Jobless claims: Another 1.877 million Americans file for unemployment benefits

The state of employment in the U.S. took centerstage Thursday when the U.S. Labor Department released its weekly jobless claims report.

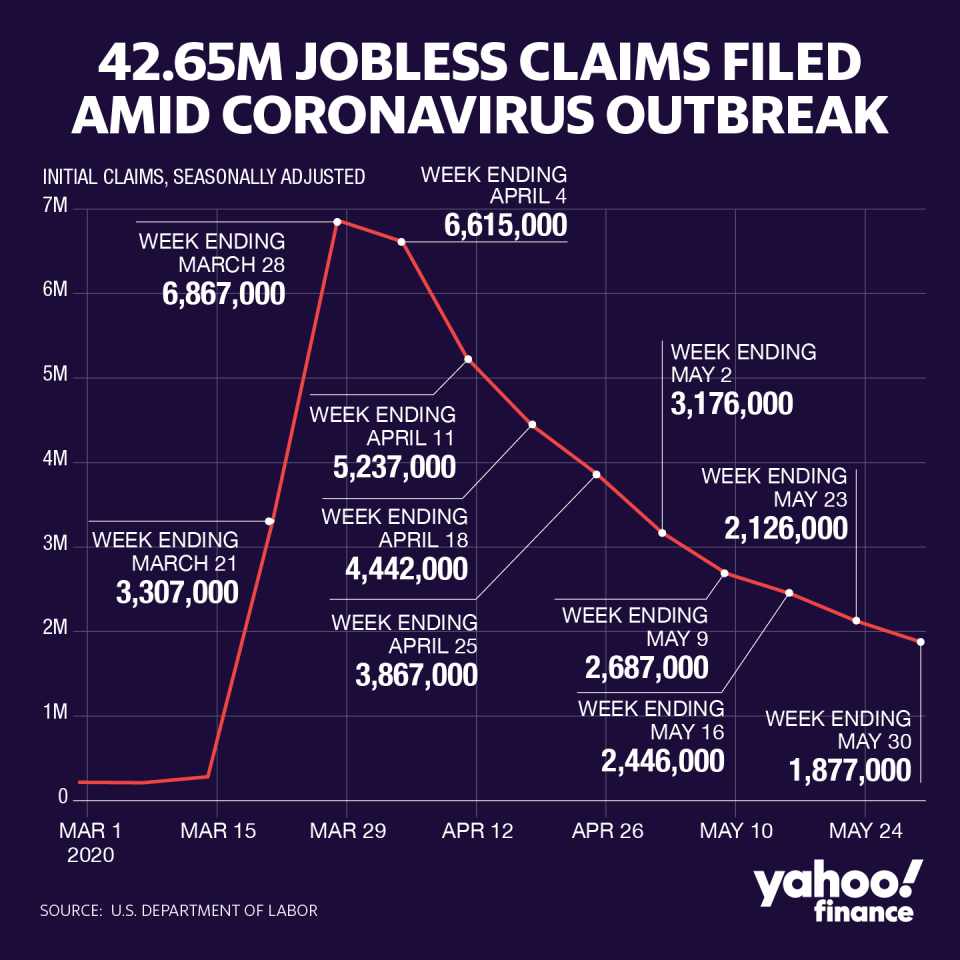

An additional 1.877 million Americans filed for unemployment benefits in the week ending May 30, exceeding economists’ estimates for 1.843 million initial jobless claims during the week. The prior week’s figure was revised higher to 2.13 million from the previously reported 2.12 million.

This week’s report marked the first time that weekly initial jobless claims came in below two million in 10 weeks. Over the past 11 weeks, more than 42 million Americans have filed for unemployment insurance.

Read more: Coronavirus: How to find a job in a tough economy

After peaking in the week ending March 28, weekly jobless claims have been on a steady decline, but the pace of the decline might not be swift enough, according to economists.

“The downward trend is obviously good news, but in the context of an economy that is re-opening it is extremely high, especially when viewed against previous recessions. It may well be that businesses that had been trying to look after their staff and keep them on the payrolls have had to capitulate,” ING Chief International Economist James Knightley wrote in a note Thursday.

“For example, social distancing constraints have made the business unviable or demand has not returned as hoped and they have been forced to adjust the numbers of staff to the new reality,” Knightley added.

After seeing a decline in the previous week’s report, continuing claims, which lags initial jobless claims data by one week, increased to 21.49 million in the week ending May 23, from 20.84 million in the previous week. Consensus expectations were for 20 million continuing claims.

“The rise in continuing jobless claims is worrisome because it means people remained unemployed and didn't return to work,” Mark Tepper, president and CEO of Strategic Wealth Partners, said in an e-mail Thursday.

Pandemic Unemployment Assistance (PUA) program claims, which include those who were previously ineligible for unemployment insurance such as self-employed and contracted workers, fell significantly to 623,073 in the week ending May 30 from the prior week’s 1.3 million.

In the week ending May 30, California reported the highest number of jobless claims at an estimated 230,000 on an unadjusted basis, up from 203,000 in the previous week. Florida had 206,000, up from 175,000. Georgia reported 148,000 and Texas had roughly 107,000 jobless claims.

The weekly initial jobless claims report comes on the heels of the ADP private employment report and ahead of the highly-anticipated May jobs report, which is set to be released Friday morning.

ADP’s report showed that the U.S. economy lost 2.76 million private payrolls in May, which was significantly fewer than estimates for 9 million job losses during the month.

“The ADP report isn't always a reliable predictor of the BLS data, but it suggests that the pace of job loss moderated noticeably between April and May, even though it remained substantial relative to pre-COVID-19 norms. This is a message broadly consistent with some other related signals, and the labor market likely has benefitted from the easing of restrictions on activity in many places in recent weeks,” JPMorgan said in a note Wednesday.

Read more: US economy shed 2.76 million private payrolls in May: ADP

Economists anticipate another historic decline in employment in May with the pace of layoffs significantly outpacing rehiring. The U.S. economy is estimated to have lost 8 million nonfarm payrolls, down from 20.54 million job losses in the prior month. The unemployment rate likely skyrocketed to nearly 20% during the month, up from 14.7% in April.

Read more: Unemployment rate expected to hit highest since the Great Depression

“In reality, the shadow unemployment rate, which includes people absent from work for other reasons, is much higher,” Morgan Stanley wrote in a note Wednesday. “There is considerable uncertainty as to how high the shadow unemployment rate could be due to compositional and categorization noise. For example, some people that were absent from work for other reasons are counted as employed, but are presumed to be unemployed. The Bureau of Labor Statistics could re-categorize this at any time, which could life the unemployment rate to as high as 25%, in our view.”

As of Thursday morning, there were 6.53 million coronavirus cases and 386,000 deaths worldwide, according to Johns Hopkins University data. In the U.S., there were 1.85 million cases and 107,000 deaths.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.