Crypto market crash prompts suicide concerns

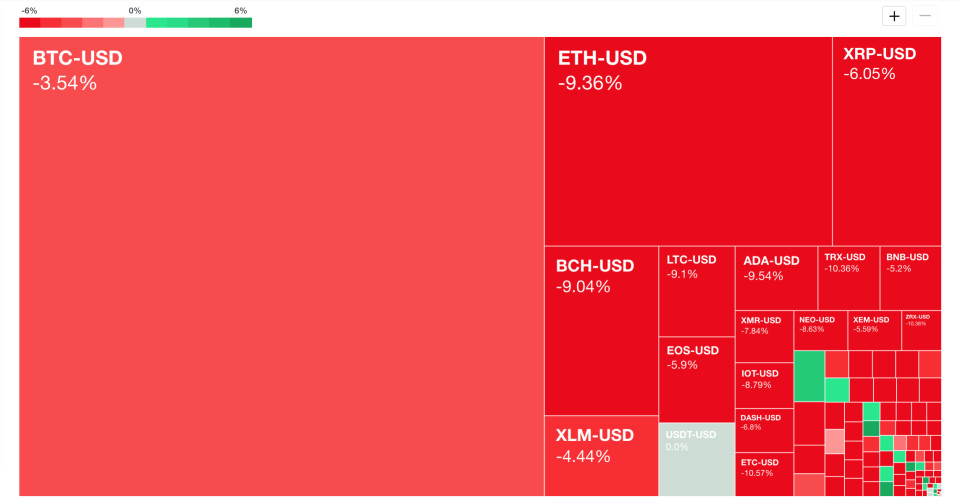

The cryptocurrency market is seeing angry shades of red this week.

On Tuesday, the 20 largest cryptocurrencies by market cap all fell by 4% to 10%, with ether, token of the smart contracts platform Ethereum, taking the biggest hit, down to about $250, its lowest price of 2018. Ether was above $1,200 in January.

By Wednesday morning, coins were rallying slightly. But volume remained low, a possible sign that coins have still not seen the worst of this correction.

The losses have some crypto believers in serious emotional distress. On Tuesday, one of the top posts on the popular bitcoin forum of Reddit was information for suicide prevention hotlines.

This has happened before: In January, Reddit users shared the same kind of posts after bitcoin plummeted from its December 2017 high of above $19,000 down to the $13,000 range, on its way to under $10,000.

Bitcoin is down 57% in 2018 so far, ether is down 67%, bitcoin cash (BCH) is down 80%, stellar lumens (XLM) is down 60%, and ripple (XRP) is down an eye-popping 87%.

The overall coin market has lost more than $600 billion in value in the last 8 months.

So futures expire in one day, alts just capitulated 20%, hodlers are on suicide watch, bitcoin shorts are stacked to the ceiling and someone just sent 100m$ to Bitmex. Interesting.

— CryptoSpaced (@cryptospaced) August 14, 2018

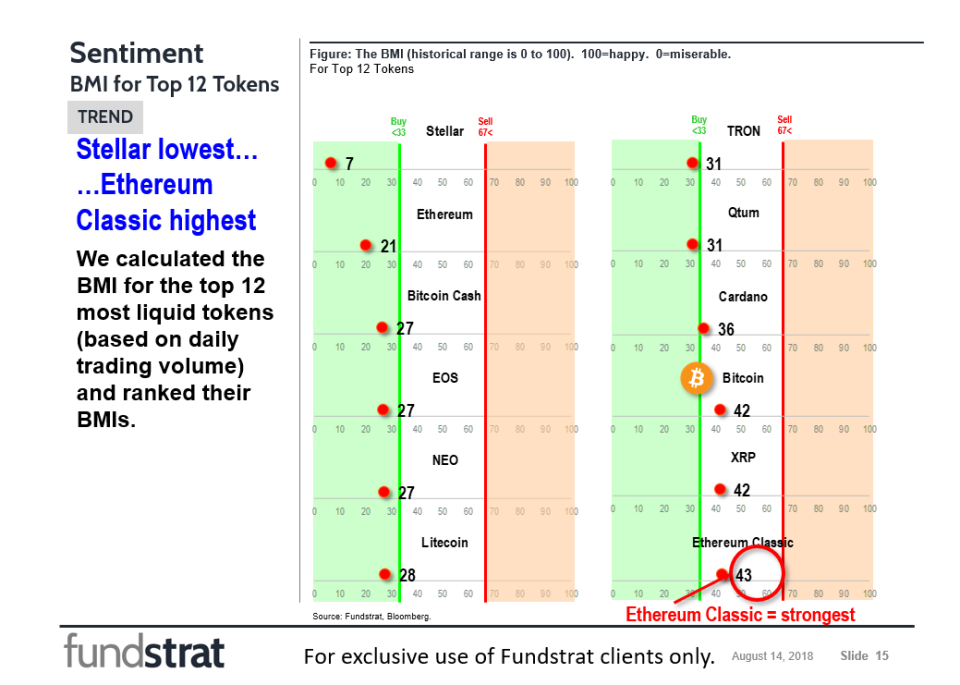

Tom Lee, an analyst with Fundstrat, offers a daily “bitcoin misery index” rating for the biggest cryptocurrencies, on a scale of 0 to 100, with the high end being positive.

On Tuesday, Lee’s index had bitcoin at 42 — bad, but it has been worse — and ether at 21, not much better than its lowest-ever rating on the index of 14 in September 2017. The index had stellar lumens at 7 out of 100.

What’s causing the crypto rout in 2018

The current crash began at the end of July when the SEC rejected a bitcoin ETF (exchange-traded fund) from Cameron and Tyler Winklevoss for the second time. In August, the SEC also delayed its decision on a bitcoin ETF from Van Eck, stoking concerns that regulators might never allow a bitcoin ETF, which is seen as crucial to its mainstream investment success.

In addition, startups that held ICOs (initial coin offerings), in which they create their own token and sell it in exchange for ether, are believed to be selling off that ether now into bitcoin or fiat currency, which explains why ether has taken the biggest hit of all the cryptocurrencies, and why bitcoin has not seen quite the same damage as the rest in the last week.

Add to all of this continued concerns around tether, a “stablecoin” pegged to the value of the U.S. dollar and believed by many to be the driving force behind bitcoin price manipulation.

If you or someone you know is in crisis, the U.S. suicide prevention line is free and open 24 hours per day: call 800-273-8255.

—

Daniel Roberts covers cryptocurrency and blockchain at Yahoo Finance. Follow him on Twitter @readDanwrite.

Read more:

Exclusive: Former FBI director Louis Freeh talks Tether investigation

Crypto scammers on Twitter target @realDonaldTrump

Exclusive: Major League Baseball is going crypto

Beware: An ICO is not like an IPO

Coinlist wants to make investing in ICOs less risky

The 11 biggest names in crypto right now