'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

A rising number American households are grappling with rising borrowing costs and consumer loan delinquencies — a worrying trend that could indicate an economic slowdown is at hand, Deutsche Bank warned on Wednesday.

As U.S. consumers rack up a record amount in credit — a recent Federal Reserve report showed outstanding consumer debt topped a record $4 trillion — Deutsche Bank’s analysts showed that more borrowers are falling behind on a range of personal debts, like credit cards and auto loans.

“The clock is ticking,” Deutsche’s chief international economist Torsten Slok told Yahoo Finance in a phone interview. “Maybe the risk here is that you’re actually in a situation where you should be paying attention to these charts and these consumers loans.”

Deutsche’s data show how the credit cycle leads an economic slowdown. In other words, when delinquency rates on consumer loans take a big dip as they are now, there’s a likelihood that a recession could be on the horizon.

However, Slok cautioned that “the economy is doing fine — we are not about to enter a recession,” he said. The labor market is strong and so are wages.

Nevertheless, more consumers are finding it difficult to make good on money that they borrowed right after the Great Recession.

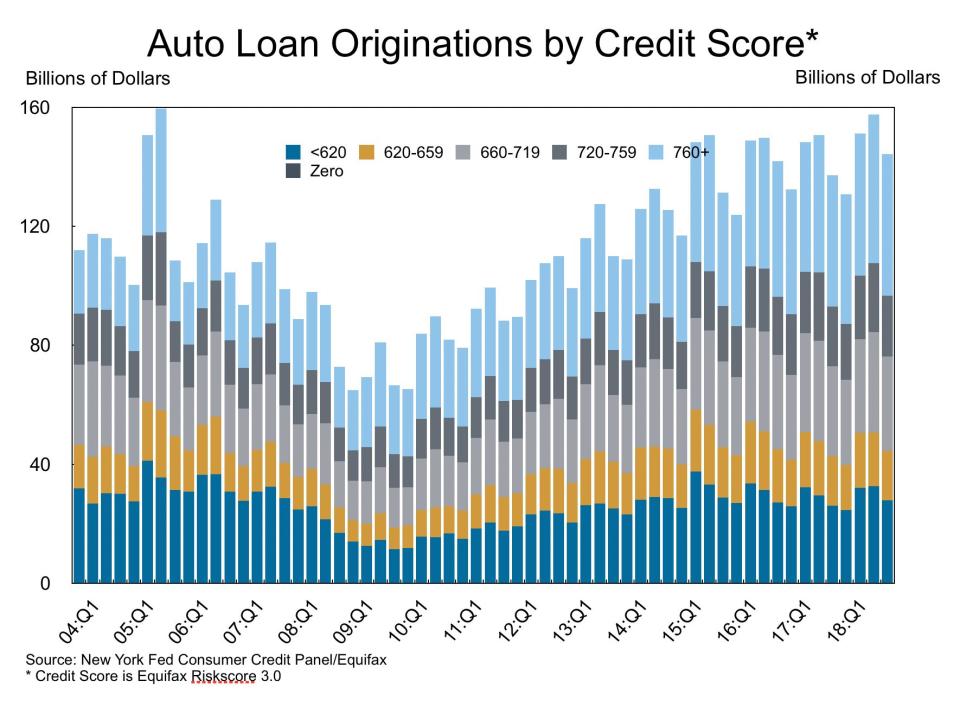

“When you come out of a recession, you can only get a loan if you [have a] stellar credit score,” Slok explained. However, after the 2009 slowdown, “loans were given more and more to people who had lower and lower credit scores … [and] soon deep-subprime credit scorers got loans.”

Delinquencies spiking

Those lower-end borrowers are now adding to the alarming spikes in auto loans, credit card debt, and other personal loans.

One of the key demographics experiencing this trouble are millennials. The New York Fed recently reported that the age cohort is leading the pack when it comes to auto loans that were more than 90 days delinquent.

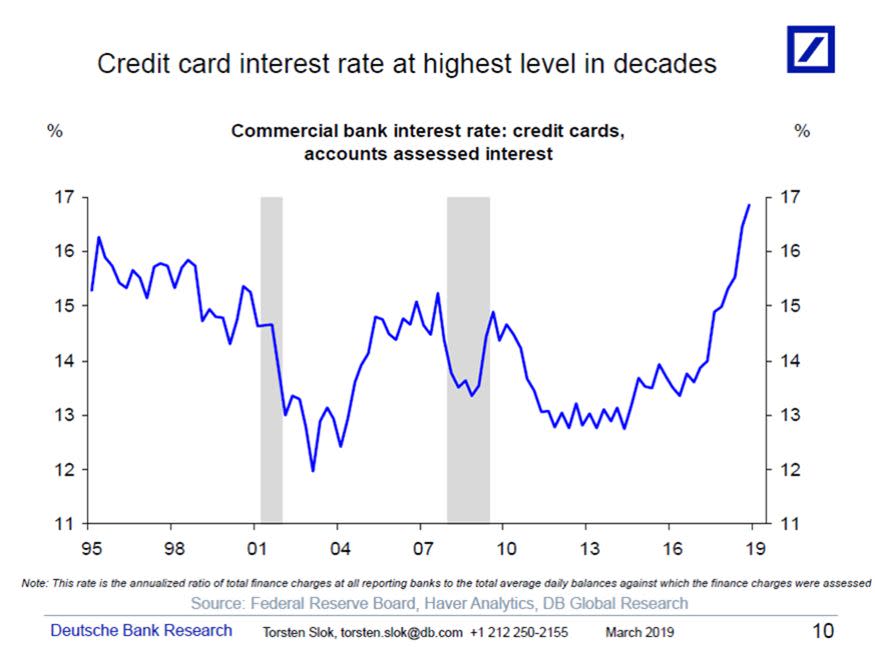

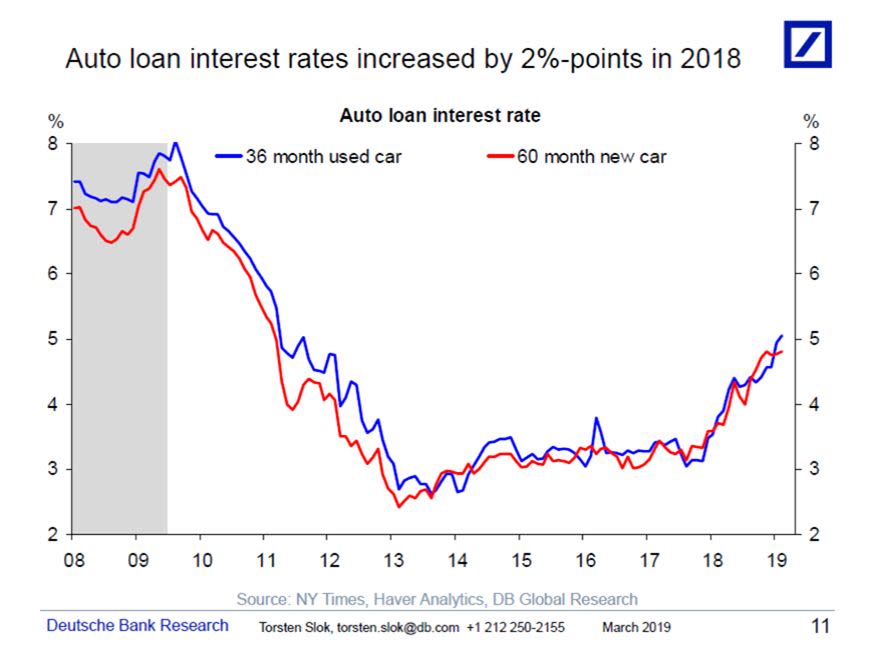

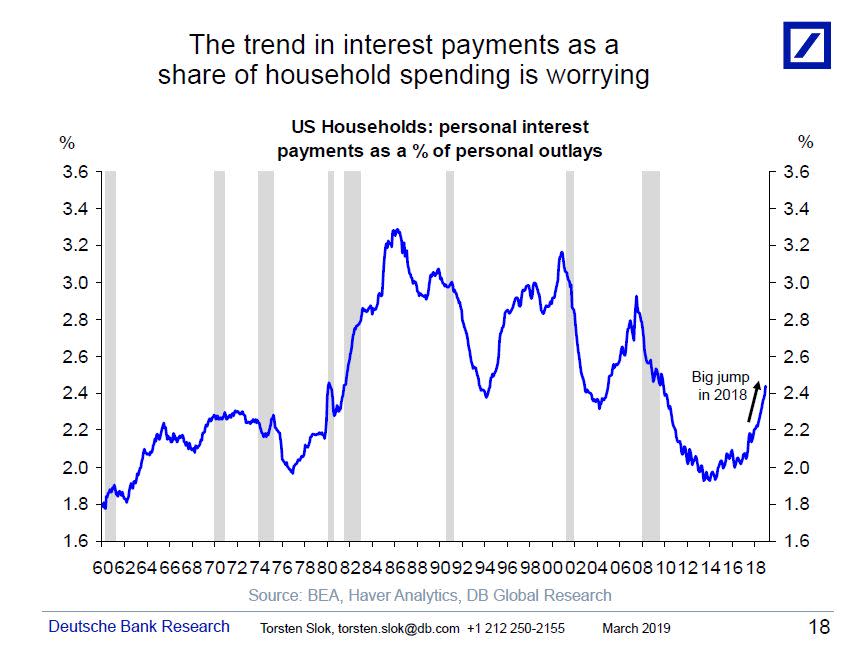

Lenders are reacting to the delinquencies by hiking the interest rates on existing consumer loans — which in turn is increasing the burden on the consumer.

As a result, the amount of personal interest that a household has to pay as a part of their overall income has ticked up, as seen in the graph below.

Only a matter of time

Overall, Slok noted, the demand for consumer loans was cooling. The implication is that the credit cycle — or the consumer loan market — may be a leading indicator of a potential economic downturn.

Given that the credit cycle is slowing down rapidly, Deutsche’s data strongly suggests that it could only be a matter of time before we see an economic slowdown.

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Americans — particularly millennials — are alarmingly late on car payments

There are now more $100 bills than $1 bills in circulation (and we're not sure why)

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.