Coronavirus update: WHO says pandemic threat 'very real' as global markets nosedive in fit of panic

Soaring coronavirus infection rates across the world — which have risen above 100,000 and triggered emergency declarations in several U.S. states — sparked new pandemic fears that hammered global markets on Monday.

The seemingly relentless march of COVID-19 cases outside of China converged with geopolitics, and raised the stakes for the global economy. A fight between Saudi Arabia and Russia for crude market share sent the price of oil plummeting by over 20% — and exacerbated market fears already heightened by the outbreak.

“Now that the coronavirus has a foothold in so many countries, the threat of a pandemic has become very real,” said Tedros Adhanom Ghebreyesus, the World Health Organization’s director general.

“But it would be the first pandemic in history that could be controlled. The bottom line is: We are not at the mercy of this virus,” he added.

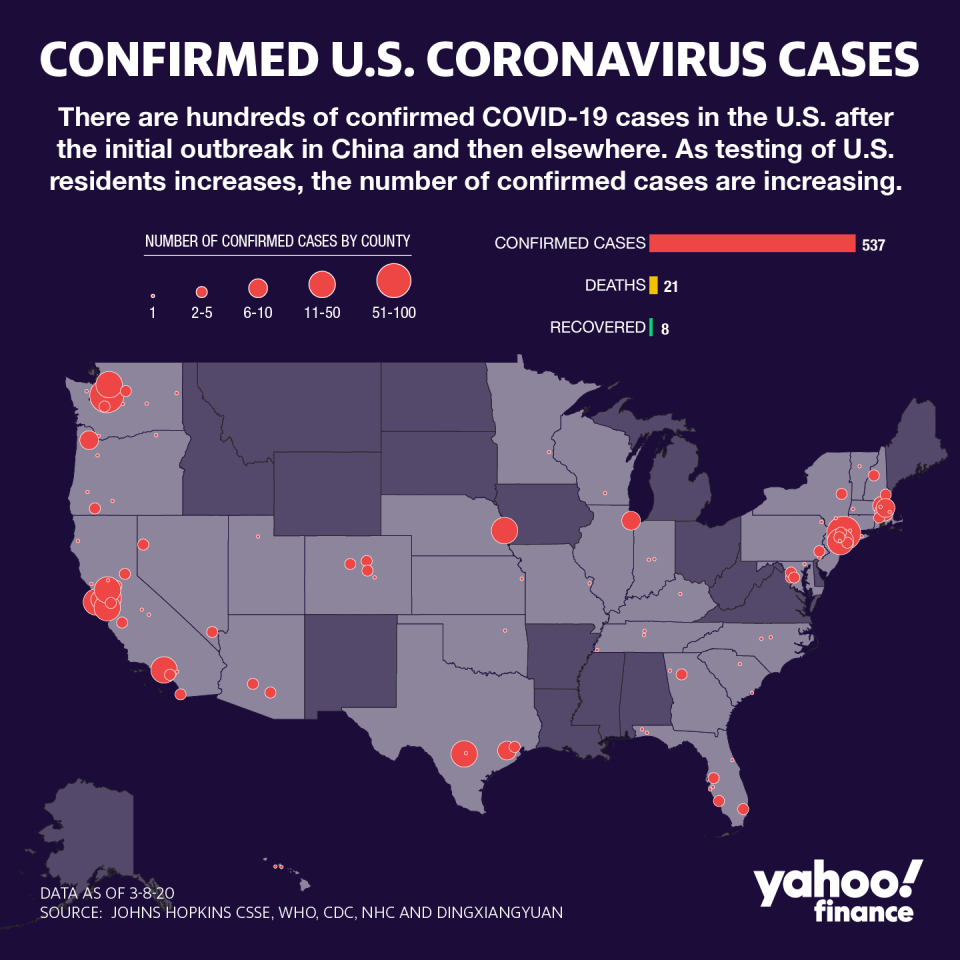

As of Monday, the pathogen has infected over 113,000 globally with nearly 4,000 deaths. Infections are on the decline in China, but the U.S. and Italy have become acute sources of worry as illnesses in both countries jump daily. The lack of a rigorous testing regime in the world’s largest economy is amplifying concerns that the outbreak could be much worse than official statistics are currently citing.

Italy, which has the highest number of deaths outside of China, was forced to lock down its wealthy northern region over the weekend. Meanwhile, Iran and South Korea are also grappling with soaring infection rates. The outbreak is still largely concentrated in China, but experts expect a similar scale to reach global hubs in the next several weeks.

Schools are closed or preparing to do so around the U.S., meanwhile companies are exploring the idea or encouraging more work from home options.

Bill Castellano, a professor at Rutgers School of Management and Labor, said it wouldn’t be a stretch to see work-from-home be a more permanent fixture of work life.

But, he said, smaller businesses or industries that are not able to do so will need help from federal and state governments to stay afloat amid the outbreak.

‘Pretty much a washout’

The bloodbath in global markets dramatically upped the stakes for the Trump administration. The White House is inviting Wall Street executives to discuss a response to the virus, an administration official told CNBC.

Over the weekend, Vice President Mike Pence met with cruise owners, following a meeting earlier President Donald Trump had with airline executives.

Officials are now weighing deferring taxes and taking other measures, as part of a wide-ranging coronavirus stimulus package. Sen. Chuck Grassley, the Iowa Republican who heads the Senate Finance, said additional steps are necessary.

"While we continue to assess the economic impacts, Chairman Grassley is exploring the possibility of targeted tax relief measures that could provide a timely and effective response to the coronavirus. Several options within the committee’s jurisdiction are being considered as we learn more about the effects on specific industries and the overall economy,” a spokesperson told Yahoo Finance.

Since the contagion reared its head, the travel industry has taken a beating since the onset of the outbreak — which only grew worse after the State Department warned U.S. travelers not to take cruises while the pathogen rages unchecked.

Carnival Cruise Lines (CCL), Royal Caribbean (RCL) and Norwegian (NCLH) have all seen a loss of at least 50% since the start of the year. And despite moves to help screen passengers or add more standardized safety precautions, cruises are staring down the barrel of a bleak 2020.

“Our assumption right now is that 2020 is pretty much a washout,” and business will return next year, Morningstar senior equity analyst Jaime Katz told Yahoo Finance.

— Yahoo Finance’s Jessica Smith contributed to this report.

Anjalee Khemlani is a reporter at Yahoo Finance. Follow her on Twitter: @AnjKhem

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.