Dunelm Group And 2 Other UK Dividend Stocks To Consider

Recent reports indicate a downturn in the FTSE 100, influenced by disappointing trade data from China and its broader economic struggles. Amidst these challenging global market conditions, investors might consider the stability offered by dividend-paying stocks. In times of market uncertainty, dividend stocks can be appealing for their potential to provide regular income and relative resilience.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 5.85% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.70% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.83% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.03% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.81% | ★★★★★☆ |

DCC (LSE:DCC) | 3.65% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.60% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.59% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.52% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.10% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

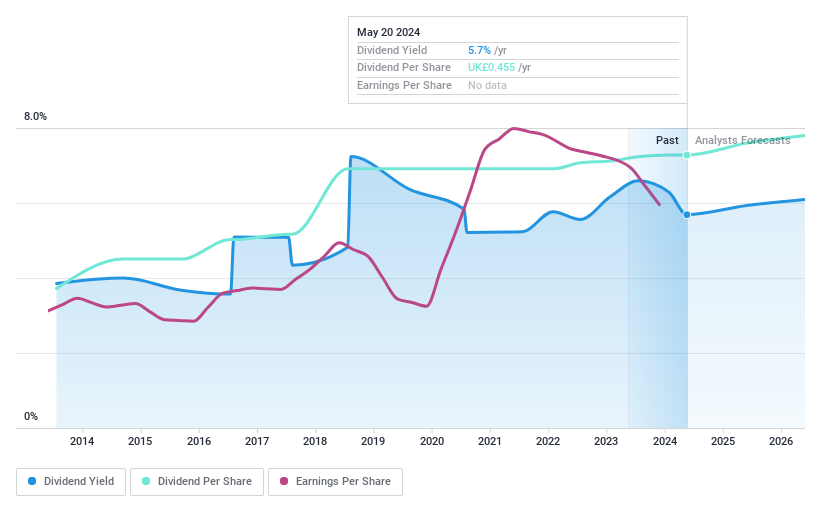

Dunelm Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc operates as a retailer of homewares across the United Kingdom, with a market capitalization of approximately £2.47 billion.

Operations: Dunelm Group plc generates its revenue primarily from the retail of homewares, totaling £1.68 billion.

Dividend Yield: 6.4%

Dunelm Group's dividend yield at 6.39% ranks in the top 25% of UK payers, supported by a solid earnings payout ratio of 58.1% and cash payout ratio of 74.8%, indicating dividends are well-covered by both earnings and cash flow. Despite this, the dividend track record is unstable with significant volatility over the past decade, including annual drops over 20%. Recent sales results showed a robust year with £1.71 billion in total sales, yet board changes raise questions about future governance stability.

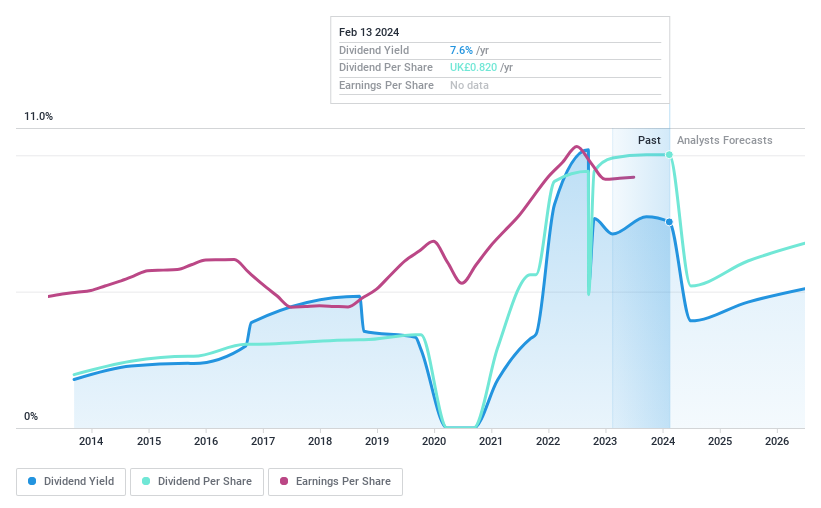

Drax Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc operates in the renewable power generation sector in the United Kingdom, with a market capitalization of approximately £2.20 billion.

Operations: Drax Group plc generates revenue primarily through three segments: Customers (£4.96 billion), Generation (£6.79 billion), and Pellet Production (£0.82 billion).

Dividend Yield: 4.1%

Drax Group's dividends, with a yield of 4.07%, are lower than the top UK dividend payers. Despite a substantial earnings increase last year, future projections suggest a decline in earnings by 15.3% annually over the next three years. The company maintains a low payout ratio at 16.2%, ensuring dividends are well-covered by earnings and cash flows (22.7%). However, Drax has experienced volatility and unreliability in its dividend payments over the past decade, alongside high debt levels and trading significantly below its estimated fair value at 65.1%. Recent board changes introduce new expertise but also highlight potential governance shifts.

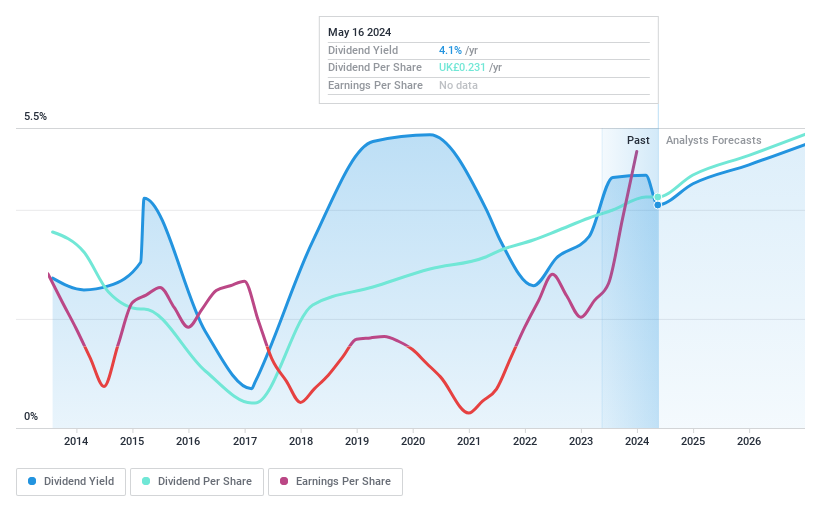

IG Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IG Group Holdings plc is a fintech company that operates globally in the online trading industry, with a market capitalization of approximately £3.18 billion.

Operations: IG Group Holdings generates its revenue primarily through its brokerage segment, which brought in £954.70 million.

Dividend Yield: 5.3%

IG Group Holdings offers a dividend yield of £5.28%, slightly below the top quartile in the UK market. While dividends have shown stability and growth over the past decade, they are not well-supported by earnings or cash flows, with a high cash payout ratio of 151.9%. The stock is trading at 55.2% below estimated fair value, suggesting potential undervaluation. Recent board appointment of Marieke Flament could bring fresh strategic insights to enhance company governance and innovation strategies.

Turning Ideas Into Actions

Unlock our comprehensive list of 55 Top UK Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:DNLM LSE:DRX and LSE:IGG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]