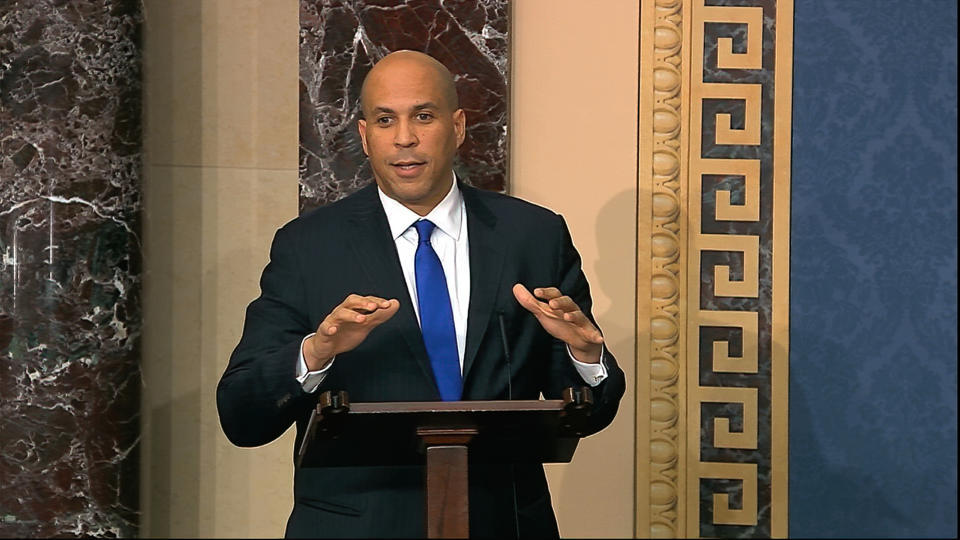

‘Senators shouldn’t own individual stocks’: Senator Cory Booker

Former presidential candidate and New Jersey Senator Cory Booker says that senators shouldn’t be allowed to own individual stocks after news that Senators Richard Burr (R-NC) and Kelly Loeffler (R-GA) sold stock holdings ahead of the COVID-19 market crash. What’s more, it’s alleged both senators made their stock moves after receiving intelligence briefings about the coronavirus outbreak.

“There’s just too much insider information down here,” Senator Booker said on Yahoo Finance’s Final Round. “No senator should own individual stocks. I am fully against that. If you want to be somebody who’s playing in the stock market, don’t run for the United States Senate. Don’t run for Congress.”

“I think we should be limited to indexed funds and more,” he added. “We need to start returning our institutions to really be beyond the appearance even of impropriety. It weakens our democracy, it undermines trust in our institutions and we should just ban a lot of these practices.”

Booker’s position echoes a bill that was introduced last year by Senators Jeff Merkley and Sherrod Brown called the Ban Conflicted Trading Act. That bill — to ban members of Congress and senior congressional staff from trading individual stocks — has received new attention following the week’s scandal.

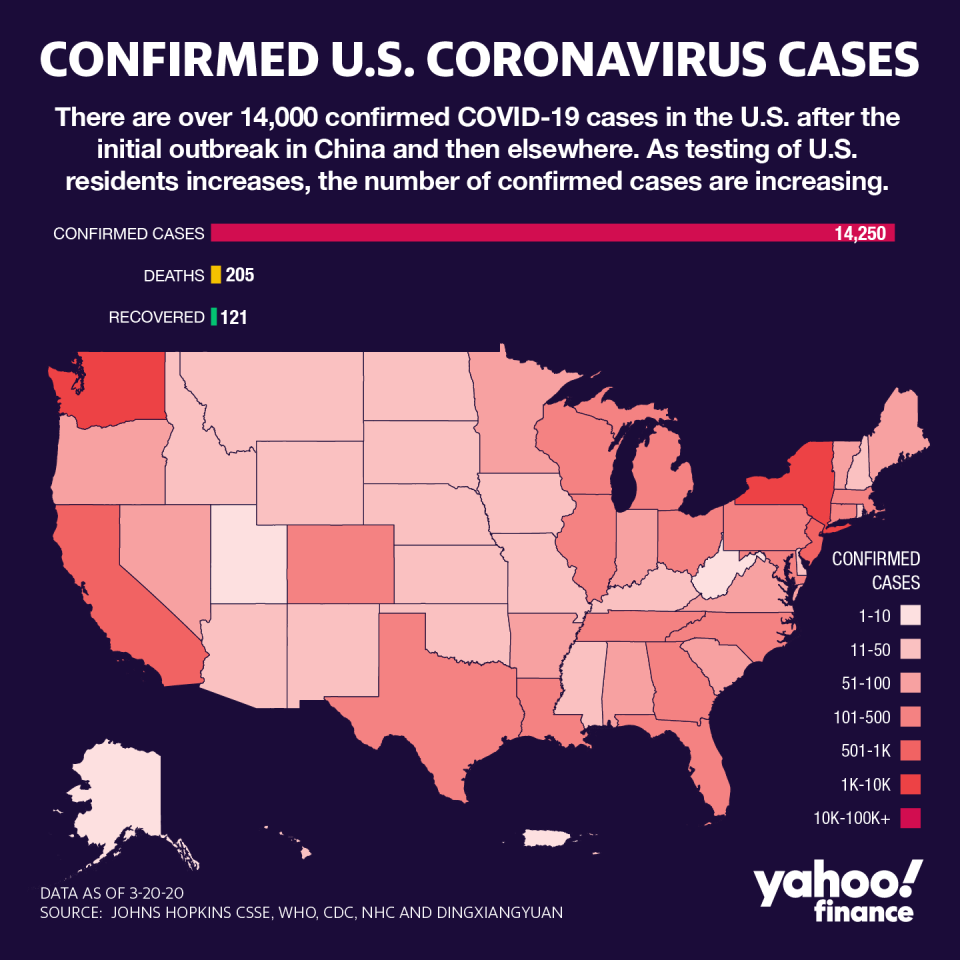

The news has prompted calls for Senators Burr and Loeffler to resign from their positions amid an outbreak that has now grown to more than 15,000 reported cases and over 200 deaths, according to the latest CDC figures.

Preventing stock buybacks

Markets continued to fall as the Trump administration unveiled a number of relief measures to blunt the impact from the virus’ spread. They unveiled a three-month delay to the April 15 tax deadline and a temporary pause on federal student loan payments.

Large companies are also anticipating industry-wide infusions of capitol and American citizens could soon be receiving checks from Washington as part of ‘phase 3’ negotiations on Capitol Hill. The potential legislation will likely overshadow the roughly $700 billion bailout during the 2008 financial crisis.

The President said he would support a provision in the final deal that could prevent companies that received federal aid from stock buybacks.

“It's nice to hear this coming from the President of the United States who really ushered in through his policies one of the largest periods of stock buybacks that I've seen in my adult life,” Booker said.

“This kind of short-termism stock manipulation is not something we want to be feeding right now,” he continued. “What we want to be doing is try to create an overall healthy economy that's going to help the average American.”

After Trump’s Tax Cut and Jobs Act passed in 2017, companies used tax credits to spend a record $1 trillion in buying back stock.

“The airline industry has done over $42 billion of stock buybacks,” he said. “They got big windfalls from Donald Trump's tax plan, as opposed to doing what they said it was going to do which was to spur more economic activity, that would generate more revenue to the government, help their employees, we just didn't see that.”

“Actually, we ended up blowing trillion-dollar annual holes in our federal budget deficit,” Booker continued. “And so the challenge is now, what have we learned from all of that?”

“I'm hoping whatever larger industry efforts that we do as we begin to put the kind of conditions on them that are going to ensure that workers are the ones that really benefit. I have definitive proposals on that.”

Ultimately, Booker says, it’s about helping companies keep their payrolls intact, and “preserving employees.” Any assistance would go “directly to employee benefits and preserving them as well,” he explained.

A three tranche plan

Booker, along with the Senate Democrats, has proposed sending money to Americans that meet certain income criteria, up to $4,500 a person, depending on the health of the economy.

“We are focusing — especially on the Democratic side right now — on getting resources directly towards people,” Booker explained. “From everything from unemployment insurance, direct cash payments, looking at small business supports. It can be everything from having grant money available to low or no interest loans.”

“I’ve been in numerous discussions today with my colleagues trying to put together this large package that's going to be between $1 trillion and $2 trillion.”

In total, an American household of 4 could stand to receive up to $18,000 depending on how well or poorly the economy fares over the remainder of the year. The payments, Booker said, would be divided into three parts: $2,000 at first, then declining to $1,500 before a final payment of $1,000.

“We're working to help the gig economy workers, self-employed workers, small businesses,” he said. “This is a time we're seeing an economic crisis to a proportion we haven't seen in our lifetime. We have to work in a way hopefully where we don't come back here later and do more.”

“It's time to be proactive and structure things into legislation that would be triggered should the economy stay in a dire strait.”

Kristin Myers is a reporter at Yahoo Finance. Follow her on Twitter.

Read more:

Coronavirus hits Democratic communities harder than Republican counterparts

Trump’s coronavirus plan to cost over $800 billion, won’t help the poor: study

Look at Amazon, Visa, and other as markets tumble: strategist

Coronavirus to impact low-wage, black workers the most

Sanders, Biden campaigns cancel Ohio rallies due to coronavirus

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.