The extreme impacts from the lockdown economy: Morning Brief

Monday, June 1, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

Employment down, savings up, and an uncertain summer for the U.S. economy

June is here.

And as summer has arrives across the country, so too does something resembling a resumption of economic activity.

We’ve noted recently that economic data has stopped getting worse, building the case that the most severe impacts of the lockdown-related economic stoppage are behind us.

But this still leaves the economy a long way from healed.

As Bank of America outlined in a note last month, the current recovery is likely to play out in three phases: lockdown, transition, recovery. We are now in the transition phase. But what this phase might look like continues to be informed by some of the jarring data coming out of the economy’s March-April lockdown phase.

What we know is that tens of millions of workers have lost jobs. Last Thursday, initial jobless claims data brought total filings for unemployment insurance since this crisis began to north of 40 million.

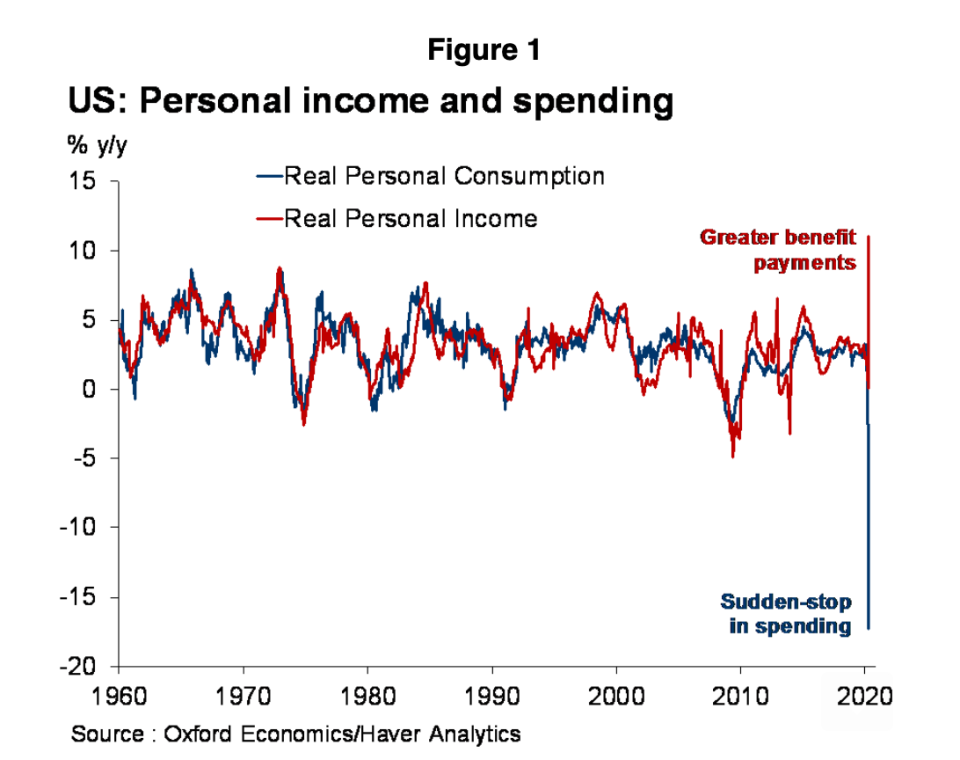

And on Friday, the April data on personal income, outlays, and savings served as another stunning entry in the history books. In response to mass unemployment, we know that consumers saved at a record rate, cut spending at a record rate, and saw incomes rise due to enhanced unemployment benefits passed through the CARES Act.

Taken together, this data really tells the simplest story of what happened in the U.S. economy during the most severe stage of this crisis — millions of people lost jobs and saved every penny they could as a result. How we go forward from here will be informed by fiscal policy, the spread of the virus, and how many workers are re-employed quickly.

“Consumer spending fell off a cliff in April, collapsing by 13.6% [month-over-month] while the annual momentum plunged to its weakest pace on record,” Lydia Boussour, senior U.S. economist at Oxford Economics, said in a note to clients. “Meanwhile greater benefit payments temporarily lifted income momentum to its strongest pace on record.”

Boussour added that, “Amid extreme uncertainty, the savings rate spiked from 12.7% to 33.0% — the highest rate ever. This underscores how the global coronavirus recession is leading to more frugal consumer behavior which will dampen the recovery. This is particularly true as the boost from social benefits will gradually erode over time leaving households more financially constrained.”

And so it seems that Congress was able to keep U.S. consumers afloat while shelter-at-home policies and fears about the future kept most of those excess dollars coming into consumer stashed away. Savings during this initial phase of the pandemic and the recession could, it seems, help boost the economy into the second half of the year.

Michael Gapen at Barclays said in a note published Friday that, “under the assumption households have not spent the entirety of safety net payments already, the potential good news in the report on April personal income is that households have, on net, likely accumulated sizeable cash savings that could be spent in upcoming quarters should the U.S. economy successfully emerge from economic lockdowns.”

April’s personal income and spending data, then, serves as evidence of the consumer holding what amounts to economic dry powder as we emerge from shelter-at-home policies.

How quickly the labor market heals, however, is likely to be more important in shaping how eager consumers are to resume consumption in the months ahead.

This coming Friday, the May jobs report is expected to show the unemployment rate rose to 19.6% last month with another 8 million Americans losing their jobs, according to estimates from Bloomberg. In the view of some economists, the stubbornly high level of initial jobless claims shows that businesses which initially closed on a temporary basis early in this crisis are now closing permanently.

The more time that passes without answers for businesses and consumers, the more these temporary disruptions become permanent. Which is the whole story of the “transition” economy and the summer of 2020 — how many temporary changes can be prevented from becoming permanent.

The fewer the better. And the clock is ticking.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

9:45 a.m. ET: Markit US Manufacturing PMI, May final (39.8 prior)

10 a.m. ET: Construction Spending month-on-month, April (-7.0% expected, +0.9% in March)

10 a.m. ET: ISM Manufacturing, May (43.5 expected, 41.5 in April)

10 a.m. ET: ISM Prices Paid, May (40.0 expected, 35.3 in April)

Top News

George Floyd protests, looting lead Target to temporarily close and adjust hours at 200 stores [Yahoo Finance]

Walmart stores suffer damage from George Floyd protests and looting — several hundred forced to close early [Yahoo Finance]

UK manufacturing 'mired in its deepest downturn in recent memory' [Yahoo Finance UK]

World's second largest economy China struggling to financially recover from pandemic [Yahoo Finance UK]

SpaceX's astronaut-riding Dragon arrives at space station [AP]

YAHOO FINANCE HIGHLIGHTS

Trump is waging a regulatory war against Twitter. He may not have a legal case

Hopes for a quick recovery fade in NYC's Chinatown

People have been ‘frightened to go back to hospitals and clinics’: UCLA Hospital System CEO

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay