Coronavirus, Good Friday, oil: What to know in the week ahead

While it will be a shortened trading week with major markets closed Friday in observance of the Good Friday holiday, coronavirus developments will continue to take centerstage for investors.

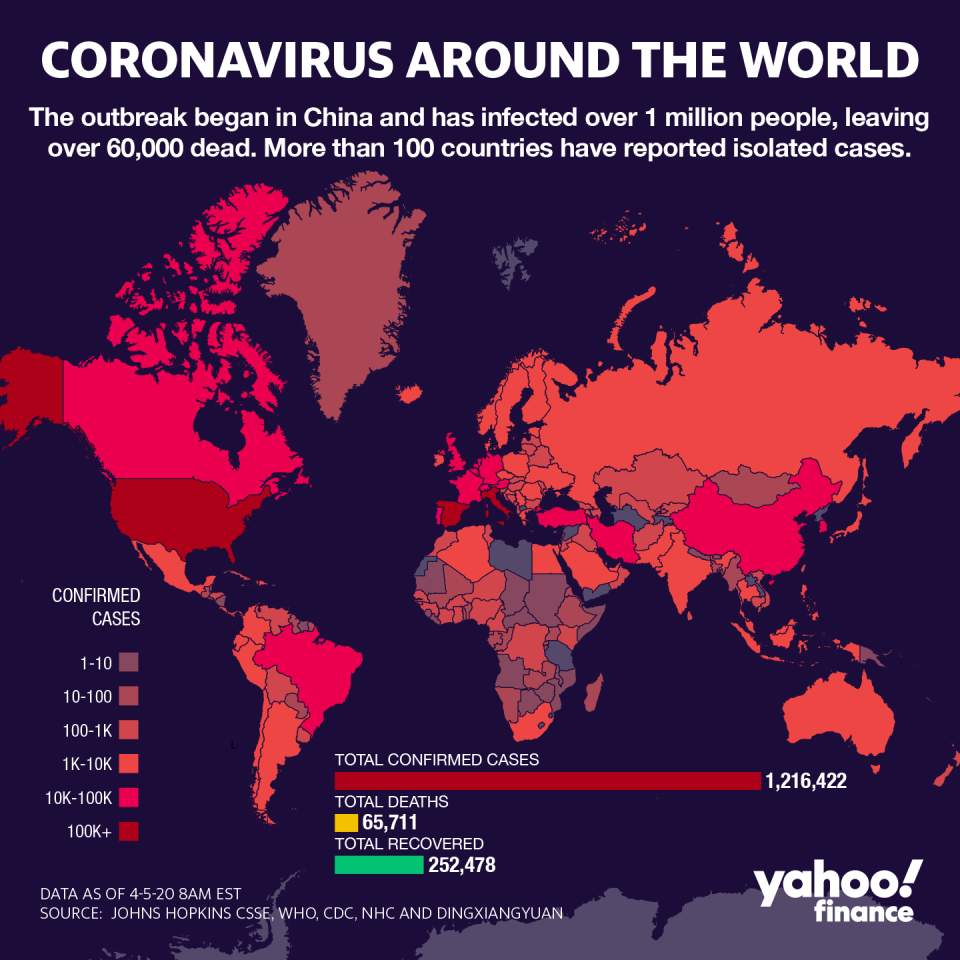

COVID-19 cases are on the rise and have yet to show signs of stabilization in the U.S. As of Sunday morning, there were 1.216 million confirmed cases globally and 65,711 confirmed deaths, according to Johns Hopkins University data. In the U.S., there were more than 312,000 cases and 8,503 deaths.

According to RBC’s March 2020 Equity Investor Survey, investors said outlook surrounding the coronavirus is critical. RBC surveyed 185 institutional investors between March 25 and March 30, and found “78% believe that a decline in new coronavirus cases in the US is needed for the equity market to stabilize. Additionally, 54% believe that significant progress on new drugs to treat the coronavirus and/or a vaccine is needed for stabilization.”

With market volatility largely expected to continue for the time being, RBC’s survey found that 57% of investors believe the market will bottom in the second quarter of 2020. Only 19% of participants believe the market has already seen its low. Meanwhile, “bearish economic outlooks have risen. In total, 43% said their view on the US economy over the next 6-12 months is either bearish or very bearish, the highest since our survey began.”

Oil in focus

Amid the chaos caused by the COVID-19 pandemic, the oil price war between Saudi Arabia and Russia has placed additional pressure on markets. The ongoing feud has pushed crude oil (CL=F) below $20 a barrel and prices have hovered around those levels before bouncing back on positive developments. Crude oil surged 25% Thursday for its best day ever and rallied another 12% Friday. For the week, oil advanced 32% for its best weekly performance on record.

Oil will be tested again this week after a virtual meeting between the Organization of the Petroleum Exporting Countries (OPEC) and its allies including Russia was rescheduled tentatively to Thursday.

The purpose of the meeting was to discuss cutting production by about 10%, or 10 million barrels, President Donald Trump first revealed the news in a tweet April 2.

Just spoke to my friend MBS (Crown Prince) of Saudi Arabia, who spoke with President Putin of Russia, & I expect & hope that they will be cutting back approximately 10 Million Barrels, and maybe substantially more which, if it happens, will be GREAT for the oil & gas industry!

— Donald J. Trump (@realDonaldTrump) April 2, 2020

Global oil demand has been weakening, and thus market participants were hopeful that a meeting to curb supply would soothe markets. “With oil at prices unsustainable and unprofitable for the global industry, the president urged both sides to call for an OPEC+ meeting, and hopefully call a truce. Despite lower fuel prices being supportive for the consumer, the current levels are detrimental to US producers and the removal of any uncertainty should help mitigate equity market volatility in the near term,” Raymond James Chief Investment Officer Larry Adam said in a note April 3.

Economic data

The detrimental economic impact of COVID-19 is expected to continue, and data released this week will reflect the damage.

The number of Americans filing for unemployment will likely remain in the millions this week, according to economists. Consensus expectations are for 5 million jobless claims for the week ending April 4 following a record-breaking 6.648 million claims filed the week ending March 28. JPMorgan economist Jesse Edgerton predicts 7 million claims were filed last week. “[We] see more reasons to expect an increase in claims than a decrease,” Edgerton said in a note April 3.

Credit Suisse’s James Sweeney echoed Edgerton’s sentiment. “We expect further waves of layoffs and upcoming claims should remain elevated as the labor market shock broadens out from hospitality and food services.”

Consumer sentiment will also be closely monitored by market participants this week. The University of Michigan’s sentiment reading for April is expected to have slowed to 75.0 from 89.1 in March, according to economists polled by Bloomberg. The survey results will include responses collected from March 25 to April 7, which captures the period when the COVID-19 fears escalated drastically.

“Given the intensification of COVID-19 contagion and shutdown orders across the country, consumer confidence should fall precipitously,” Sweeney said. “Given the unprecedented surge in unemployment insurance claims and the enormous shock to growth in the second quarter, we would not be surprised if sentiment eventually falls below the lowest point during the great recession (55.3 in November 2008) in the weeks ahead.”

Finally, the Federal Open Market Committee’s (FOMC) meeting minutes from its scheduled March meeting and emergency meetings will be released Wednesday afternoon. “The minutes of the emergency FOMC meeting in early March, and the mid-March meeting which was held two days earlier than scheduled, may not contain many new insights given how rapidly the economic landscape has been changing over the past couple of weeks,” Capital Economics said in a note April 3.

While the minutes will unlikely reveal many new insights, it will provide more context, according to Nomura. “Given the number of actions taken during March after the 15 March meeting, and the rapidly deteriorating outlook over the month, the minutes may be somewhat stale. However, they may provide more context for how much the Fed is willing to utilize its existing authority or whether any participants suggested seeking an expansion of that authority,” the firm said in a note April 3.

Economic calendar

Monday: N/A

Tuesday: JOLTS Job Openings, February (6500 expected, 6963 in January)

Wednesday: MBA Mortgage Applications, week ended April 3 (15.3% prior)

Thursday: PPI Final Demand month-on-month, March (-0.4% expected, -0.6% in February); PPI excluding food & energy month-on-month, March (0.0% expected, -0.3% in February); PPI Final Demand year-on-year, March (0.5% expected, 1.3% in February); PPI excluding food & energy year-on-year, March (1.2% expected, 1.4% in February); Initial Jobless Claims, week ended April 4 (5 million expected, 6.648 million prior); Continuing Claims, week ended March 28 (3.029 million prior); Bloomberg Consumer Comfort, week ended April 5 (56.3 prior); Wholesale Inventories month-on-month, February final (-0.5% expected, -0.5% prior); University of Michigan Sentiment, April preliminary (75.0 expected, 89.1 prior)

Friday: CPI month-on-month, March (-0.3% expected, 0.1% in February); CPI excluding food & energy month-on-month, March (0.1% expected, 0.2% in February); CPI year-on-year, March (1.6% expected, 2.3% in February); CPI excluding food & energy year-on-year, March (2.3% expected, 2.4% in February)

Earnings calendar

Monday: N/A

Tuesday: Levi’s (LEVI) after market close

Wednesday: N/A

Thursday: N/A

Friday: N/A

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.