Discover 3 Undervalued Small Caps In The United States With Insider Buying

The market has climbed by 4.1% over the past week, with every sector up and the Information Technology sector leading the way. In the last year, the market has climbed 25%, and earnings are forecast to grow by 15% annually. Identifying undervalued small-cap stocks with insider buying can be a strategic approach in such a robust market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Ramaco Resources | 12.0x | 0.9x | 35.99% | ★★★★★★ |

Columbus McKinnon | 20.5x | 0.9x | 43.64% | ★★★★★★ |

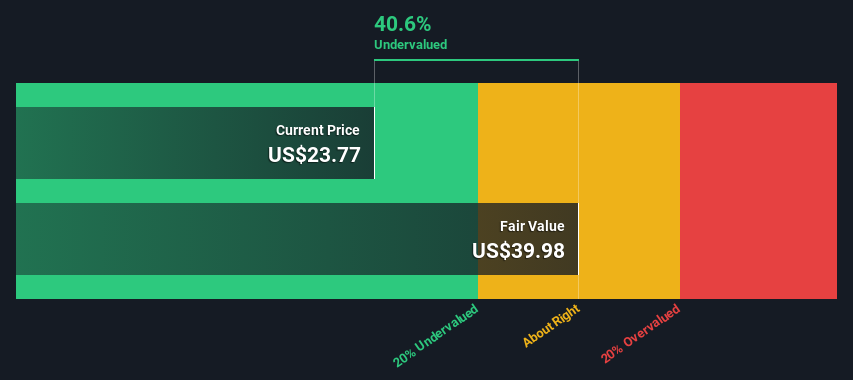

Titan Machinery | 3.4x | 0.1x | 40.66% | ★★★★★☆ |

Chatham Lodging Trust | NA | 1.3x | 32.00% | ★★★★★☆ |

Franklin Financial Services | 9.6x | 1.9x | 39.28% | ★★★★☆☆ |

MYR Group | 34.1x | 0.5x | 42.35% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Leggett & Platt | NA | 0.4x | -1.92% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -62.86% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -106.04% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

AtriCure

Simply Wall St Value Rating: ★★★★★☆

Overview: AtriCure specializes in developing and selling surgical and medical equipment, with a market cap of approximately $2.16 billion.

Operations: AtriCure generates revenue primarily from Surgical & Medical Equipment, with recent figures reaching $429.95 million. The company reported a gross profit margin of 74.84% for the latest period ending June 2024, while net income stood at -$40.12 million, reflecting ongoing challenges in achieving profitability amidst substantial operating expenses and R&D investments.

PE: -29.0x

AtriCure, a small cap in the medical device sector, recently reported Q2 2024 sales of US$116.27 million, up from US$100.92 million a year ago, though net loss widened to US$8.01 million from US$5.12 million. Despite being unprofitable and reliant on external borrowing for funding, insider confidence is evident with significant share purchases over the past year. The company anticipates 2024 revenue between US$456-461 million and has secured regulatory approval in China for its AtriClip device, enhancing its market potential globally.

Click to explore a detailed breakdown of our findings in AtriCure's valuation report.

Evaluate AtriCure's historical performance by accessing our past performance report.

Bloomin' Brands

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bloomin' Brands is a restaurant company operating multiple casual dining brands, with a market cap of approximately $2.16 billion.

Operations: The company generates revenue primarily from its U.S. operations ($3.97 billion) and international segments ($615.57 million). The cost of goods sold (COGS) for the latest period is $3.84 billion, resulting in a gross profit of $748.99 million and a gross profit margin of 16.32%.

PE: 45.4x

Bloomin' Brands, a small-cap stock, recently reported Q2 2024 earnings with revenue of US$1.12 billion and net income of US$28.4 million, down from the previous year. Despite lowered guidance for the full year and a high debt level, insider confidence is evident with significant share purchases over the past six months. The company was added to multiple Russell indexes in July 2024 and declared a quarterly dividend of US$0.24 per share payable in September 2024.

Liberty Latin America

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Liberty Latin America is a telecommunications company that provides broadband, video, telephony, and mobile services across Latin America and the Caribbean with a market cap of approximately $1.92 billion.

Operations: Liberty Latin America generates revenue primarily from its segments in Panama, the Caribbean, Liberty Networks, Costa Rica, and Puerto Rico. The company's gross profit margin has shown variations over time; for instance, it was 77.38% as of December 31, 2023. Operating expenses and non-operating expenses significantly impact net income margins across periods.

PE: -22.2x

Liberty Latin America, a small cap stock, has shown insider confidence with Independent Director Brendan Paddick purchasing 400,000 shares worth US$3.58 million recently. Despite reporting a net loss of US$42.7 million for Q2 2024 compared to a net income of US$35.1 million the previous year, the company forecasts an annual earnings growth of 85%. Additionally, being added to the Russell 2000 Value-Defensive Index highlights its potential for value investors seeking opportunities in smaller companies.

Turning Ideas Into Actions

Unlock our comprehensive list of 67 Undervalued US Small Caps With Insider Buying by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:ATRC NasdaqGS:BLMN and NasdaqGS:LILA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]