experts disagree. “The federal government will certainly collect less revenue than it would have without the tax cut,” says economist Kyle Pomerlau of the nonprofit Tax Foundation. “Eventually, the government does need to pay its bills. We’re not on a sustainable path.”

Confidential tip line: [email protected]. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn