Doubt about a Nobel prize winner’s valuation ratio: Morning Brief

Monday, November 18, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Beware of the CAPE

It’s been an extraordinary year for the stock market, with prices exploding to new record highs even as earnings growth has been next-to-non-existent. That dynamic would suggest valuations should be rising as well.

However, one notable measure of stock market value has barely budged: the cyclically-adjused price-earnings (CAPE) ratio.

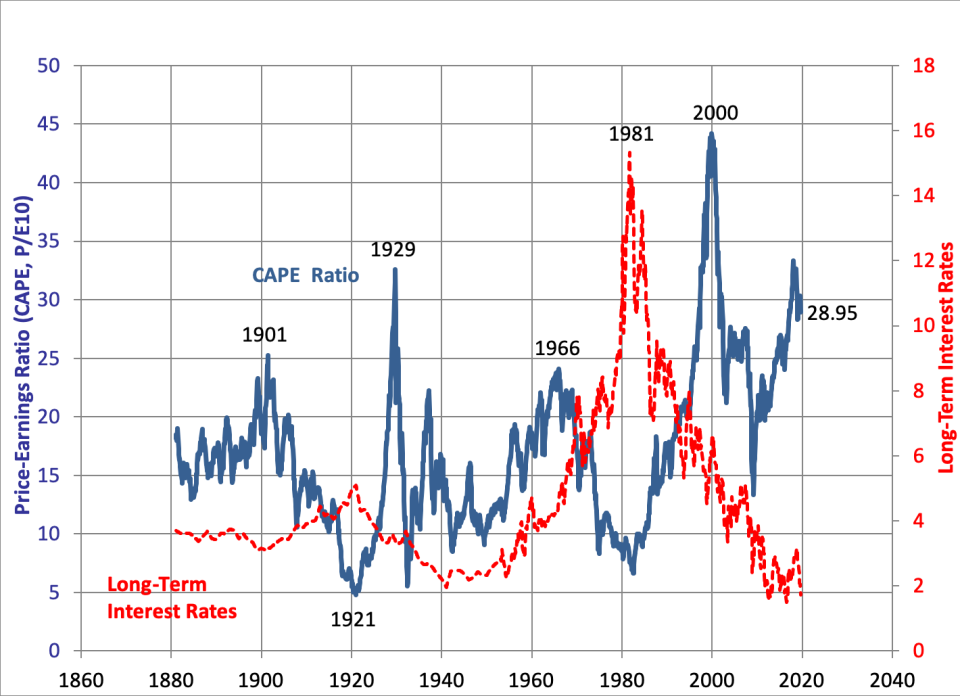

The CAPE ratio was made popular by Nobel prize-winning economist Robert Shiller. CAPE is calculated by taking the price of the S&P 500 (^GSPC) and dividing it by the average of 10 years worth of earnings. When CAPE is above its long-term average, the stock market is thought to be expensive and is likely to offer low returns on average for years to come. Many credit Shiller and CAPE for predicting the burst of the dot-com bubble.

According to Shiller’s data, the CAPE ratio is sitting at about 28.9, the lowest level since January (albeit considerably higher than its long-term average).

What gives?

“The explanation is to be found in the denominator of the CAPE, which is the average level of 12m trailing reported EPS over the prior decade, adjusted for inflation,” Capital Economics’ John Higgins wrote on Friday. “The surprisingly-small increase in the ratio this year reflects the fact that the denominator is no longer being dragged down by a collapse in EPS that occurred after the Global Financial Crisis.”

Like all recessions, the financial crisis came with a drop in earnings. Unlike most recessions, the crisis was highlighted by a collapse in the housing market, which forced financial institutions to write down billions of dollars on housing-exposed instruments like mortgage-backed securities. Those memories are starting to fade as CAPE no longer captures the darkest days of the crisis.

“12m trailing reported EPS fell from a (nominal) pre-GFC level of more than $80 in 2007 to less than $7 in the spring of 2009, when the deepest recession since the Great Depression came to an end,” Higgins noted. “Less than two years later, EPS had recovered to more than $80. Yet their prior plunge continued to drag the denominator of the CAPE down until this year.”

Sure you can put an asterisk next to CAPE because of that period of deflated earnings. But then again, the whole point of using a 10-year average of earnings is to smooth out short-term noise you often see in the numbers.

Regardless, what matters is that we’re having this conversation about putting CAPE, or any other valuation measure, into some greater context. After all, it isn’t exactly rigorous analysis to take as gospel what happens when you take one variable and divide it by a second variable.

Higgins, however, does argue that valuation metrics like CAPE are justifiably higher when you consider another variable: the incredibly low rates we’ve had for years.

“In our view, the normal level of the CAPE has risen in response to a secular decline in real interest rates, and probably isn’t a long way beneath its level today,” he wrote.

Warren Buffett echoed this at Berkshire Hathaway’s annual shareholders meeting in 2017. In response to a questions specifically about CAPE, Buffett responded: “Every number has some degree of meaning... It’s just not quite as simple as having one or two formulas and then saying the market is undervalued or overvalued... The most important thing is future interest rates.”

For his part, even Shiller warns against making too much of the metric he made popular.

“CAPE is useful, but it does not provide a clear guide to the future,” he wrote in the New York Times.

"Things can go for 200 years and then change," he warned in another interview in 2012. "I even worry about the [CAPE] — even that relationship could break down."

So, maybe CAPE tells us something. Maybe it doesn’t.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

10 a.m. ET: NAHB Housing Market Index, November (71 expected, 71 in October);

2 p.m. ET: Net Long-term TIC Flows, September (-$41.1 billion prior); Total Net TIC Flows, September ($70.5 billion prior)

Top News

HP rejects takeover bid from Xerox [AFP]

Oil giant Saudi Aramco seeks $1.7 trillion valuation in IPO [Yahoo Finance UK]

China trims market borrowing costs as economic outlook dims [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Amazon and Apple have different but effective work cultures, venture capitalist says

Federal Reserve officials reveal 50/50 split over October rate cut

Starbucks’ open bathroom policy may be hurting foot traffic, new study finds

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.