Discovering Hidden Gems in Germany This October 2024

As October 2024 unfolds, the German market is experiencing a cautious sentiment amid escalating Middle East tensions and a recent dip in the DAX index by 1.81%, reflecting broader European market trends. Despite these challenges, potential opportunities lie within Germany's small-cap sector, where investors often seek companies with strong fundamentals and innovative capabilities that can thrive even in uncertain economic climates.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

Mineralbrunnen überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

Westag | NA | -1.56% | -21.68% | ★★★★★★ |

Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Südwestdeutsche Salzwerke

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, along with its subsidiaries, is engaged in the mining, production, and sale of salt across Germany, the European Union, and international markets with a market capitalization of €746.03 million.

Operations: Südwestdeutsche Salzwerke generates revenue primarily from its salt segment, amounting to €283.67 million, supplemented by waste management services contributing €62.46 million. The company has a net profit margin of 7%, reflecting its profitability after accounting for all expenses and taxes.

Südwestdeutsche Salzwerke AG, with its impressive earnings growth of 4290.9% over the past year, stands out in the industry. The company reported half-year sales of €163.06 million and net income of €15.4 million, doubling from last year's €7.96 million. Basic earnings per share rose to €1.47 from €0.76 previously, reflecting robust performance despite a volatile share price recently observed over three months. Trading at 87.8% below estimated fair value suggests potential undervaluation for investors seeking opportunities in this sector.

KSB SE KGaA

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, along with its subsidiaries, is engaged in the global manufacturing and supply of pumps, valves, and related services with a market capitalization of approximately €1.10 billion.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv services (€978.20 million).

KSB SE KGaA, a notable player in the machinery sector, has shown robust performance with earnings growing 16.8% over the past year, outpacing the industry average of -4%. Despite a significant one-off loss of €102.5M impacting recent results, KSB's debt-to-equity ratio impressively decreased from 9.2% to 0.8% over five years. Trading at 77.5% below estimated fair value and boasting positive free cash flow (€187.84M), it presents an intriguing opportunity for investors seeking undervalued stocks in Germany's market landscape.

MLP

Simply Wall St Value Rating: ★★★★★★

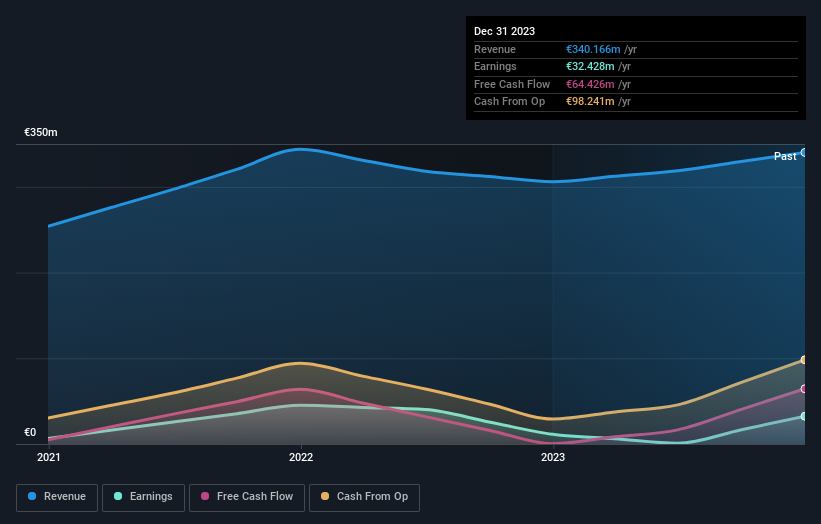

Overview: MLP SE, along with its subsidiaries, offers financial services to private, corporate, and institutional clients in Germany and has a market capitalization of approximately €654.69 million.

Operations: MLP SE generates revenue primarily from its Financial Consulting segment, contributing €429.61 million, followed by FERI at €231.23 million and Banking at €206.97 million. The DOMCURA segment adds €129.26 million to the revenue stream, while Deutschland.Immobilien contributes €51.61 million and Industrial Broker accounts for €36.51 million.

MLP, a nimble player in Germany's financial sector, has showcased impressive earnings growth of 28.4% over the past year, outpacing the industry average of 19%. The firm is debt-free and trades at a value estimated to be 43.3% below its fair market price. Recent earnings reports highlight a net income increase to €10.31 million from €2.39 million year-over-year for Q2, reflecting high-quality earnings and strong operational performance within its industry context.

Navigate through the intricacies of MLP with our comprehensive health report here.

Review our historical performance report to gain insights into MLP's's past performance.

Key Takeaways

Click here to access our complete index of 57 German Undiscovered Gems With Strong Fundamentals.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:SSH XTRA:KSB and XTRA:MLP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]