Discover Bayerische Motoren Werke And 2 Other German Dividend Stocks

As the German economy faces a forecasted contraction for 2024, investors are closely monitoring dividend stocks as potential sources of steady income amidst market uncertainties. In this environment, identifying robust companies with strong dividend histories can offer a measure of stability and potential returns, making them an attractive option for those navigating the current economic landscape.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.70% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.92% | ★★★★★★ |

SAF-Holland (XTRA:SFQ) | 5.68% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.66% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.52% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.25% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.17% | ★★★★★☆ |

Allianz (XTRA:ALV) | 4.64% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

MVV Energie (XTRA:MVV1) | 3.69% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top German Dividend Stocks screener.

We'll examine a selection from our screener results.

Bayerische Motoren Werke

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles, motorcycles, and related spare parts and accessories globally with a market cap of €47.35 billion.

Operations: Bayerische Motoren Werke's revenue is primarily derived from its Automotive segment, generating €132.39 billion, followed by Financial Services at €37.87 billion and Motorcycles at €3.15 billion.

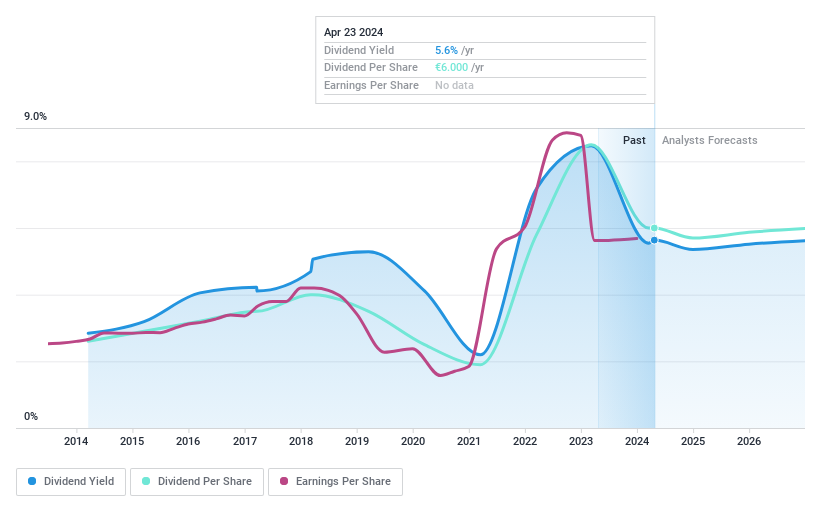

Dividend Yield: 7.9%

BMW's dividend yield of 7.92% ranks in the top 25% among German stocks, yet its sustainability is questioned due to a high cash payout ratio of over 5000%, indicating dividends are not well covered by cash flows. Despite trading at a significant discount to estimated fair value, BMW's dividend history has been volatile and unreliable over the past decade. Recent delisting from OTC Equity may impact international investor access but doesn't directly affect dividend policy.

Click to explore a detailed breakdown of our findings in Bayerische Motoren Werke's dividend report.

MLP

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €677.65 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue through various segments including Financial Consulting (€429.61 million), FERI (€231.23 million), Banking (€206.97 million), DOMCURA (€129.26 million), Deutschland.Immobilien (€51.61 million), and Industrial Broker (€36.51 million).

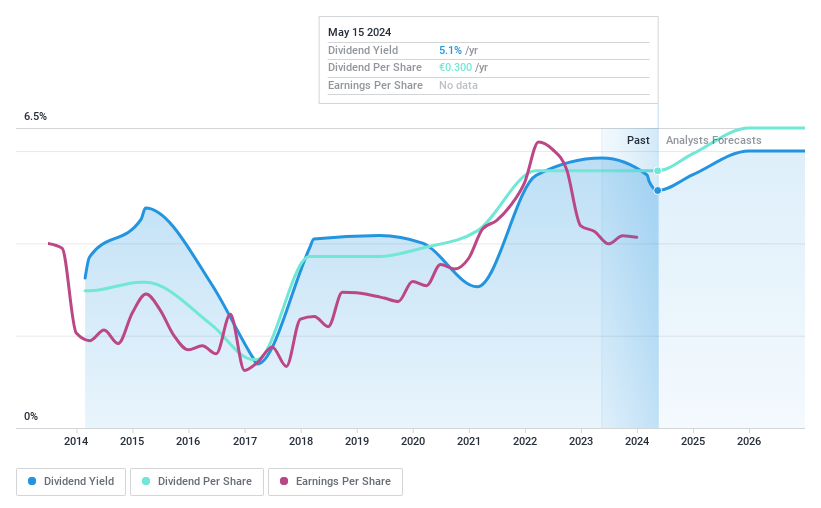

Dividend Yield: 4.8%

MLP's dividend yield of 4.84% places it in the top 25% of German dividend payers, supported by a sustainable payout ratio of 54.2% and a low cash payout ratio of 11.1%, indicating strong coverage by earnings and cash flows. Despite its dividends being unreliable over the past decade due to volatility, recent performance improvements and raised earnings guidance for 2024 suggest potential stability ahead, with EBIT now expected between €85 million to €95 million.

Delve into the full analysis dividend report here for a deeper understanding of MLP.

The valuation report we've compiled suggests that MLP's current price could be quite moderate.

PharmaSGP Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PharmaSGP Holding SE manufactures and sells over-the-counter drugs and other healthcare products in Germany with a market cap of €282.97 million.

Operations: PharmaSGP Holding SE generates revenue primarily from its Pharmaceuticals segment, which amounted to €109.76 million.

Dividend Yield: 5.8%

PharmaSGP Holding's dividend yield of 5.76% ranks it among the top 25% of German dividend payers, though its track record is short with only two years of payments. The company's dividends are covered by earnings and cash flows, with payout ratios at 89.6% and 77.8%, respectively. Despite high debt levels, recent earnings reports show growth, with net income rising to €8.68 million for H1 2024 from €6.86 million the previous year.

Where To Now?

Get an in-depth perspective on all 34 Top German Dividend Stocks by using our screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BMW XTRA:MLP and XTRA:PSG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]