When you buy a house, you lose

My friend posted on social media recently that she had just bought a house and she was #Winning. The truth is that when you buy a house you are making a terrible investment. You’re not winning. You’re losing.

Many believe that homeownership equals wealth. But that’s simply not true. The average person is much better off renting and putting extra money he or she would use for a down payment into liquid investments. By liquid, I mean something you can sell immediately if you get into a financial pinch, such as stocks or bonds.

First, renting is often cheaper than ownership. For some reason there’s disagreement about this, but renting is clearly cheaper. Nationwide, from 2012 to 2016, the average median monthly gross rent was $949. That’s rent plus utilities. Comparable homeownership via mortgage plus taxes and other costs averaged $1,491.

And then people say, “But if I buy a house, and it appreciates in value, I earn the difference and I get a place to live. Paying rent is like flushing money down the toilet!”

Let’s debunk that myth now. First, shelter is one of humanity’s basic needs. So if you’re flushing money down the toilet paying for rent — as in a roof over your head — you’re not flushing money down the toilet.

Renters also save money by not having to pay things like homeowners association fees, property taxes, realtor fees, and closing costs, not to mention fixing anything that goes wrong with your home, such as the water heater, furnace, air conditioning system, plumbing, roof, septic … Everything.

You lose

When the toilet — the one I’m flushing my money down — breaks in my apartment, I call my apartment manager or supervisor and he takes care of it. For free.

And secondly, sure, houses can appreciate in value, but not as fast as the stock market. Between 1969 and 2004, home prices rose by an average of 6.4%. That’s great until you realize that the average size of a house doubled during that time. Throw in inflation, and that basically accounts for the increase.

Then there’s what happened after 2004. Prices plateaued and then fell off a cliff, dropping 30% in just three years, between 2008 and 2010. The S&P 500 has risen an average of 9.8% every year since 1909, including even the Great Recession.

As Ken Fisher, the founder and executive chairman of Fisher Investments, wrote recently, “Yes, you might make money if you spot some trend, then buy right, at the right time and the right location, then put lipstick on a pig (which few do well), and flip it. It’s a comforting mythology, like reality TV. Folks routinely fool themselves by calculating returns dead wrong.”

You lose

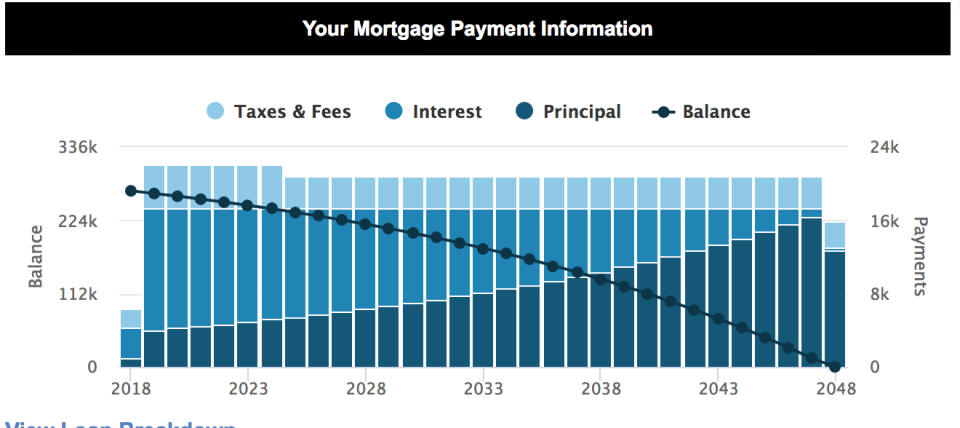

Third, homebuyers who take out a mortgage don’t actually pay the sticker price. For a $300,000 home with a 10% down payment, the average buyer is going to end up paying an additional $251,790 in interest over the terms of a 30-year mortgage. Then they’ll pay another $72,000 in taxes and an additional $38,775 for insurance and homeowners’ fees. That’s not even counting property taxes and fees to real estate agents and brokers.

Yes, you can write off a portion of your mortgage interest, but that portion is just that — a portion —and there’s a lot of red tape around what you can and can’t deduct thanks to the new Tax Cut and Jobs Act.

So even if you sell your home for twice what you bought it for you might not break even.

And that’s if you pay it off. For the first few years of a mortgage, most people are just paying off interest because mortgages are structured to keep them from paying off the principal — the actual money that goes toward the home — until the very end.

You lose

When investing, you want to weigh the evidence and find the investment that is going to provide you the best return.

And evidence says that, “On average, renting and reinvesting wins in terms of wealth creation regardless of property appreciation, because property appreciation is highly correlated with gains in the traditional financial asset classes of stocks and bonds.” Those were the findings of a 2017 study from Florida Atlantic University, Florida International University and the University of Wyoming.

Instead of paying $300,000 of interest, you could be earning it. As interest rates rise — as they’re doing now — it means it’s more expensive to buy a house. You can also earn more on investments. Now is the time to invest that money and let the bank pay you, rather than paying the bank. Home ownership is a crock, it’s a sham, it’s a bad bet. You can play if you want, but odds are you’ll lose.

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

More from our Women + Money series:

‘It gets confusing fast’: FAFSA financial aid for students, explained

Women are now 42% of U.S. breadwinners — but also ‘underestimate the costs of motherhood’

This story was originally featured on October 10th, 2018.