The new Silk Road is China's 'second pillar of legitimacy' — and Europe is starting to buy in

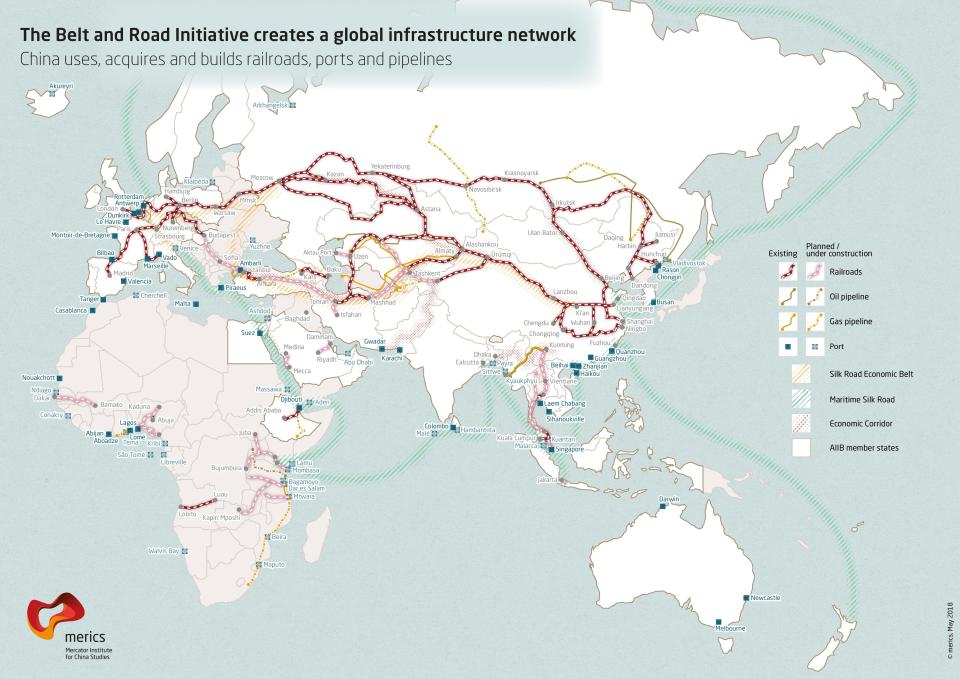

China is undertaking a colossal project called the Belt and Road Initiative (BRI), which involves pushing billions of dollars into various economies in Asia and Europe through opaque loans to expand influence around the world.

The BRI — also known as the New Silk Road — is envisioned as a revival of an ancient trade route between China and Europe. According to one expert, the project stems from China’s desire to build a “second pillar of legitimacy.”

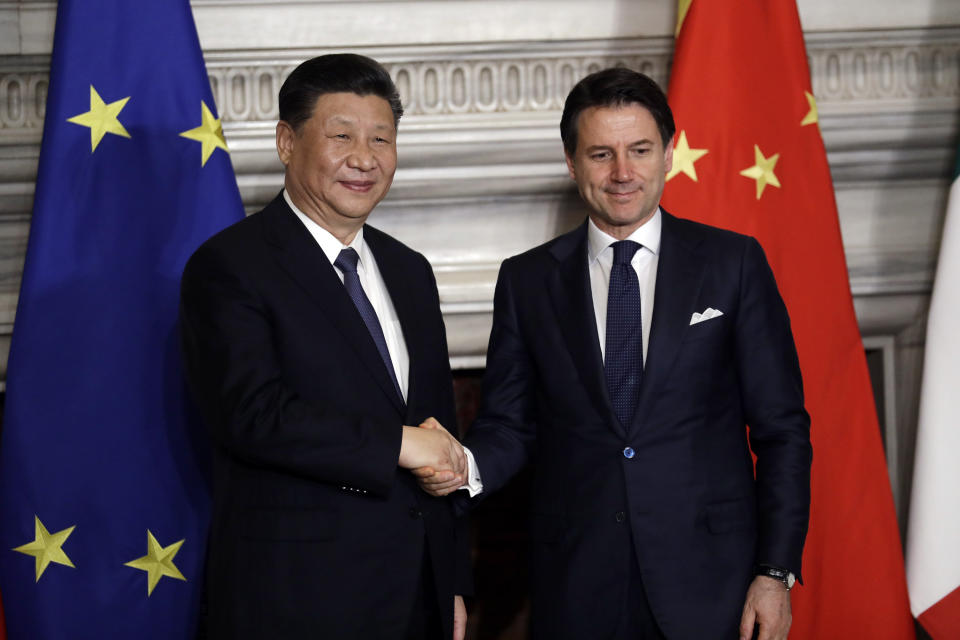

The project has taken on new significance, with Italy signing a memorandum of understanding with China this week. The country, despite heated opposition from fellow European Union (EU) member states and the U.S., inked deals with China that are expected to increase to $22.6 billion in the future.

Luxembourg followed by signing an agreement with China to develop BRI projects, but details were scarce.

‘The second pillar of legitimacy’

China’s big push with the New Silk Road was born out of fears over waning economic growth, according to Thomas Eder, a research associate at German think-tank Mercator Institute for China Studies.

“It’s been almost a cliche that the Chinese government is legitimate as long as there is 7.5% growth,” Eder told Yahoo Finance. “So [it] didn’t have that anymore. But they’re building up the second pillar of legitimacy with this collection of foreign policy successes, prestige, influence ... worldwide.”

China has seen its GDP grow each year at a rate of more than 7.5% from 1991 to 2013, before it began to report lower than 7% growth starting in 2015, according to World Bank data. Amid the slowing growth, the BRI provides “a political win for China,” Eder said. “It delivers more prestige to the Chinese government.”

And according to Peking University law professor He Weifang, the BRI serves a domestic purpose as well.

“The economy is the only tool for the Communist Party to win the people’s support,” Weifang told South China Morning Post. “However, the government has been prioritizng ideological control rather than economic development, which doesn’t and won’t work.”

Debt-trap diplomacy

As part of the build-up of the new Silk Road, China has loaned billions of dollars through various financial institutions — such as the Chinese Development Bank and the Export-Import Bank of China — which enjoy “very low borrowing costs … allowing them to lend cheaply to Chinese companies working on BRI projects,” the Center for Strategic and International Studies stated.

Eder highlighted that many of these projects were largely shouldered by the Chinese where 85% of the loan would be financed by a Chinese bank, versus a 15% share taken on by the local government. Furthermore, contracts and tenders were often won by Chinese companies through a non-competitive process.

Some of these projects have led the Chinese to places like Sri Lanka, Djibouti, Montenegro, and Tajikistan.

Experts warn that the situation is ripe for manipulation because by controlling the model, China is able to lay out a “debt trap,” where it loans an untenable sum of money to a developing country. When that country is unable to pay it back, China asks for political favors.

This has already played out in Sri Lanka. After the country listed its port as an asset down for collateral, when it wasn’t able to repay its loans, China seized its prized Hambantota port.

And the same could possibly play out in Kenya, with its Mombasa port.

Eder also brought up the case in Montenegro, which also fell prey to China’s influence. Montenegro is the “main European example of a country that is taking on massive debt, and it’s not clear yet how it’s going to manage to deal with that,” said Eder.

It had taken on a dollar-denominated Chinese loan for 809 million euros — around $910 million — at a 2% interest rate, and hired Chinese contractors (as per the requirements laid out by China) to build a 103-mile highway through some of the roughest terrain in the southern part of Europe.

But the debt-to-GDP levels have dramatically risen “just for one highway project,” said Eder, and had risen by 20% by his measure.

In response to criticisms over the BRI project creating debt traps, State Councilor and Foreign Minister Wang Yi told China Daily that there were “plenty of facts are proof that the BRI is not a debt trap that some countries may fall into, but an economic pie that benefits local populations. It is not a geopolitical tool but a great opportunity for shared development.”

‘Italy needs to be careful’

In the meantime, American anger has been pronounced.

There is "no need for Italian government to lend legitimacy to China's infrastructure vanity project," a spokesman for the White House's national security advisers recently told reporters.

Eder noted that “relations have worsened between many, not all, Europeans states and the U.S. at the moment. And that is, of course, a problem for the transatlantic relationship.” He added that the topic of tariffs was souring the mood further, and the threat of auto tariffs on German car companies “of course, doesn't go down well on this side.”

In the meantime, the Italy-China deal is not a “a deliberate policy on the part of Italy to move away from the EU and the U.S.,” Lorenzo Codogno, a former chief economist and director-general at the Italian Treasury, told Yahoo Finance.

Codogno added that the bigger deal was that the move potentially “weakens the EU negotiating position in a world that is increasingly moving away from a ruled-based system in favor of a power-based system for international trade, i.e. size matters and having a united front matters as well.”

Hence, “Italy needs to be careful not to undermine traditional links and alliances,” Codogno noted. “Otherwise, this may be counterproductive.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Economist says U.S. 'is trying to have its cake and eat it too' in trade war

Boeing, 'cozy forever' with the U.S. government, under scrutiny after Max 8 crashes

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.