Discover August 2024's Top Undervalued Small Caps With Insider Action

As global markets grapple with volatility and mixed economic signals, small-cap stocks have shown resilience despite broader market fluctuations. With the S&P 600 index reflecting these dynamics, investors are keen to identify undervalued opportunities that could offer growth potential amid uncertainty. In this environment, a good stock often exhibits strong fundamentals and insider buying activity, signaling confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Columbus McKinnon | 20.2x | 0.9x | 44.38% | ★★★★★★ |

PCB Bancorp | 10.9x | 2.8x | 43.21% | ★★★★★☆ |

AtriCure | NA | 2.6x | 43.47% | ★★★★★☆ |

Titan Machinery | 3.7x | 0.1x | 35.91% | ★★★★★☆ |

Lindblad Expeditions Holdings | NA | 0.6x | 49.59% | ★★★★★☆ |

Norcros | 7.5x | 0.5x | 2.88% | ★★★★☆☆ |

CVS Group | 22.1x | 1.2x | 41.57% | ★★★★☆☆ |

Hemisphere Energy | 6.8x | 2.5x | 13.53% | ★★★☆☆☆ |

MYR Group | 33.5x | 0.5x | 43.28% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

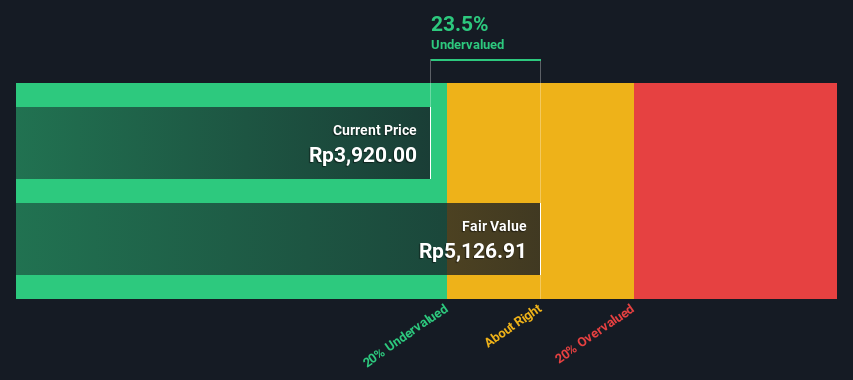

Semen Indonesia (Persero)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Semen Indonesia (Persero) is a leading cement and building materials manufacturer in Indonesia with a market cap of approximately IDR 53.33 billion.

Operations: The company generates revenue primarily from Cement Production (IDR 33.81 billion) and Non-Cement Production (IDR 13.35 billion). Gross profit margin has shown a downward trend, reaching 24.89% as of June 30, 2024.

PE: 15.2x

Semen Indonesia (Persero) presents an intriguing opportunity among undervalued small caps. Despite a 38.91% insider confidence boost from Donny Arsal's recent purchase of 268,000 shares worth IDR 1 billion, the company faces challenges with a slight decline in half-year sales to IDR 16.41 trillion and net income dropping to IDR 501 billion. However, earnings are forecasted to grow at an annual rate of 16.54%, indicating potential for future growth despite current external borrowing risks.

Centerra Gold

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centerra Gold is a mining company focused on gold and copper production with operations in Turkey, the United States, and Canada, boasting a market cap of approximately C$1.87 billion.

Operations: Centerra Gold generates revenue from three main segments: ?ksüt ($603.31 million), Molybdenum ($239.65 million), and Mount Milligan ($429.08 million). The company experienced fluctuations in its net income margin, with recent periods showing negative margins, such as -0.3471% in June 2023 and -0.1896% in September 2023, indicating challenges in profitability despite varying gross profit margins across different periods.

PE: 10.9x

Centerra Gold, a smaller mining company, has seen significant insider confidence with share purchases in the past six months. Despite earnings forecasted to decline by 13.7% annually over the next three years, recent financials show promise: Q2 sales jumped to US$282.31 million from US$184.52 million last year, and net income reached US$37.67 million versus a net loss previously. The company also announced a quarterly dividend of CAD 0.07 per share and provided robust production guidance for 2024.

Dive into the specifics of Centerra Gold here with our thorough valuation report.

Gain insights into Centerra Gold's historical performance by reviewing our past performance report.

MDA Space

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MDA Space is a company specializing in geointelligence, robotics and space operations, and satellite systems with a market cap of CA$1.34 billion.

Operations: MDA Space generates revenue primarily from Geointelligence, Robotics & Space Operations, and Satellite Systems. For the period ending June 30, 2024, the company reported a revenue of CA$860.80 million with a gross profit margin of 32.41%. Operating expenses include significant allocations to R&D and General & Administrative expenses.

PE: 37.7x

MDA Space recently reported strong Q2 2024 earnings, with sales jumping to C$242 million from C$196 million a year ago and net income rising to C$11 million. The company raised its full-year revenue guidance for 2024 to between $1.02 billion and $1.06 billion, indicating significant growth potential. Notably, insider confidence is evident as Independent Chairman Brendan Paddick purchased 85,000 shares valued at over C$1 million in the past year, reflecting a substantial belief in the company's future prospects.

Summing It All Up

Investigate our full lineup of 201 Undervalued Small Caps With Insider Buying right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include IDX:SMGR TSX:CG and TSX:MDA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]