Companies are dropping big hints about the 'new normal' once coronavirus lockdowns end

Officials are delineating the parameters of relaxing stay-at-home orders that have throttled the global economy, yet a few companies are already giving the public a glimpse of life once stringent coronavirus restrictions begin winding down.

Currently, states and cities are crafting a pell-mell retreat away from lockdowns designed to contain the COVID-19 crisis but that have decimated growth and the jobs market. Yet, it's widely acknowledged that social distancing protocols that enforce small crowds — and require the use of face masks in public — will remain in effect.

Already, a range of big and small businesses around the country are actively implementing the post-lockdown “new normal.” It’s become a catchphrase that has defined public discourse since COVID-19 upended societal norms, and brought the global economy to its knees.

This new normal will impact a wide range of activities, from the simplest daily tasks to key business models, to the function of government. As everyone rightly plans for the future, we need to understand how we can return to work and the leisure activities we always enjoyed.

— Scott Gottlieb, MD (@ScottGottliebMD) May 8, 2020

It’s also a dynamic consumers will be forced to navigate in the near-term, with many citizens desperate to resume public life, but without an approved coronavirus treatment or vaccine on the immediate horizon.

From cashless transactions, to smaller office footprints with fewer on-site workers, to cleaner hotels and less crowded casinos (alas, with no buffets), the post-lockdown era will be characterized by changes to public life that will be both subtle and dramatic.

“To be honest I think we’re going to be seeing structural changes within the U.S. economy, and other economies around the world as well, because this has opened up new opportunities too,” ING Chief International Economist James Knightly told Yahoo Finance in a recent interview.

Knightly believes that with so many white-collar professions working remotely, employers are likely to ask hard questions about whether they need as much office space, and whether business travel is necessary.

Last month, Barclays (BCS) CEO Jes Staley told reporters that “the notion of putting 7,000 people in a building may be a thing of the past.” And already, companies are reconfiguring existing offices to conform to the imperatives of preventing the spread of the deadly virus, and planning for more to work from home.

“There could be longer-term implications for the airline industry, hotel chains and of course hospitality,” ING’s Knightly said.

“That runs the risk of making the recovery story last longer, or take longer to come to fruition,” the economist said — adding that it could take 2 years to recoup the growth lost in the wave of lockdowns that put the economy in suspended animation.

What happens in Vegas may not stay there

The hospitality industry, which includes hotels and casinos, have been hemorrhaging money, and are deeply invested in a return to normal. However, whether consumers feel safe returning to public life in droves is very much an open question.

Hilton (HLT) CFO Kevin Jacobs told Yahoo Finance on Monday that the chain was pushing “heightened level of cleanliness” for guests, while Las Vegas Sands (LVS) COO Robert Goldstein warned on an earnings call that “it will take time for Americans to 'acclimate' to this new world.”

Separately, Andre Carrier, the COO of Eureka Casinos in Las Vegas said recently that the gaming industry is “in the process of imagining” what a socially-distant casino experience will look like once the city reopens for business.

“Clearly distancing is part of that, we’re blessed that by their nature, casino floors are large, and we do have the ability to spread out games and equipment,” Carrier told Yahoo Finance last week.

Casinos will have more equipment and processes to sanitize and enforce social distancing, he said. Meanwhile, at the behest of Nevada regulators, elaborate open air buffet dining — a staple of the Las Vegas dining experience — will be a thing of the past for now, as will jam-packed casino floors.

“I think you may see fewer games on the floor to provide the spacing required, so some casino environments have 2000 games, there may be fewer when we come back,” the executive said.

‘Subplot’ to a global pandemic

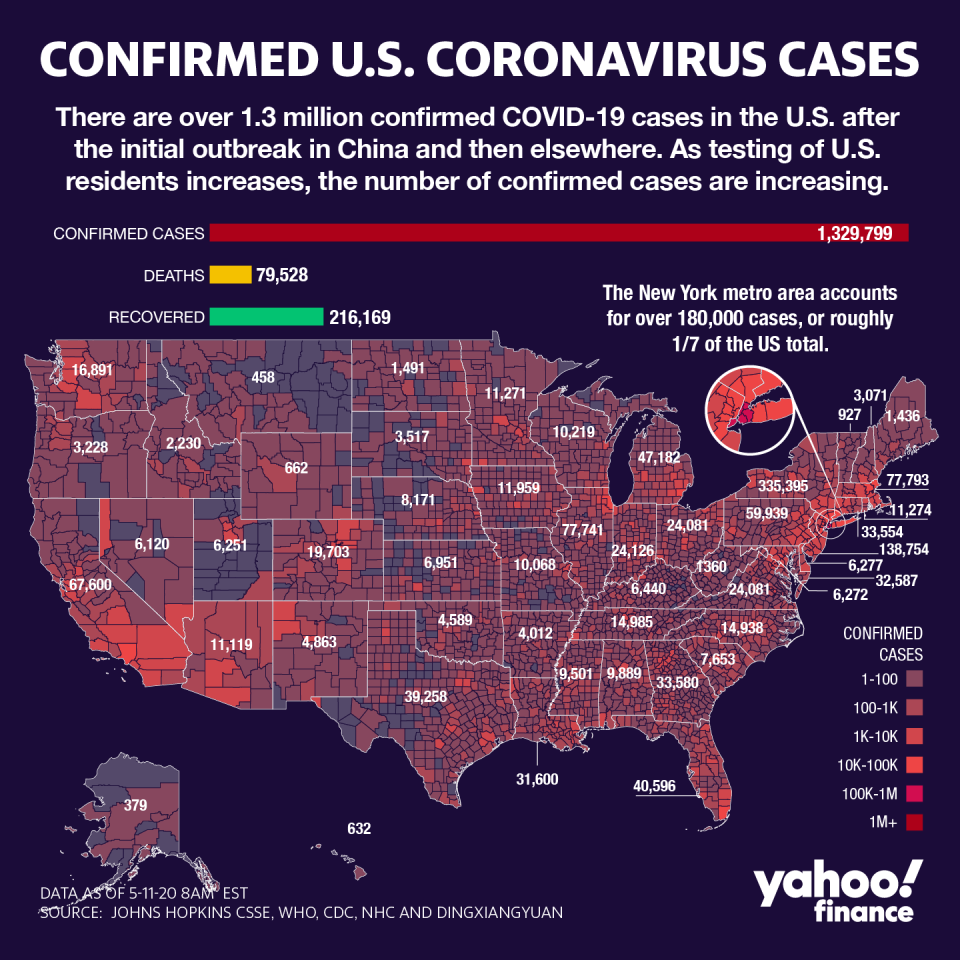

The wealthy yet densely populated East and West Coasts have been epicenters of the U.S. outbreak, which has infected over 1.3 million and killed about 80,000.

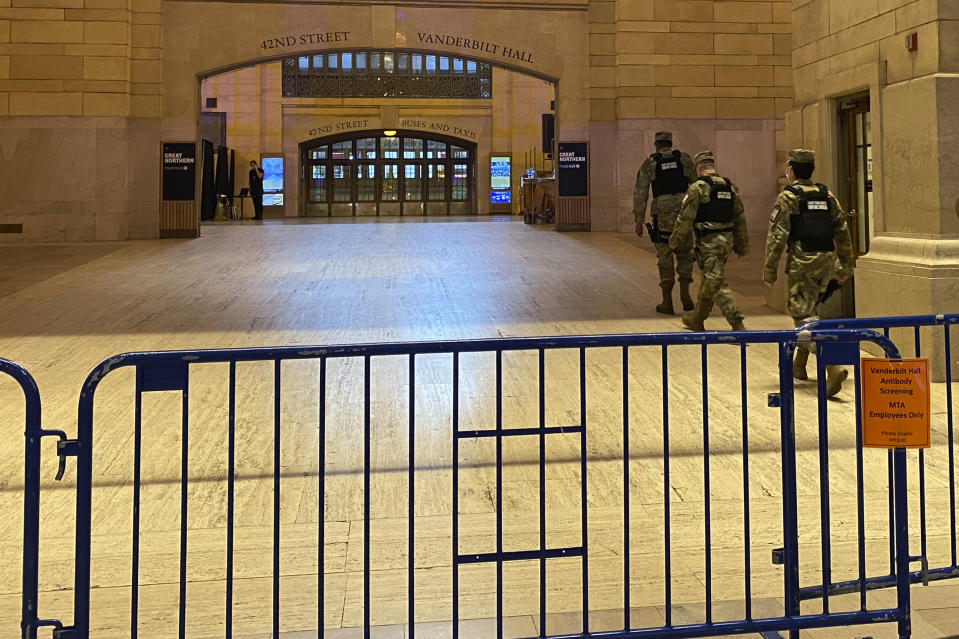

According to some observers, a major overarching theme in the post-coronavirus future is the potential for a migratory shift away from bustling coastal regions that include New York, San Francisco and Los Angeles, all hotbeds of coronavirus infections.

“A subplot to this global vs. local dynamic is urban vs. rural. The virus outbreak has been hardest felt in dense urban areas,” which are also major hubs of business activity, according to Antonio DeSpirito, a managing director and CIO of U.S. Fundamental Active Equity at BlackRock.

Along with “turbocharged virtual life” trends like online learning, streaming and gaming, DeSpirito thinks the move away from traditional office spaces may fuel a move away from big city life.

“We could see a shrinking office footprint as populations gravitate away and remote workforces grow,” he wrote in a recent note to clients.

“Meanwhile, less-urban areas could benefit in several ways: on-shoring of manufacturing would likely go to these areas; the ability to work remotely means people can relocate from urban hubs; and retirees who preferred culture centers like New York City may see disadvantages of dense areas and look to more rural settings,” DeSpirito added.

ING’s Kingsley cautioned that the staggering job losses seen over the last two months could take longer to come back, mainly because protocols that block large crowds will still be in effect — while consumer psychology may take longer to heal.

“We have to be cognizant of the risks people don’t want to take, people don’t want to go to as many bars or restaurants, they don’t want to go to as many stores,” Kingsley said. “These issues all do make it... a risk that we see a much more prolonged period before we regain the lost output.”

Javier David is an editor at Yahoo Finance. He can be reached at @TeflonGeek.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.