Did Hedge Funds Drop The Ball On Glaukos Corporation (GKOS)?

World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients' money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It's not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It's also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Glaukos Corporation (NYSE:GKOS) shareholders have witnessed a decrease in support from the world's most elite money managers recently. Our calculations also showed that GKOS isn't among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are assumed to be underperforming, outdated financial tools of the past. While there are more than 8000 funds in operation today, Our researchers hone in on the moguls of this group, approximately 750 funds. It is estimated that this group of investors manage bulk of the hedge fund industry's total capital, and by observing their inimitable equity investments, Insider Monkey has identified a few investment strategies that have historically defeated the market. Insider Monkey's flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let's check out the fresh hedge fund action surrounding Glaukos Corporation (NYSE:GKOS).

Hedge fund activity in Glaukos Corporation (NYSE:GKOS)

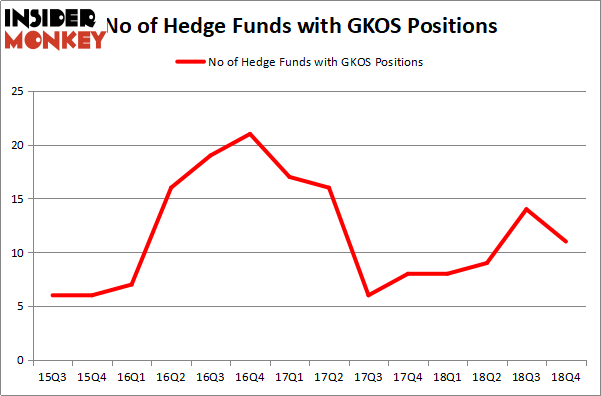

At Q4's end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in GKOS over the last 14 quarters. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Deerfield Management held the most valuable stake in Glaukos Corporation (NYSE:GKOS), which was worth $28.3 million at the end of December. On the second spot was Renaissance Technologies which amassed $8 million worth of shares. Moreover, D E Shaw, Driehaus Capital, and Millennium Management were also bullish on Glaukos Corporation (NYSE:GKOS), allocating a large percentage of their portfolios to this stock.

Seeing as Glaukos Corporation (NYSE:GKOS) has experienced bearish sentiment from hedge fund managers, logic holds that there exists a select few hedge funds who were dropping their entire stakes heading into Q3. It's worth mentioning that Dmitry Balyasny's Balyasny Asset Management sold off the largest position of the 700 funds followed by Insider Monkey, totaling an estimated $13.8 million in stock, and Steve Cohen's Point72 Asset Management was right behind this move, as the fund sold off about $7.8 million worth. These moves are important to note, as total hedge fund interest fell by 3 funds heading into Q3.

Let's now review hedge fund activity in other stocks similar to Glaukos Corporation (NYSE:GKOS). We will take a look at ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD), Globant SA (NYSE:GLOB), Edgewell Personal Care Company (NYSE:EPC), and Mimecast Limited (NASDAQ:MIME). This group of stocks' market caps match GKOS's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position ACAD,20,846012,1 GLOB,15,27446,-2 EPC,18,188341,0 MIME,23,427545,-3 Average,19,372336,-1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $372 million. That figure was $50 million in GKOS's case. Mimecast Limited (NASDAQ:MIME) is the most popular stock in this table. On the other hand Globant SA (NYSE:GLOB) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Glaukos Corporation (NYSE:GKOS) is even less popular than GLOB. Hedge funds clearly dropped the ball on GKOS as the stock delivered strong returns, though hedge funds' consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on GKOS as the stock returned 25.4% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index