Coronavirus will reshape how people, companies, governments behave

Early during the coronavirus crisis, there was hope the economic damage and ensuing recovery would be V-shaped: acutely free-fall but then a quick recovery as things were put on track.

But this might not be the case, writes Torsten Sl?k, chief economist at Deutsche Bank. Why? Because the coronavirus lockdown may fundamentally change much of the behavior of people, businesses, and governments.

"Once the global economy reopens, we are likely to see changed behavior from households, corporates, and the government sector," Sl?k wrote. “These behavioral changes are the reason why we will not get a V-shaped recovery, and there is not much fiscal policy can do about it.”

The impact from the immediate, complete, and necessary shutdown of the economy has brought large portions of the consumer discretionary economy — restaurants and any public activity — to a standstill, resulting in record unemployment filings and a crashed stock market.

Due to the delays of the American response, the societal shutdowns are already approaching a month — a long term, behavioral-shaping length that could get much longer. The damage is going to be deep.

“We estimate that the increasingly stringent lock-down measures to combat Covid-19 in Europe and the US are depressing the levels of consumer and business spending by more than anything we have seen since the Great Depression,” a recent note from Deutsche Bank economists said. “The peak-to-trough decline in [European] and US GDP is likely to be more than double that during the more prolonged Global Financial Crisis.”

How your behavior will change

After a seemingly endless bull market following the Great Recession, bad times had become almost academic as they faded into memory — and many younger workers have lived in nothing but bull market. This will be a stark wakeup call to prepare for the bad times as well as the good.

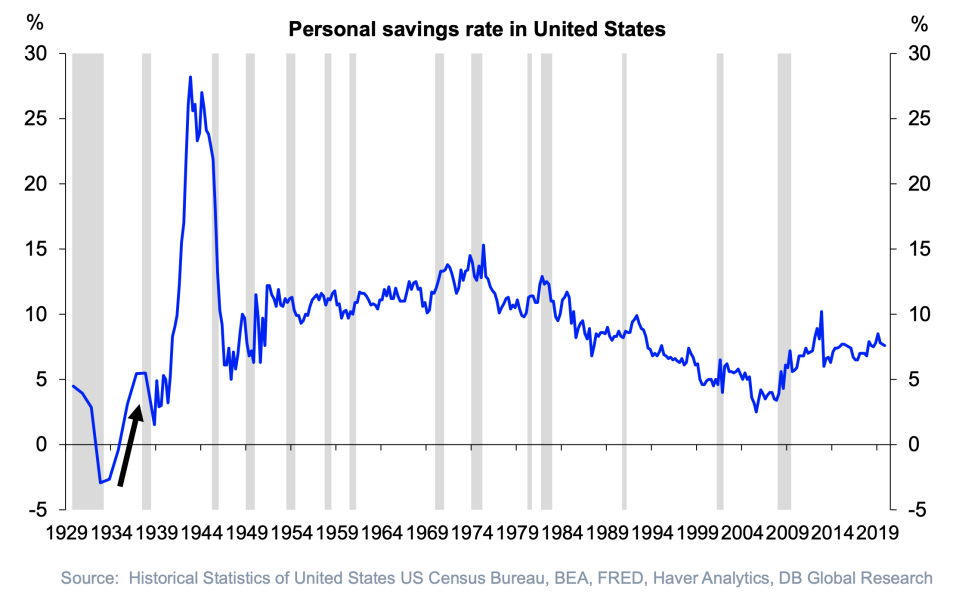

For the slightly older millennials, the Great Recession shaped their psyche and worldview, pushing them away from credit cards (and toward debit cards) and compelling them to save more than their parents, even though they’ve accrued less by the same age. More traumatic times have had starker effects, as many in the Greatest Generation never shook the habits of moderation, indelibly shaped by wartime rationing.

Some of the psychological changes Deutsche Bank predicts are fairly positive, but inhibit growth — like consumer spending. After this is all over, it will likely change people’s view of emergency savings.

Spiking unemployment and acute financial concerns for millions may spur more emergency savings.

This isn’t just for lower-income groups. According to the AARP and Deutsche Bank data, a quarter of households pulling in $150,000 or more don’t have emergency savings.

After the Great Depression in the 1930s, personal savings rates shot up — a trend echoed during the Great Recession. If that ends up happening amid this pandemic, it would coincide with the highest credit card interest rates in decades, further pushing people away from spending.

The changes may not always be obvious. Sl?k writes they could take the form of increased spacing between seats on airplanes, restaurants, cinemas, sporting events, concerts, conferences, trains, buses — and even offices.

In the near term, fewer people may choose to go on vacation until a vaccine emerges, which at its earliest would be in a year-and-a-half, many experts say.

With people unable or incentivized not to go to the store, online commerce has seen a boost, and services like grocery delivery have rapidly scaled up to deal with the demand. When the crisis subsides, many consumers will decide to keep the deliveries coming.

To avoid contact with COVID-19 patients, many hospitals have embraced telemedicine when possible, a trend that could continue.

The effects won’t be the same for everyone. The coronavirus crisis (which Deutsche Bank calls the “Virus Crisis” at a few points) will hit lower-income groups far harder as these groups see less paid leave, health benefits, and may not be able to work from home.

The corporate sector will change, too

The prolonged restrictions will also have an effect on businesses. Companies may decide that many business trips are less necessary, as teleconferencing via Slack, Zoom, Hangouts, Meet, FaceTime, Skype, and WhatsApp becomes more common.

Sl?k writes that work schedules might become more staggered and flexible and as more people adopt permanent work-from-home setups, fewer cubicles and seats in offices could result.

For both businesses and people, higher health insurance premiums will emerge, as well as more pressure from workers for improved labor benefits like paid sick leave — and gig worker protections.

Governmental changes and permanence

The coronavirus crisis will reshape the government as well. Sl?k predicts more travel restrictions for high-risk areas and more fever scanners at borders. More regulation could emerge pushing both companies and households to have emergency savings, the health care system to have better disaster preparedness, and more systemic planning across the board — including a beefed-up strategic reserve of critical medical supplies, removing the dependency on other countries in a crisis.

Another Deutsche Bank note even suggests that, “European solidarity is being questioned and threatens to turn a socio-economic crisis into a political crisis.”

Mohamed El-Erian, Allianz SE chief economic adviser, popularized the term "the new normal” after the 2008 financial crisis, pointing out that the event may have been significant enough to reshape society rather than simply result in a reversion to pre-recession normal. In 2008, he said the U.S. had exited this post-recession situation as economic growth spiked.

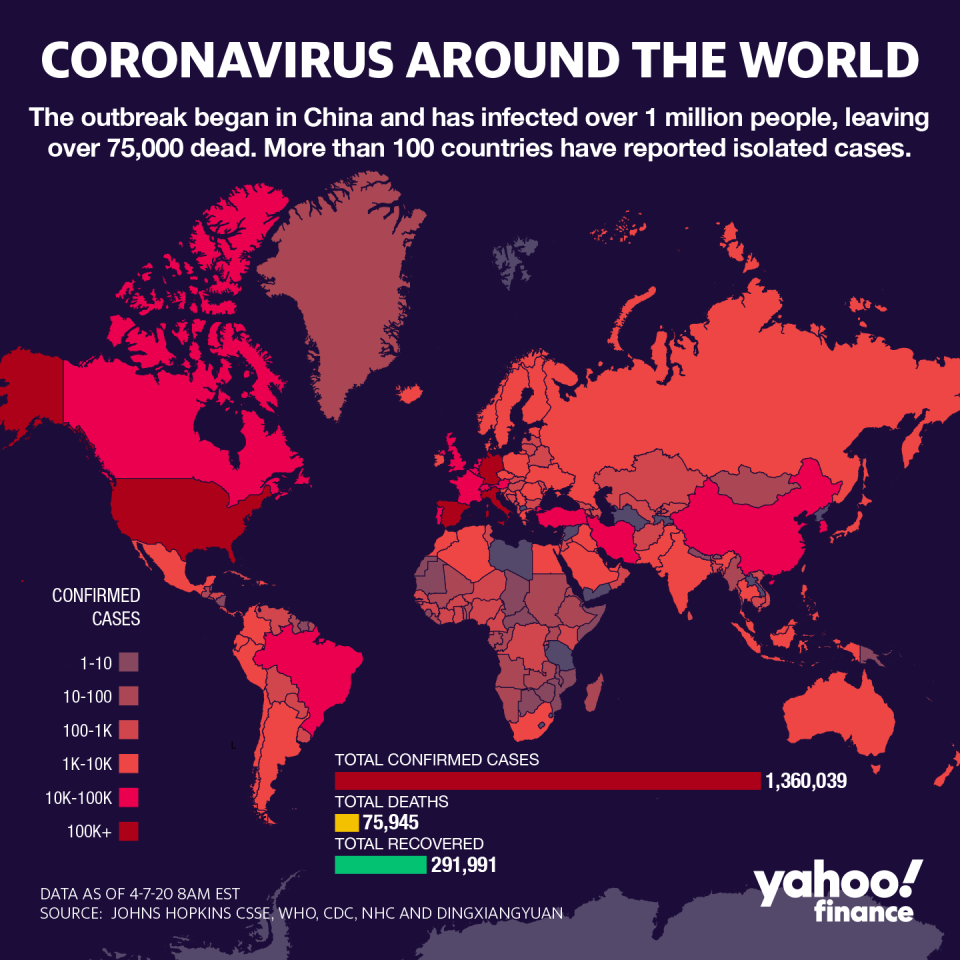

What Sl?k is predicting is a similar re-definition of normal, and the unique nature of the coronavirus pandemic could result in a much more pointed change than 2008. Added to staggering jobless numbers is the stress and fear of a virus that has already killed over 10,000 people in the U.S.

This is a deadly disaster that has reshaped how everyone lives — even rich celebrities and billionaires. There could and will likely be effects far beyond the first and second-order predictions Sl?k puts forth, as isolation changes our behavior. Much of it, however, is hard to predict. When this is over, will people spend more time together, deprived of IRL social contact? Will they flex back to their original form? Or will they stay bent inward?

--

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Coronavirus: Food delivery is 300 times more popular vs. a month ago, according to Yelp data

Coronavirus ‘good scenario’ could see 30% of small businesses failCoronavirus could accelerate US cannabis legalization

Companies face fresh security risks due to people working from home

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube.