Discover July 2024's Top Undervalued Small Caps In United Kingdom With Insider Buying

Over the last 7 days, the United Kingdom market has risen 1.1%, driven by gains of 2.7%. In the last year, the market has climbed 5.9%, with earnings forecast to grow by 13% annually. In this context, identifying undervalued small-cap stocks with insider buying can present promising opportunities for investors looking to capitalize on growth potential within a rising market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Tracsis | 39.8x | 2.3x | 39.49% | ★★★★★★ |

Bytes Technology Group | 25.0x | 5.7x | 0.77% | ★★★★★☆ |

GB Group | NA | 3.1x | 24.05% | ★★★★★☆ |

THG | NA | 0.4x | 42.18% | ★★★★★☆ |

Harworth Group | 14.2x | 7.4x | -595.07% | ★★★★☆☆ |

Breedon Group | 15.2x | 1.0x | 37.14% | ★★★★☆☆ |

CVS Group | 22.2x | 1.2x | 39.27% | ★★★★☆☆ |

Hochschild Mining | NA | 1.7x | 40.47% | ★★★★☆☆ |

Norcros | 7.8x | 0.5x | -12.45% | ★★★☆☆☆ |

H&T Group | 8.0x | 0.8x | -12.72% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Aston Martin Lagonda Global Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings is a luxury automotive manufacturer known for its high-performance sports cars and grand tourers, with a market cap of approximately £1.30 billion.

Operations: Aston Martin Lagonda Global Holdings generates revenue primarily from its automotive segment. The company's gross profit margin has shown variability, with a recent figure of 40.80%. Operating expenses, including sales and marketing as well as general and administrative costs, significantly impact the net income, which was -£293.3 million for the latest period ending June 30, 2024.

PE: -4.5x

Aston Martin Lagonda Global Holdings, a UK-based company, has experienced significant insider confidence with recent share purchases. Despite reporting sales of £603 million for H1 2024, down from £677.4 million a year ago, and a net loss of £207.8 million compared to £142.6 million previously, the company is forecasting medium-term revenue targets of £2.5 billion by FY 2027-28. The appointment of Adrian Hallmark as CEO starting September 2024 could bring strategic changes to improve financial performance and leverage growth opportunities in the luxury auto market.

Breedon Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: Breedon Group is a leading construction materials company with operations in cement, aggregates, asphalt, and concrete across Great Britain and Ireland, boasting a market cap of approximately £1.30 billion.

Operations: Breedon Group's revenue primarily comes from its operations in Great Britain (£1006.60 million), Ireland (£237.60 million), and Cement (£311.30 million). The company's cost of goods sold (COGS) was £952.50 million for the period ending September 30, 2023, resulting in a gross profit of £525.20 million and a gross profit margin of 35.54%.

PE: 15.2x

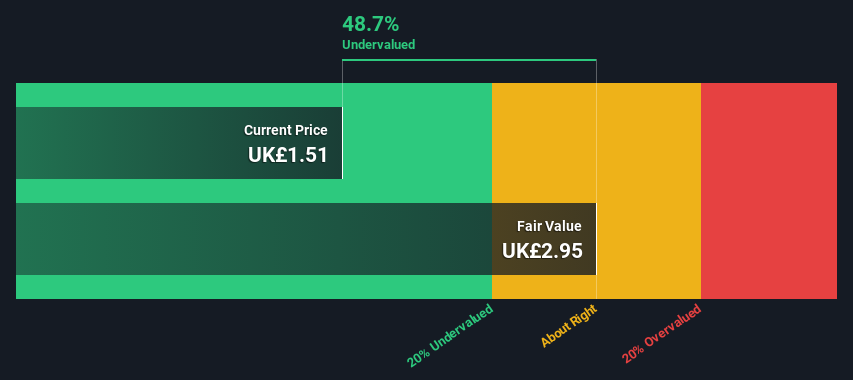

Breedon Group, a UK-based construction materials company, reported half-year sales of £764.6 million, up from £742.7 million last year, though net income dropped to £34.1 million from £43.9 million. The company's basic earnings per share fell to £0.10 from £0.13 year-over-year as of June 30, 2024. Despite relying solely on external borrowing for funding, Breedon's earnings are projected to grow by 14% annually and recent insider confidence is evident with significant share purchases over the past six months.

Dive into the specifics of Breedon Group here with our thorough valuation report.

Evaluate Breedon Group's historical performance by accessing our past performance report.

Card Factory

Simply Wall St Value Rating: ★★★★★☆

Overview: Card Factory operates a chain of retail stores and online platforms specializing in greeting cards, gifts, and party supplies with a market cap of approximately £0.27 billion.

Operations: Card Factory's primary revenue streams include Cardfactory Stores, Cardfactory Online, Getting Personal, and Partnerships. The company has seen fluctuations in its net profit margin over the years, with a recent figure of 10.17% as of October 2023.

PE: 8.5x

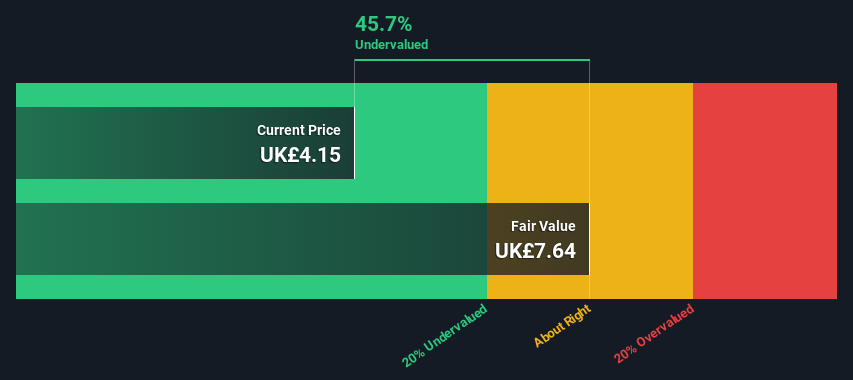

Card Factory, a prominent player in the UK's greeting card and gift market, has shown significant insider confidence with CEO Darcy Willson-Rymer purchasing 92,371 shares valued at £89,554. This move increased their stake by 34.76%. Recent board changes include Pamela Powell's appointment as Senior Non-Executive Director and Nathan Lane stepping down. The company reported a 10.3% rise in sales to £510.9 million for fiscal year 2024 and projected ambitious growth targets for fiscal year 2027 with plans to reach £650 million in sales and open 90 new stores.

Delve into the full analysis valuation report here for a deeper understanding of Card Factory.

Explore historical data to track Card Factory's performance over time in our Past section.

Taking Advantage

Take a closer look at our Undervalued UK Small Caps With Insider Buying list of 26 companies by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:AML LSE:BREE and LSE:CARD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]