Gundlach: Gold should keep rising if negative-yielding debt keeps growing

Prominent bond investor Jeffrey Gundlach, the CEO of $140 billion DoubleLine Capital, nailed his bullish gold call from September 2018, and now he sees further upside for the yellow metal as the supply of negative-yielding bonds balloons.

"At this point, I think the way to think about it is, as long as the volume of negative interest rate bonds outstanding increases, it’s quite likely that gold moves higher in a similar vein," Gundlach told Yahoo Finance in an interview on Tuesday evening.

When looking at the markets broadly, Gundlach's view is that the global stock market hit its peak on January 26, 2018. And while certain indices did breach record levels again, not all of them did.

"The New York Stock Exchange Composite (^NYA) never did. The Transportation Average (^DJT) never did,” he said. “But then, one by one, the global stock markets started to slide during the middle of 2018. And finally, on October 3rd, basically, every index in the United States hit a peak or had previously hit a peak and then moved down very sharply into December 26th of last year, and I talked about that as being the start of a bear market.”

He also noted that economic data globally also peaked out in January 2018 amid that narrative of synchronized global expansion.

"We've never really seen economic data that strong since,” he said. “It’s held up better in the United States to October/November, but we have much worse economic data pretty much across the board."

Subsequently, central banks have responded with what Gundlach calls "increasingly negative interest rate manipulation."

As the amount of negative-yielding debt increase, gold prices will go up

"We are now, I think it's today or yesterday over $15 trillion of global debt is at a negative yield. And the US bond market is being dragged to lower yields by a combination of the race to ever more negative yields in parts of the developed world, and by weak economic data," Gundlach said.

With that backdrop, there's been a direct correlation between the volume of negative-yielding bonds in the world and the dollar price of gold that's moved up very much in sync, with very little divergence along the way.

As negative-yielding bonds moved from $10 trillion to $15 trillion in April and May, gold has moved up close to 20%. Gold futures (GC=F) settled at $1,473.40 on Tuesday. It was last seen around $1,517 on Wednesday.

"It makes all the sense in the world,” he said. “It's one thing when bonds yield negative a basis point. That's painful. This amount of pain isn’t really excruciating.”

“But now that you’re getting into some more significant negative yields, it’s not surprising that people might want to buy things that have a higher yield than bonds,” he added. “With the yield of 0, gold has a higher yield than bonds. And if you store the gold, you now have a lower cost of carry on gold than you have on 10-year bunds.”

Gundlach turned positive on gold last summer. In June 2018, he said that if gold checked the $1,200 level he would be a buyer. Gold bottomed on August 16 at around $1,174. Then, on a September 11, 2018 webcast, he called gold a "really good buy" at the $1,200 level. This June, he reiterated his long gold position on another webcast, noting that he thought it would "break out to the upside."

"[If] this pace of negative-yielding bonds continues with this kind of linear track, then gold should go another 20% higher, if that happens. So, the initial target for gold was $1,400. We finally took that out. Now, I think the target is probably something in the $1,600 to $1,700 category. As long as the trends that are behind all this continue," Gundlach told Yahoo Finance.

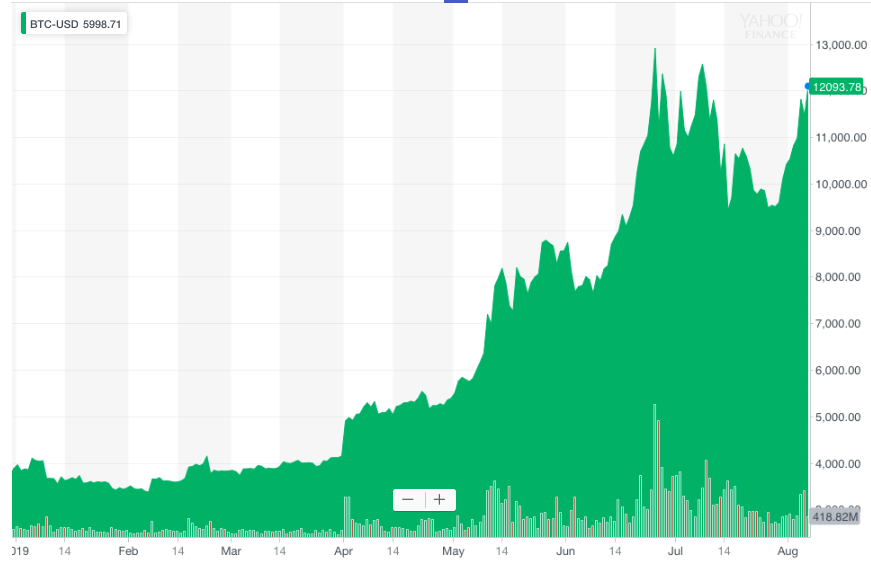

Gundlach noted that Bitcoin (BTC-USD) has also gained, "probably for some of the same reasons."

In his January "Just Markets" webcast, he made bullish comments on the cryptocurrency, noting that it could "easily make it to $5,000." While he didn't recommend betting "your savings," he said that it could be an easy way to make 25%. In just a few months, he was proven right.

Bitcoin was last trading around $11,747, but Gundlach emphasized the cryptocurrency is "highly speculative."

"Gold is something which is much more for the conservative crowd," he said.

The present levels for gold haven't been seen since around May 2013. Gold hasn't touched the $1,600 level since February/March of 2013. The precious metal took a big spill that year.

"Now, we basically have the conditions to head back to those levels, I think," he said.

What's more, the demand from gold isn't coming from the U.S., yet.

"Americans aren't really buying gold at all. It's mostly foreign demand. Most of the gold dealers in the United States say that business is very slow. The orders aren't there yet. And, you know, the public doesn't get involved in the United States with these types of things until the move is largely over," he said.

He explained that in 2011 people would ask him about gold because inside a three year period it had moved from $700 to $1,900.

"Suddenly everybody wants it because they see it's a big momentum ride," he said. "That could happen here if the public gets involved, particularly if U.S. interest rates are manipulated down."

-

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit. Read the latest financial and business news from Yahoo Finance