Construction industry hit hard, even as states deem it an ‘essential service’

U.S. homebuilder sentiment in April dipped to its lowest level in over seven years. It was the steepest monthly decline in the 30-year history of the National Association of Home Builders/Wells Fargo Housing Market Index.

It is easy to see why confidence has cratered. Even though construction has been deemed an essential service in all but six states with stay-at-home orders, at least 3,180 U.S. construction projects have been canceled or delayed, as of April 15, up 132 from only the day earlier, according to ConstructConnect, an Ohio-based construction management software company.

Disrupted supply chains and rising unemployment pose increasingly large hurdles to the construction industry during the coronavirus pandemic, and many residential and commercial builders are canceling or delaying projects altogether.

Six states — Washington, Michigan, Pennsylvania, New York, New Jersey and Vermont — have halted residential and commercial construction as part of their stay-at-home orders. In fact, 27% of contractors said a municipal, state or federal government had ordered them to halt or cancel construction projects, according to an Associated General Contractors of America (AGC) survey of 1,640 residential and commercial contractors from April 6 to 9. Most of the closures are handed down from private investors and owners. Over half of the contractors say projects have been voluntarily canceled by companies.

“You have to think about constraints on funding sources, like banks. Cash is the bloodline of a project. When you start constraining blood flow, you will have real problems,” said Wayne Maiorano, partner at Smith Anderson, a law firm in Raleigh, N.C.

Looking ahead, disruptions are likely to continue, since the pipeline of new projects likely won’t break ground during the pandemic, said Maiorano, who specializes in construction, development, land use and zoning.

“You are going to see a big dip in new projects. All of our projects are all on hold,” said Doug Brien, co-founder and CEO of California-based MYND Property Management, which has about 8,000 units in 15 markets across the U.S. and offers construction management to its clients.

Ongoing labor shortages

Over half of the surveyed contractors reported furloughs and layoffs at their firm, according to the AGC.

The construction sector lost 29,000 jobs in March, and unemployment in the construction sector shot up to 6.9% in March, up from 5.5% in February and 5.2% in March 2019, according to U.S. Bureau of Labor Statistics data.

Job losses especially hit construction in restaurant, travel and leisure industries, and April losses are expected to be even higher, according to Lawrence Yun, National Association of Realtors chief economist.

On top of rising construction unemployment, firms have been dealing with a labor shortage: 25% of contractors reported a labor shortage for the week ending April 10, up from 11% only a month prior, for the week ending March 20, according to the AGC survey.

Construction has suffered from an industry-defining skilled labor shortage since the Great Recession, but that shortage is being exacerbated by the coronavirus pandemic.

On top of that, safety concerns may be making some construction workers reluctant to enter job sites, preferring instead to quarantine. Firms may be laying off and furloughing workers, who do not want to return to work for health and safety reasons, so they can apply for unemployment benefits, according to Ali Wolf, chief economist at Meyers Research, a California-based housing data company.

The concern for job site safety is growing. Some 17% of respondents in the AGC survey said that they were told someone with COVID-19 entered and potentially infected a job site, up from 13% the week prior. Contractors usually wear PPE, or personal protective equipment, which is now in short supply, so 39% of contractors are now reporting that the shortage is disrupting or delaying projects.

“The next step after making sure they [construction workers] can legally continue working, is to make sure that companies are taking every step to keep employees as safe as possible,” said Jerry Howard, CEO of the National Association of Home Builders (NAHB), which has provided construction site safety resources and webinars to developers amid the pandemic.

Supply chain disruptions

Some 23% of contractors said they have already experienced supply chain disruptions during the pandemic, and 80% said they expect to face shortages in the next few months, according to a Meyers Research survey of 300 homebuilding division presidents.

Cabinetry, countertops, light fixtures and elevators are often sourced from China, Italy, Pennsylvania and other geographies currently on lockdown, according to the NAHB and Meyers Research.

Shipping capacity has also slowed due to layoffs and labor shortages. Some 42% of contractors said suppliers had notified them of upcoming delivery delays due to the pandemic, up from 35% the week prior, according to the AGC survey.

“Once it gets to the U.S., we’ve had to do layoffs at the port, so it’ll get here but will there be enough workers on site to get them in trucks and drive to their destination. A lot of little parts could go wrong along the way. Not yet but inevitable that it will be along the way,” said Wolf.

Once materials are delivered and labor is ready, construction sites still may not be able to complete their work: government-level labor disruption has slowed down permitting and required governmental oversight for construction companies, 16% of those surveyed by AGC said.

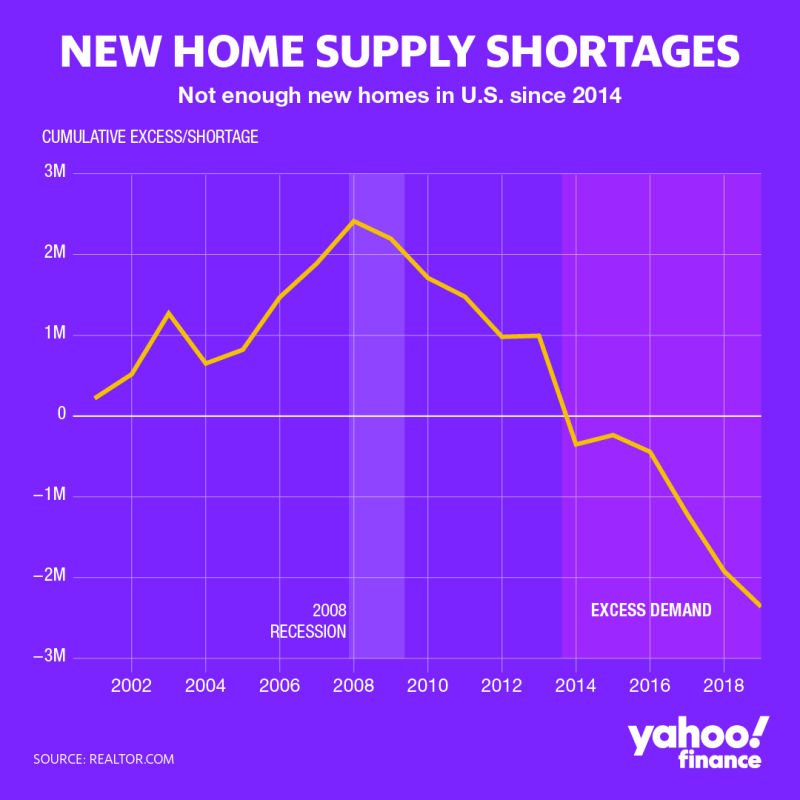

The novel coronavirus pandemic comes as the U.S. faces an affordable housing crisis. The crisis has put more pressure on Americans’ finances, so keeping home prices down is essential, say developers. Prices have been on the rise because of a lack of homes for sale. U.S. inventory began declining after the 2008 recession, and demand has outpaced supply since 2013, according to Realtor.com.

“Demand is so great, and people still need housing. We never really built our way out of the shortage,” said Justin Onorato, CIO of BTI Partners, a Fort Lauderdale-based residential developer.

The supply chain disruptions will likely crush any inventory relief that was expected prior to the virus.

“If they [builders] have delays or need to find a new supplier, then that’ll push up the price of new homes,” said Wolf, adding that “in today’s landscape, I’m not sure builders are in the position to push prices too high.”

Sarah Paynter is a reporter at Yahoo Finance. Follow her on Twitter @sarahapaynter

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

Coronavirus fallout: One-third of Americans missed rent payments in April

Google searches for ‘mortgage relief’ and ‘mortgage refinance’ hit all-time high in March