Cathay Pacific Airways Leads Three SEHK Dividend Stocks To Consider

Amidst a backdrop of global economic shifts and market recalibrations, the Hong Kong stock market remains a focal point for investors seeking stable returns through dividend-paying stocks. In this environment, understanding the characteristics that define resilient and potentially lucrative investments becomes crucial, especially in sectors like aviation where companies like Cathay Pacific Airways are prominent.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

CITIC Telecom International Holdings (SEHK:1883) | 9.30% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.61% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.08% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 7.81% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.89% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.36% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.09% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.20% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.44% | ★★★★★☆ |

Click here to see the full list of 93 stocks from our Top SEHK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

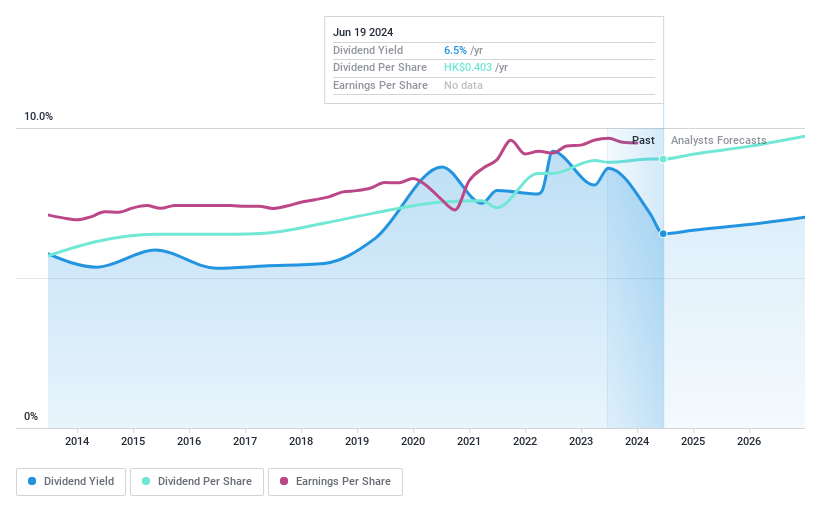

Cathay Pacific Airways

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cathay Pacific Airways Limited operates globally, providing international passenger and air cargo transportation services, with a market capitalization of approximately HK$53.69 billion.

Operations: Cathay Pacific Airways Limited generates its revenue primarily through its segments: Cathay Pacific at HK$85.34 billion, HK Express at HK$5.60 billion, Air Hong Kong at HK$3.45 billion, and Airline Services at HK$3.86 billion.

Dividend Yield: 5.2%

Cathay Pacific Airways has demonstrated a mixed performance as a dividend stock. While the company maintains a low dividend yield of 5.16% relative to Hong Kong's top dividend payers, its dividends are well-covered by earnings and cash flows, with payout ratios at 30.5% and 14.1%, respectively. Recent strategic moves include redeeming HK$9.98 billion in preference shares, enhancing financial flexibility but also reflecting potential volatility in future payouts due to unreliable historical dividend growth and forecasted earnings declines averaging -4.7% annually over the next three years.

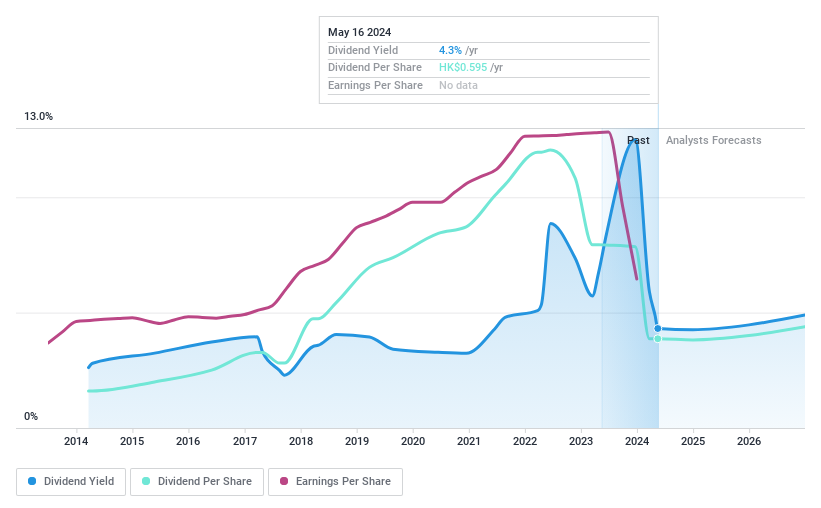

Bank of Communications

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Communications Co., Ltd. operates as a commercial bank offering a range of banking products and services, with a market capitalization of approximately HK$520.64 billion.

Operations: Bank of Communications Co., Ltd. generates revenue primarily through its Corporate Banking Business at CN¥97.35 billion, Personal Banking at CN¥81.71 billion, and Treasury Business at CN¥20.99 billion.

Dividend Yield: 6.8%

Bank of Communications Co., Ltd. offers a stable dividend yield at 6.84%, underpinned by a modest payout ratio of 32.7%, suggesting that dividends are well-covered by earnings. Recent financial activities include the distribution of a final dividend of RMB 0.375 per share, with payment due on 31 July 2024, reflecting the company's commitment to returning value to shareholders despite its yield being slightly lower than the top quartile in Hong Kong's market. Additionally, leadership transitions with new appointments may influence strategic directions affecting future profitability and dividend sustainability.

Longfor Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Longfor Group Holdings Limited operates in property development, investment, and management across the People’s Republic of China, with a market capitalization of approximately HK$77.96 billion.

Operations: Longfor Group Holdings Limited generates revenue primarily through property development at CN¥155.86 billion, followed by services and others at CN¥18.14 billion, and investment property operations at CN¥12.94 billion.

Dividend Yield: 5.1%

Longfor Group Holdings Limited recently declared a reduced final dividend of RMB 0.23 per share, with the payout set for 22 August 2024. This follows a series of robust monthly sales results, including RMB 10.04 billion in June alone, indicating strong operational performance. However, despite these positive sales figures and a low payout ratio of 26.6%, which suggests earnings sufficiently cover the dividend, the company's dividend track record has been unstable over the past decade with recent decreases highlighting potential concerns for long-term sustainability in its dividend policy.

Turning Ideas Into Actions

Get an in-depth perspective on all 93 Top SEHK Dividend Stocks by using our screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:293 SEHK:3328 and SEHK:960.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]