Warren accuses Fed of approving bank mergers with 'rubber stamp'

Sen. Elizabeth Warren, the Massachusetts politician and 2020 hopeful, on Tuesday pressed Federal Reserve Chairman Jerome Powell on the regulator’s high percentage of approvals for bank mergers and acquisitions.

How high? One-hundred percent.

In a heated line of questioning in his testimony to the Senate Banking Committee on Tuesday, Warren noted that among the 3,819 applications for bank mergers received by the Fed since 2006, none were rejected. Asked if “zero sounds right,” Powell responded, “if you say so.”

It was an unusually barbed exchange for Powell, who has tried to build a cordial rapport with Congress by working the halls of Capitol Hill. Reuters reported that Powell has interacted with at least 72 members of Congress between February and November of last year.

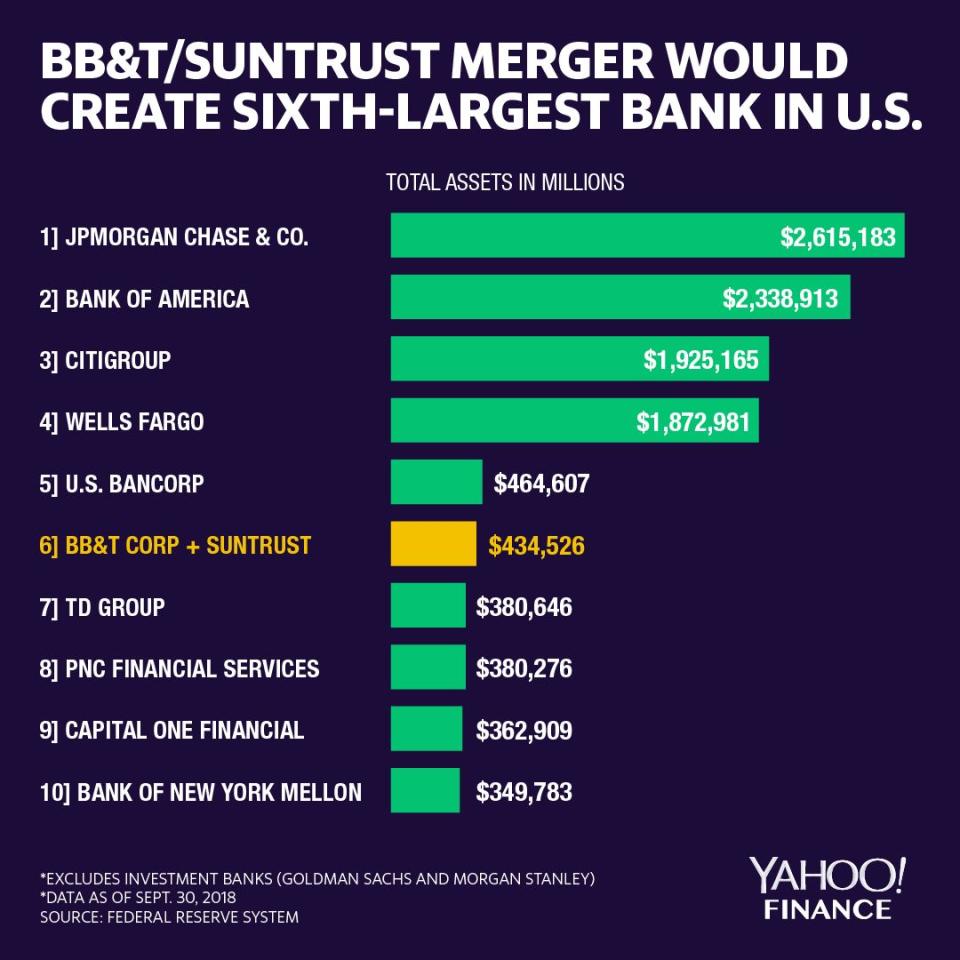

Warren asked the question amid concerns over the pending merger between BB&T (BBT) and SunTrust (STI), which would create the sixth largest U.S. bank if approved by the Fed. That entity would be magnitudes smaller than the big four banks.

She took particular issue with the timing of the Fed’s approval process. Banks seeking to merge often consult with their regulators before officially announcing anything, and Warren argues that these discussions effectively allow regulators like the Fed to “grease the wheels” before it’s made public. Warren said that this disadvantages communities that could be negatively impacted by the deal since they only have the opportunity to protest after it’s announced, by which point regulators may have already given the banks the green light to merge.

“No wonder you’ve approved 100% of the merger applications,” Warren said. “Not a single ‘no.’ Your approval process itself appears to be a rubber stamp, that everything is happening behind closed doors.”

With only a few chances to respond, Powell insisted that the Fed is “going to conduct a very fair and open transparent process” with regard to any application it receives.

Powell also said that bank mergers facing a “statutory problem” may withdraw their applications upon realizing that they may not survive the approval process, meaning the Fed would never have an opportunity to formally deny the application. Warren acknowledged this point and noted that about 13% of the 3,819 applications in question were withdrawn.

Community input

Warren actually began her inquiry on the Fed’s merger process immediately after the BB&T-SunTrust deal was announced in early February. She asked the Fed for detail on how regulators assess the impact of a merger on a community when it reviews that merger’s application. Citing Yahoo Finance reporting, Warren expressed concern that the possible wave of large bank consolidation could “result in reduced competition and choice for consumers and small businesses.” In some mergers, management chooses to close branches and lay off employees in order to achieve cost saves.

Warren’s interaction with Powell Tuesday raises questions about how much say community groups have in mergers, given the fact that any protests can only be filed after a merger is made public.

But the Community Reinvestment Act has existed as a control to regulatory considerations to community needs. The bill was enacted in 1977 and requires bank regulators like the Fed to ensure that financial institutions meet the credit needs of low and moderate income neighborhoods and communities that they exist in. Banks receive a rating that reflects their compliance with the CRA.

Bank regulators are required to factor a bank’s CRA rating into any merger applications, and poor ratings have indeed delayed deals in the past. In 2016, the Federal Deposit Insurance Corp. told BancorpSouth Bank and Ouachita Bancshares Corp. that they could not complete their merger until BancorpSouth improved its work on community reinvestment.

Warren has made note of this but argues that the Trump administration is working to weaken the CRA and therefore make it easier for banks to earn merger approvals. The FDIC and the Office of the Comptroller of the Currency have launched reviews of their CRA programs. The Trump-appointed heads of those agencies have insisted that the 40-year old statute needs to be revised to give consideration to the age of digital banking.

The Federal Reserve was not part of that review.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Powell signals that balance sheet rolloff could end as early as October

Fed Chair Powell: We're seeing 'crosscurrents and conflicting signals'

Three-fourths of business economists expect a recession by 2021, survey finds

Fed officials acknowledge concerns over balance sheet normalization

Congress may have accidentally freed nearly all banks from the Volcker Rule